April 2025 is simply across the nook, and the crypto market is setting the stage for a dynamic month forward. With main altcoins displaying promising setups, alternatives proceed to emerge for merchants and buyers.

Regardless of some corrections, the market stays stuffed with potential performs—whether or not by means of strategic long-term holdings or capturing short-term volatility. On this dialogue, we’ll break down among the prime altcoins to look at, analyze key market tendencies, and assess whether or not now could be the best time to build up.

Bitcoin (BTC)

Bitcoin stays a dominant drive within the cryptocurrency market, with a market capitalization of $1.67 trillion, accounting for over 50% of blockchain’s complete valuation. Whereas it could not supply the 10X or 100X potential that some altcoins do, Bitcoin continues to be a key asset for institutional buyers and long-term holders.

Figures like Michael Saylor and main funding corporations persistently accumulate Bitcoin as a hedge towards inflation, usually referring to it as “liquid gold.” At present valued at $84.2K, Bitcoin’s stability and historic efficiency make it a cornerstone in crypto portfolios.

Moderately than trying to time the market, long-term success usually comes from staying invested over time, as $BTC has repeatedly demonstrated its capability to face up to volatility and attain new highs.

Ethereum (ETH)

Ethereum is displaying robust efficiency, outpacing Bitcoin and a lot of the market in each value motion and buying and selling quantity. It has reclaimed key ranges between $1,950 and $2,000, with $2,000 performing as a major psychological barrier.

The current value surge, supported by elevated quantity, signifies bullish momentum. Final week’s technical actions noticed $ETH fill an imbalance zone and efficiently check essential help ranges, reinforcing purchaser confidence.

Supply – Jacob Crypto Bury on YouTube

Regardless of the bullish construction, warning is warranted. Traditionally, Ethereum outperforming Bitcoin has usually led to a market pullback. Moreover, a surge in leverage means that quick liquidations are driving the value up fairly than natural demand.

Whereas $ETH might nonetheless push towards $2,100, sustaining this breakout requires stronger fundamentals or Bitcoin sustaining its power. With out these elements, a correction might observe, with $1,950 probably serving as a secure help degree.

A number of Ethereum-based altcoins are additionally benefiting from this momentum. Whereas Ethereum’s present development presents potential alternatives, long-term sustainability stays unsure with out additional affirmation of a broader market uptrend.

Sui (SUI)

Sui is positioned as a extremely succesful token with vital potential for restoration. It brings the advantages of Web3 with the convenience of Web2, making it an interesting possibility for buyers in search of revolutionary blockchain options. Since its inception in 2024, $SUI’s market capitalization has grown from $2.4 billion to $15 billion.

Nonetheless, it has additionally skilled a 50% correction in market cap, with its value reaching a peak of $5.29 earlier than dropping to $2.25. Regardless of this pullback, Sui stays a powerful contender within the house, showcasing resilience and potential for future progress.

Solana (SOL)

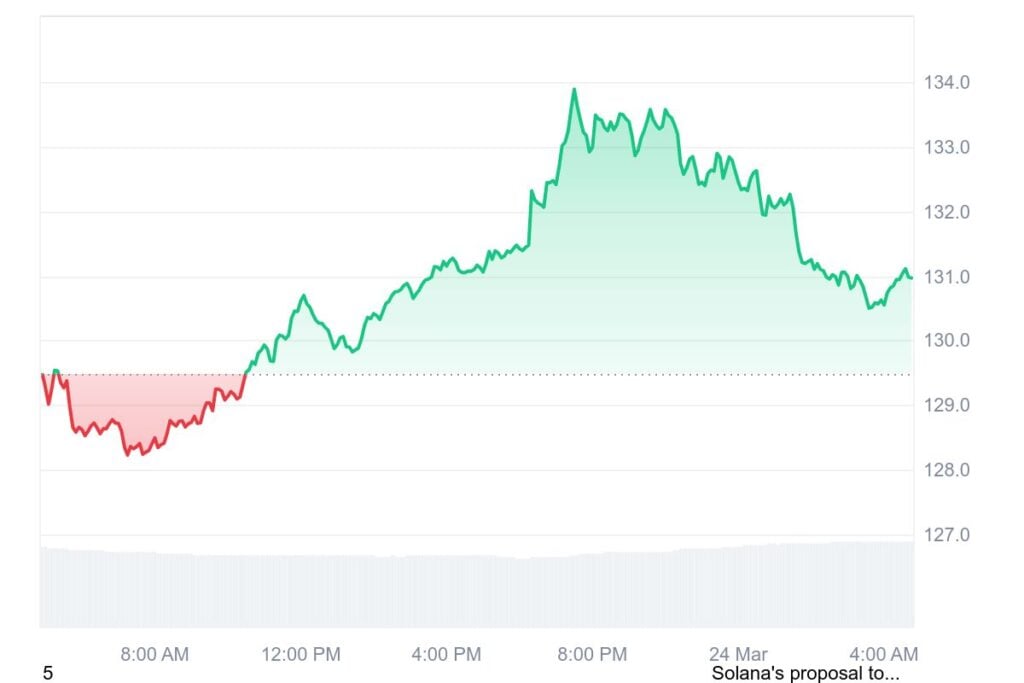

Solana has proven some bullish momentum after a bearish finish to final week, however issues stay concerning its sustainability. Whereas the general crypto market has seen some constructive motion, $SOL’s rally seems to be pushed largely by leverage fairly than robust natural demand.

