With whole unrealized income now surpassing $102.5 billion, MicroStrategy’s Bitcoin holdings have produced a powerful return. Beneath the management of Govt Chairman Michael Saylor, the corporate’s aggressive dollar-cost averaging technique has paid off within the context of Bitcoin’s latest bull run.

In response to the newest knowledge, MicroStrategy’s practically 500,000 BTC acquisition price averaged $66,384, whereas the value of BTC is presently buying and selling above $87,000. Bitcoin’s latest surge, which noticed costs rise from under $30,000 in early 2023 to new all-time highs in Q1, 2025, has considerably strengthened the agency’s portfolio place. With cumulative features, the corporate’s holdings now whole an astounding $43.66 billion, representing a 31.74% improve in total place worth since inception.

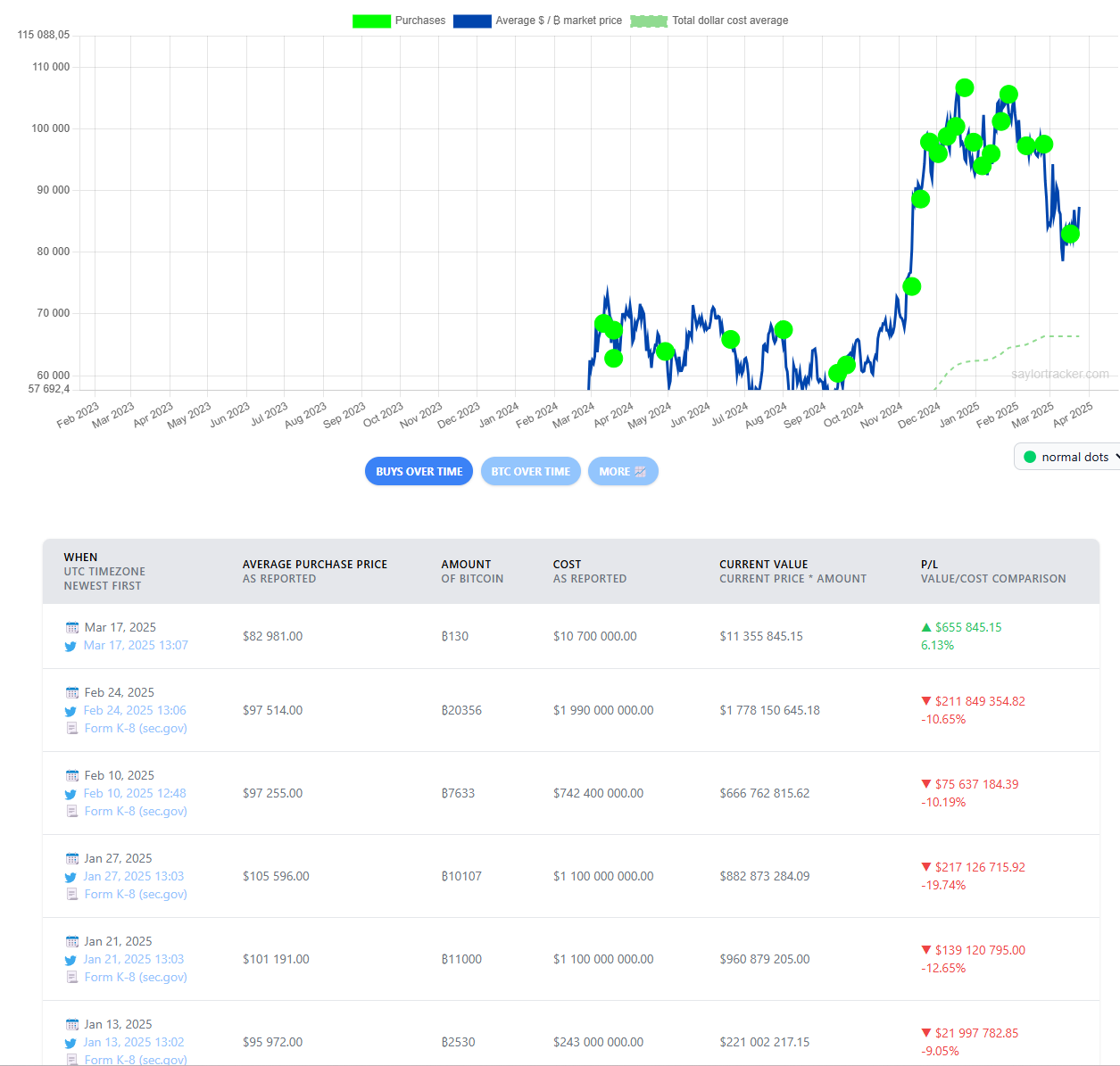

Regardless of the encouraging headline, a better examination of MicroStrategy’s previous acquisitions reveals that almost all of its most up-to-date acquisitions are nonetheless pending. Excessive-volume purchases made in late 2024 and early 2025, together with a number of entries value over $1 billion at common costs between $97,000 and $105,000, are nonetheless dropping cash.

For instance, the acquisition of 10,107 BTC on Jan. 27 at $105,596 presently represents a 19.74% loss, whereas the acquisition of over 20,000 BTC on Feb. 24 at $97,514 represents a ten.65% decline. Nonetheless, the corporate’s long-term method of build up throughout declines and retaining by volatility is beginning to repay.

Massive purchases made between 2020 and 2022 at costs beneath $30,000 and beneath $40,000 now tremendously outweigh short-term losses. This helps Saylor’s argument that Bitcoin is a superb treasury reserve asset with room to develop in worth over time. MicroStrategy’s wager appears an increasing number of acceptable with provide constraints related to the halving of Bitcoin and the strengthening of inflows into Bitcoin’s spot ETF’s method.

Although some positions haven’t but reached break-even, the agency’s unwavering accumulation technique continues to outperform that of many institutional counterparts. MicroStrategy’s continued dedication positions it as a number one company pressure within the Bitcoin area because the digital asset panorama develops its greater than $10 billion in unrealized features.