Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

In response to a current report by 10X Analysis, Bitcoin (BTC) could also be making an attempt to kind an area backside, as US President Donald Trump is predicted to melt his stance on reciprocal tariffs, that are set to enter impact on April 2.

Up Solely For Bitcoin?

Bitcoin’s plunge to $77,000 on March 10 might have marked the underside for the highest cryptocurrency within the present market cycle. Since then, the digital asset has appreciated by greater than 10%, buying and selling within the mid $80,000 vary on the time of writing.

Associated Studying

The 10X Analysis report means that Trump’s current pivot towards “flexibility” on the upcoming April 2 reciprocal commerce tariffs might have alleviated some considerations about additional deterioration within the world macroeconomic outlook.

Moreover, the report emphasizes the US Federal Reserve’s (Fed) feedback following this month’s Federal Open Market Committee (FOMC) assembly, the place the central financial institution indicated that it might gradual the tempo of steadiness sheet drawdown and finish the present cycle of quantitative tightening.

The Fed’s remarks adopted the launch of the February 2025 Client Worth Index (CPI) inflation information, which got here according to expectations, easing considerations about inflation. The report’s declare that BTC has shaped a backside aligns with crypto entrepreneur Arthur Hayes’ current assertion, the place he famous that BTC might have “most likely” bottomed at $77,000.

