Bitcoin (BTC) has elevated greater than 4% within the final 24 hours and over 5% up to now seven days because it makes an attempt to get well the $90,000 stage. The current worth rebound comes amid bettering technical indicators that counsel rising bullish momentum.

Merchants are carefully watching whether or not Bitcoin can reclaim $90,000 and construct a stronger basis for additional upside. A number of pattern indicators, together with the DMI, Ichimoku Cloud, and EMA traces, are signaling {that a} potential breakout may very well be forming.

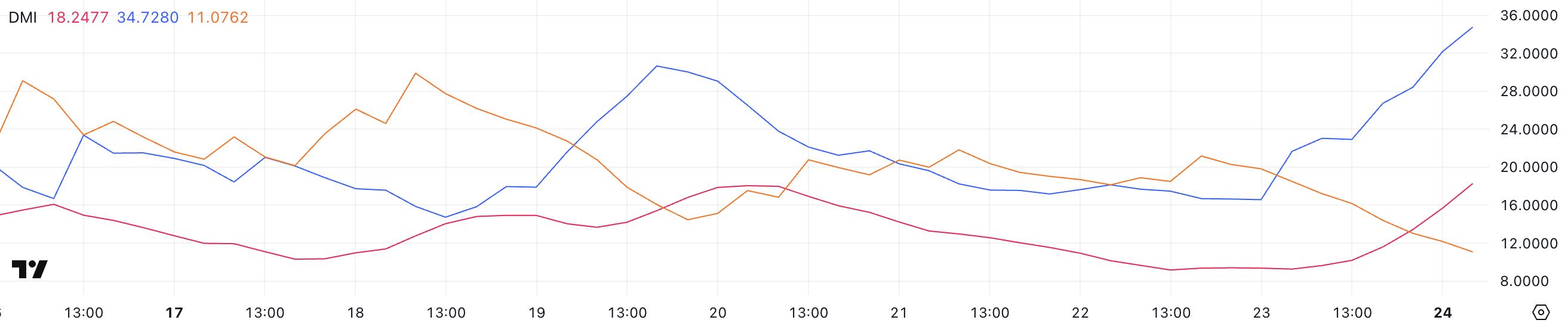

BTC DMI Reveals Consumers Are Now In Full Management

Bitcoin’s DMI chart is exhibiting a major uptick in momentum. The ADX (Common Directional Index) has climbed to 18.24 at present, a notable enhance from 9.2 simply yesterday, signaling that the energy of the present pattern is constructing.

An ADX studying beneath 20 usually means that the market is trending weakly or is range-bound, so this rise may very well be an early signal of a growing pattern.

Whereas the ADX itself doesn’t point out the course of the pattern, it measures the general energy, and at present’s studying suggests momentum is starting to choose up.

The ADX is a extensively used technical indicator that helps merchants gauge the energy of a market pattern. Usually, an ADX worth beneath 20 alerts a scarcity of a transparent pattern, whereas readings above 25 counsel a powerful pattern is current.

Alongside the ADX, the +DI (Constructive Directional Indicator) and -DI (Adverse Directional Indicator) present perception into pattern course. Presently, the +DI has surged to 34.7 from 16.57 yesterday, whereas the -DI has declined to 11 from 21.17.

This widening hole between +DI and -DI signifies that bullish momentum is gaining dominance, as consumers look like overwhelming sellers. If this pattern continues, it might level to an extra rise in BTC’s worth within the close to time period, because the market shifts in direction of a extra decisive bullish pattern and Bitcoin ETFs present indicators of restoration.