In contrast to Ethereum, which is experiencing an inflow of regular buying and selling quantity, Solana’s quantity stays comparatively low, making its current value will increase much less convincing.

Essentially, Solana’s metrics are nonetheless weak. Whole worth locked (TVL) has bottomed out alongside the value, and though decentralized trade (DEX) buying and selling volumes stay above $1 billion, the general community efficiency has been declining.

Some reviews recommend a major downtrend in DEX exercise and TVL, highlighting issues about Solana’s long-term stability. Nonetheless, the opportunity of a Solana ETF and the resilience proven by its ecosystem supply some causes for optimism.

To substantiate a bullish breakout, $SOL wants to interrupt above $136 with robust quantity. If profitable, it might rally towards $145 and $150. Whereas a bullish breakout remains to be anticipated in the long run, the timing stays unsure, requiring persistence from buyers.

Avalanche (AVAX)

Avalanche has demonstrated spectacular progress in previous market cycles, reaching a market capitalization of $22 billion in 2021. Regardless of its robust fundamentals, Avalanche has but to realize a brand new all-time excessive within the present cycle, making it a possible candidate for additional progress.

$AVAX is at the moment priced at $19.55, with a market capitalization of $8 billion and a 24-hour buying and selling quantity of $157 million. Over the previous week, $AVAX has risen by 6%. The blockchain is understood for its pace, scalability, and interoperability, offering a safe and environment friendly surroundings for decentralized functions (dApps).

With a totally doxxed staff behind the challenge, Avalanche stays a promising possibility for buyers looking for a high-performance blockchain community with room for enlargement.

XRP (XRP)

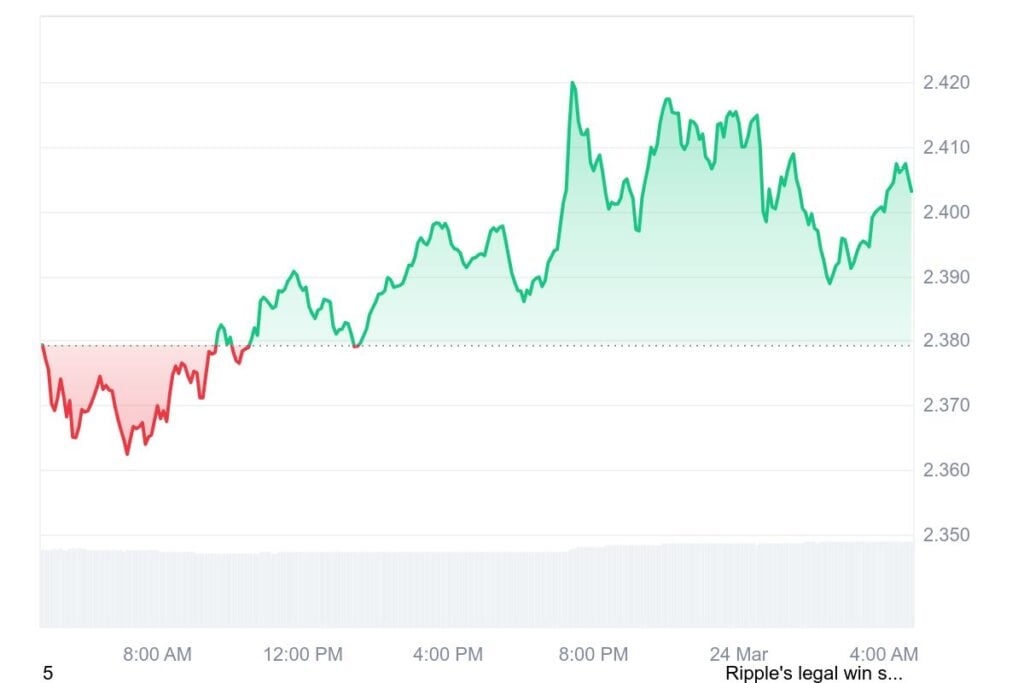

XRP stays a major participant within the crypto market, regardless of not producing as a lot pleasure as another tokens. From a basic perspective, $XRP holds robust potential, particularly after the decision of its authorized battle with the SEC.

Whereas the lawsuit’s final result didn’t classify XRP as a safety, its clearance from regulatory uncertainty gives a extra secure path ahead.

Traditionally, XRP has not but reached the $4 mark, however there may be hypothesis that it might revisit its earlier excessive of $3 and probably push past that degree. With a large market share and stable dominance, $XRP continues to be a related asset within the broader crypto panorama.

Cardano (ADA)

Cardano at the moment holds a market capitalization of $24.7 billion however has but to make any vital strikes on this cycle. Nonetheless, there may be rising hypothesis that Coinbase is changing into more and more favorable towards Cardano, which might result in a serious launch on the trade.

Such a improvement has the potential to drive a considerable value surge for the asset. Whereas $ADA has remained comparatively quiet when it comes to main developments, a strategic itemizing or elevated help from main platforms like Coinbase may very well be the catalyst for a powerful upward motion in its valuation.