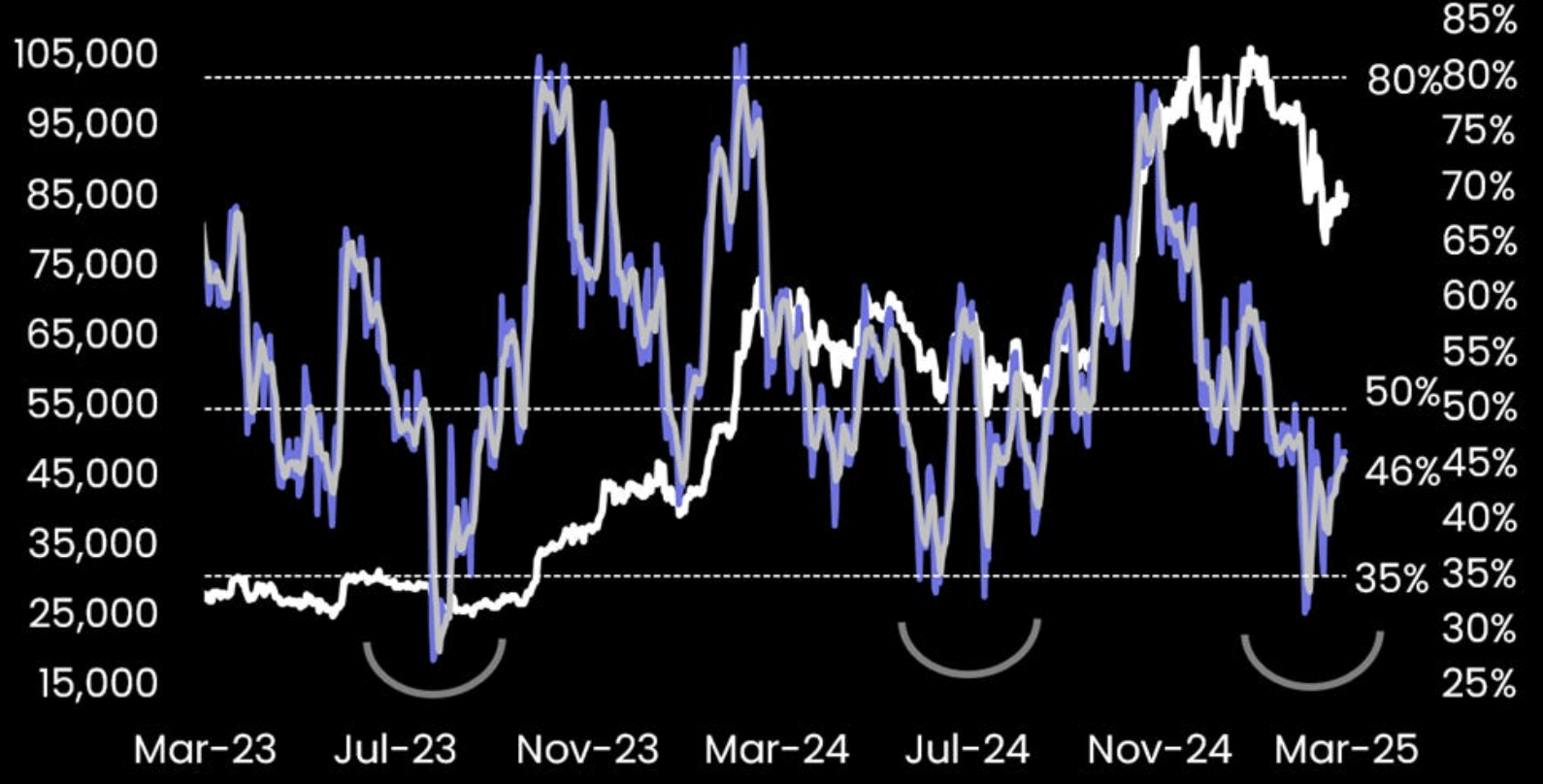

The next chart illustrates a bullish reversal in BTC’s 21-day shifting common, which presently sits at $85,200. The report factors out that these weekly reversal indicators are again at ranges sometimes seen when previous bull markets have resumed.

For instance, in September 2023, BTC benefited from bullish momentum because the Bitcoin exchange-traded funds (ETF) narrative gained traction. Equally, BTC launched into a historic rally in August 2024 because the US presidential election drew nearer.

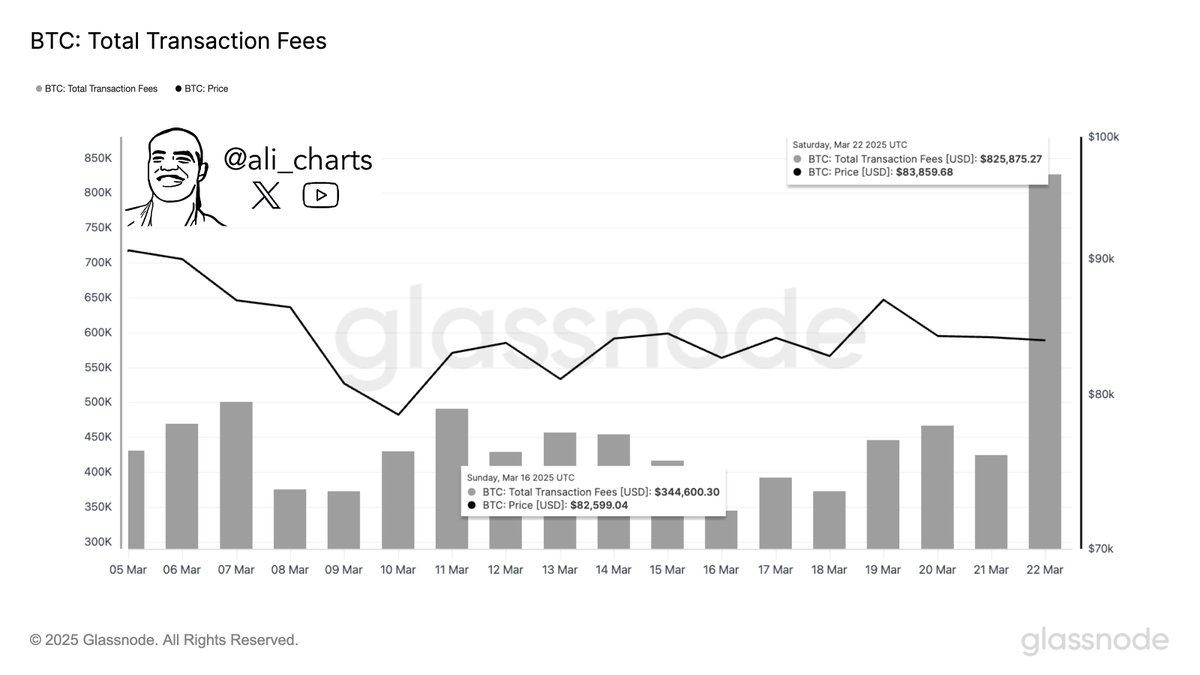

Moreover, a current publish on X by seasoned crypto analyst Ali Martinez highlights that Bitcoin transaction charges have almost tripled over the previous week, indicating an uptick in community exercise as market sentiment improves.

BTC Nonetheless Not Utterly Bullish

Whereas Trump’s softening stance on tariffs is sweet information for risk-on belongings like cryptocurrencies, BTC nonetheless wants to interrupt by means of and maintain sure worth ranges to regain sturdy bullish momentum.

Associated Studying

Latest evaluation by Martinez recognized $94,000 as a important worth stage for BTC to beat. If the digital asset decisively breaks by means of and sustains this stage, it might be poised to climb as excessive as $112,000.

That stated, considerations stay about BTC’s comparatively weak worth efficiency in comparison with different safe-haven belongings like gold. At press time, BTC is buying and selling at $87,650, up 3.6% prior to now 24 hours.

Featured picture from Unsplash, charts from 10X Analysis, X, and TradingView.com