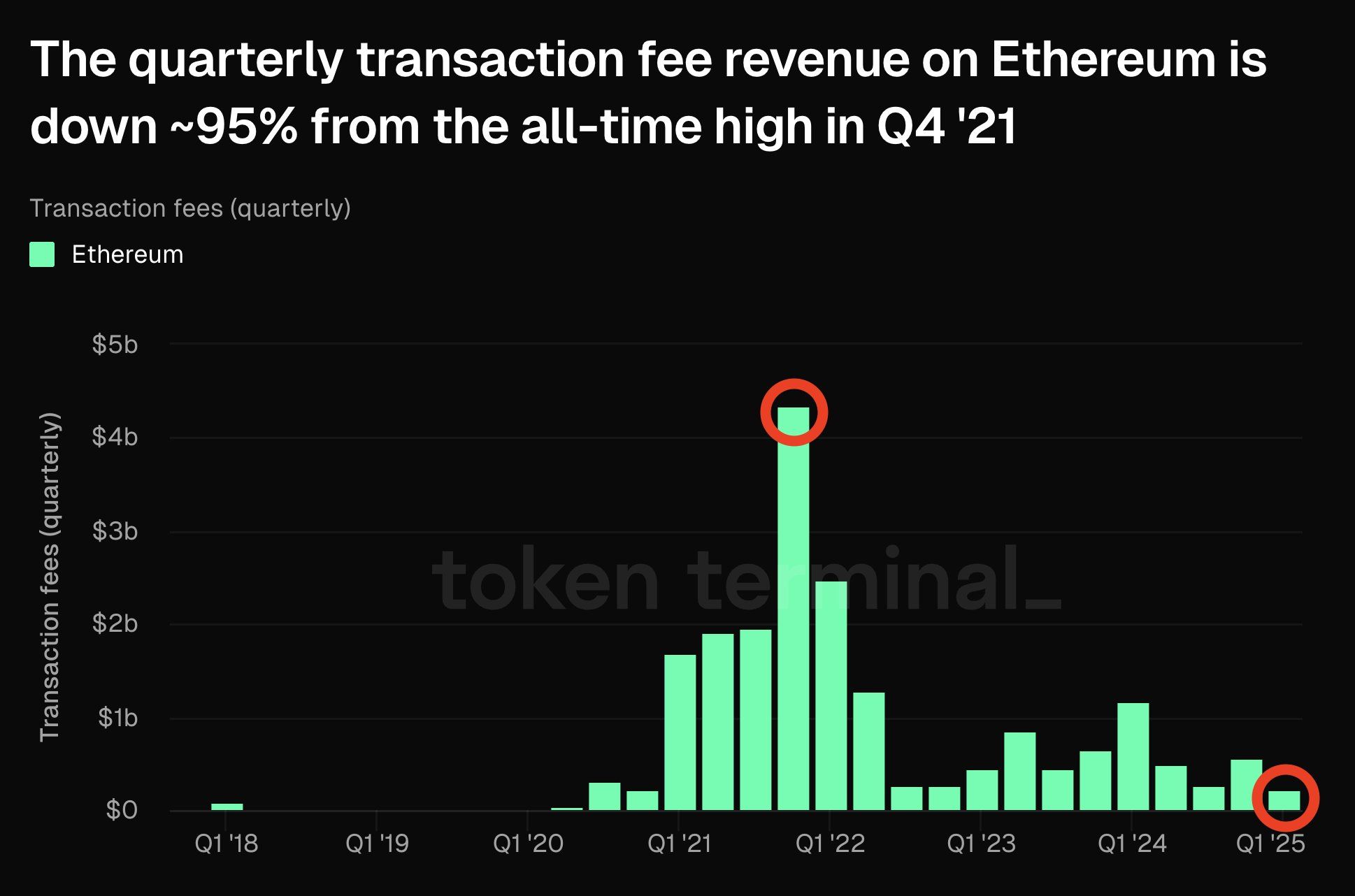

Ethereum (ETH), the world’s second-largest blockchain by market capitalization, has seen its quarterly transaction charge income drop dramatically by roughly 95% from its all-time excessive in This autumn 2021.

This decline could be primarily attributed to a lower in Layer 2 contributions, coupled with a big dip in exercise throughout the non-fungible token (NFT) market.

What’s Driving the Drop in Ethereum’s Transaction Charge Income?

Token Terminal highlighted this shift within the newest X (previously Twitter) put up. Primarily based on their estimate, Ethereum’s transaction charge income for Q1 2025 is projected to achieve roughly $217 million.

This determine represents a dramatic 95% discount from the all-time excessive of $4.3 billion recorded in This autumn 2021. At the moment, Ethereum’s income surged by 1,777% year-over-year, in response to Bankless. It climbed from $231.4 million in This autumn 2020 to $4.3 billion by the final quarter of 2021.

Furthermore, Ethereum’s DeFi ecosystem noticed vital development in Complete Worth Locked (TVL), decentralized trade (DEX) volumes, NFT gross sales, and Layer 2 TVL. Nonetheless, the dynamics have modified since then.

That is evident from Ethereum’s latest efficiency. In 2025, month-to-month revenues sharply declined, with January recording $150.8 million and February solely $47.5 million. Assuming the development of declining transaction charges continues, March may additionally see equally low figures.

Moreover, within the fourth quarter of 2024, Ethereum generated solely $551.8 million in transaction charge income, emphasizing the continued downward development.

One of many main contributors to the decline is the shift to Layer 2 options. These have turn into more and more standard for his or her skill to course of transactions off-chain whereas selecting Ethereum’s mainnet.

As well as, the activation of EIP-4844 has considerably decreased the information value of posting to Ethereum’s chain, additional decreasing L2 charge contributions. In response to a CoinShares report, this improve has made transactions cheaper however has additionally diminished the income Ethereum’s mainnet collects from L2 exercise.

“Layer 2-related charges, which had been excessive in 2023 and early 2024, have since declined as a result of value financial savings launched by EIP-4844,” the CoinShares report learn.

The decline in NFT exercise has additionally performed a big position. This autumn 2021 marked the height of the NFT craze, with platforms like OpenSea recording billions of {dollars} in month-to-month buying and selling quantity. Nonetheless, now the curiosity has waned, resulting in a pointy drop in transaction quantity and, consequently, charge income.

ETH Suffers its Worst Quarterly Decline Since 2018

This decline extends past transaction charge income. The value of Ethereum has adopted an identical downward development. After reaching an ATH in November 2021, ETH has dropped considerably, now buying and selling 58.8% under that peak.

Even throughout the election euphoria, when many cryptocurrencies, together with Bitcoin (BTC), noticed new highs, Ethereum didn’t hold tempo.

“ETH has skilled the sharpest decline in Q1, dropping by -40%, marking its largest quarterly loss since 2018,” an analyst wrote on X.

Over the previous month alone, ETH has fallen by 25.1%. As of press time, the altcoin was buying and selling at $1,997, representing a slight achieve of 0.45% over the previous day.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.