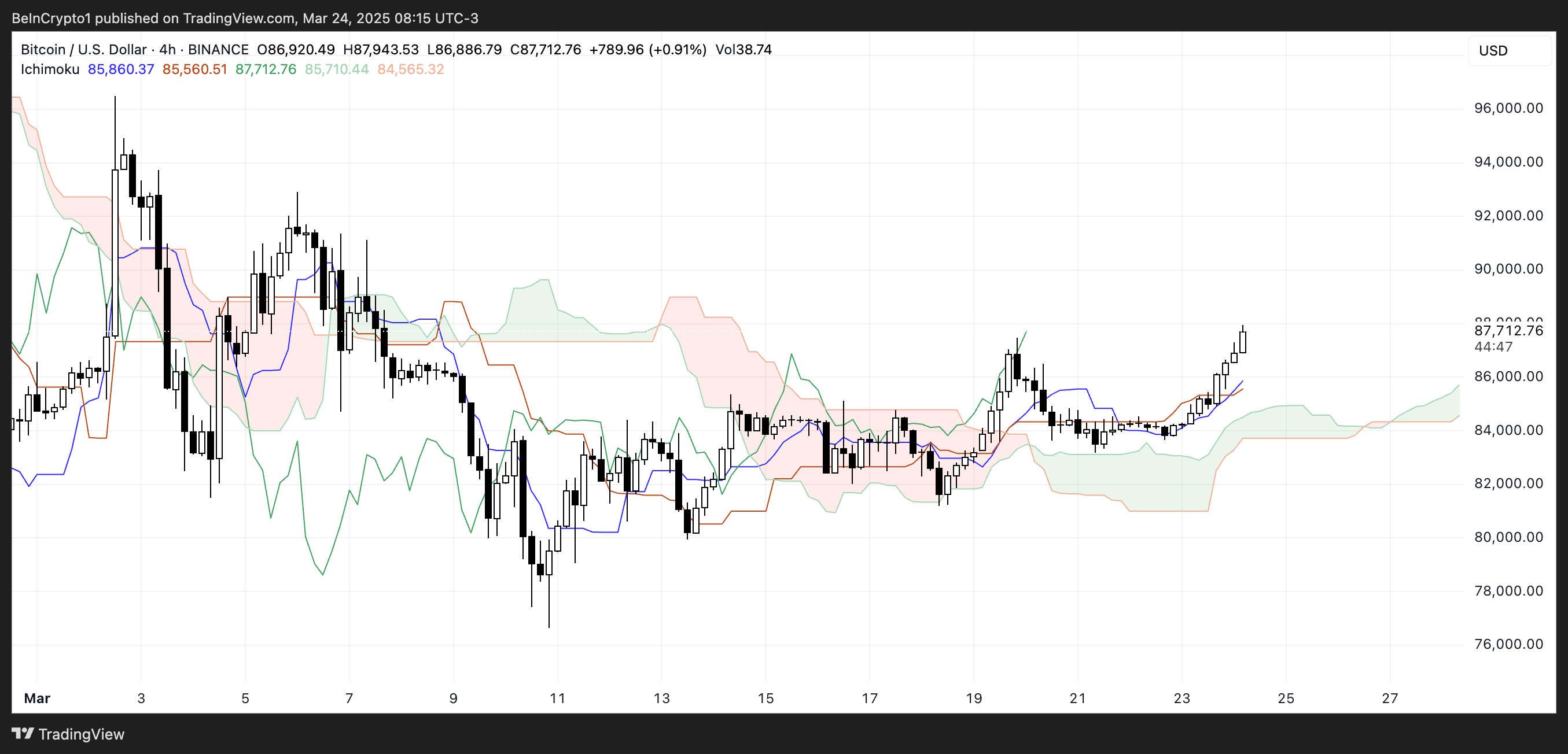

Bitcoin Ichimoku Cloud Reveals A Bullish Setup Is Forming

The Ichimoku Cloud chart for Bitcoin exhibits the Tenkan-sen (blue line) and Kijun-sen (crimson line) crossing in a bullish sample. The sooner Tenkan-sen strikes above the slower Kijun-sen, signaling a momentum shift.

These traces have converged after a interval of separation, indicating strengthening pattern situations.

The cloud formation (Kumo) has modified from crimson to inexperienced in the precise portion of the chart, marking a shift from bearish to bullish sentiment. Worth motion has damaged above the cloud after testing it as help a number of occasions all through mid-March.

This emergence above the cloud alerts that earlier resistance has probably grow to be help. The cloud’s various thickness all through the interval displays altering market volatility and conviction within the pattern course.

Can Bitcoin Reclaim $100,000 Earlier than April?

Bitcoin’s EMA traces are at the moment exhibiting blended alerts. Whereas the broader pattern stays bearish, short-term exponential transferring averages have began to show upward, and a current golden cross means that bullish momentum is constructing.

If this momentum continues and extra golden crosses happen, Bitcoin worth might goal key resistance ranges. The primary main resistance lies at $92,920, and a profitable breakout might see BTC pushing in direction of $96,484.

If the uptrend strengthens additional, Bitcoin might check $99,472. It has the potential to interrupt above $100,000 for the primary time since February 3. This may very well be pushed by 5 US financial occasions that may affect Bitcoin sentiment this week.

Nevertheless, the bullish situation hinges on sustained shopping for strain. If the upward momentum fades and the broader bearish pattern resumes, Bitcoin might first retest the help stage at $85,124.

A break beneath this stage would possibly open the door for a decline in direction of $81,187, with additional draw back probably main BTC again beneath the $80,000 mark.

In a stronger bearish situation, Bitcoin might revisit $76,642, reinforcing the bearish bias.

Disclaimer

According to the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.