- Bitcoin ETFs noticed $744M in web inflows, snapping a five-week outflow streak.

- Ethereum ETFs continued to bleed, with $102.9M in outflows for the fourth straight week.

- Regardless of ETF losses, BlackRock’s BUIDL fund boosted its ETH holdings to $1.15B, exhibiting sturdy institutional curiosity.

After 5 straight weeks within the purple, U.S. spot Bitcoin ETFs lastly bounced again, clocking in a web influx of $744.4 million for the week ending March 21—their largest in eight weeks, in keeping with information from SoSoValue.

Who’s Driving the Rally?

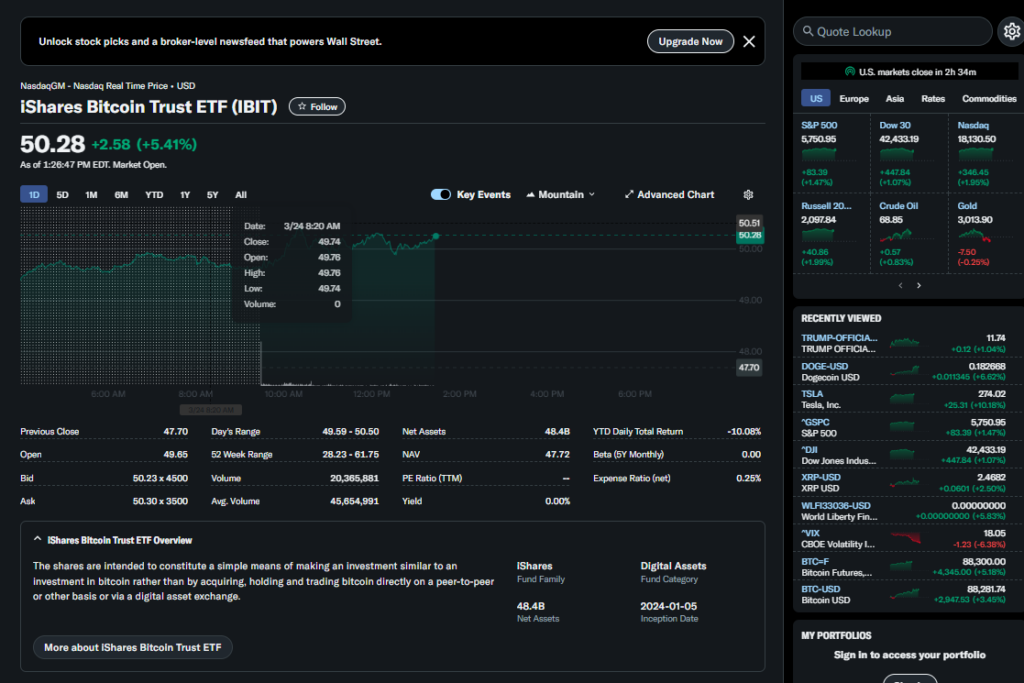

The majority of the inflows got here from the same old heavyweights: BlackRock’s iShares Bitcoin Belief (IBIT) led the cost with $537.5 million, whereas Constancy’s FBTC adopted behind with $136.5 million.

This comes after a tough patch for each crypto and world markets—because of commerce conflict chatter and looming recession fears. However now? The tide is perhaps turning.

Earlier this 12 months, Bitcoin ETFs had their greatest runs but—pulling in $1.96 billion the week ending Jan. 17 and $1.76 billion the week after. These inflows helped push BTC to a document excessive of $109K on Jan. 20, which additionally occurred to be President Trump’s inauguration day.

BTC Worth Rebounds

After dipping into the $78K vary through the correction, Bitcoin’s worth is again up—hovering round $87,343 on the time of writing. So yeah, sentiment’s warming up once more.

ETH Nonetheless within the Purple

Ethereum? Not fairly as fortunate. ETH ETFs noticed $102.9 million in outflows this week—the fourth week in a row of web losses. BlackRock’s ETHA took the most important hit, dropping $74 million.

Nonetheless, ETH isn’t completely out of the sport. It’s buying and selling above $2,090, after briefly dipping under $2K for the primary time in over a 12 months.

Vibrant Spot for Ethereum

Though ETF flows aren’t trying nice, establishments are nonetheless quietly loading up. BlackRock’s BUIDL fund, targeted on tokenized real-world belongings, now holds $1.15 billion value of ETH, up from $990 million simply final week.

That’s a transparent signal: huge gamers nonetheless see Ethereum because the spine of real-world asset tokenization.

Market Sentiment: Cautious Optimism

The Crypto Concern & Greed Index rose from 32% to 45% this week, hinting at a shift in investor temper. Nonetheless, not everybody’s satisfied.

Singapore’s QCP Capital issued a warning: tariff escalations set for April 2 may slam danger belongings once more. So whereas the bulls are waking up, they’re nonetheless sleeping with one eye open.