Gold’s upward trajectory has caught the eye of Bloomberg’s Mike McGlone, who sees the potential for the metallic to achieve unprecedented highs.

With gold already surpassing $3,000, McGlone suggests that the following main goal may very well be $4,000, pushed by a mixture of falling Treasury yields, declining danger asset costs, and heightened financial uncertainty.

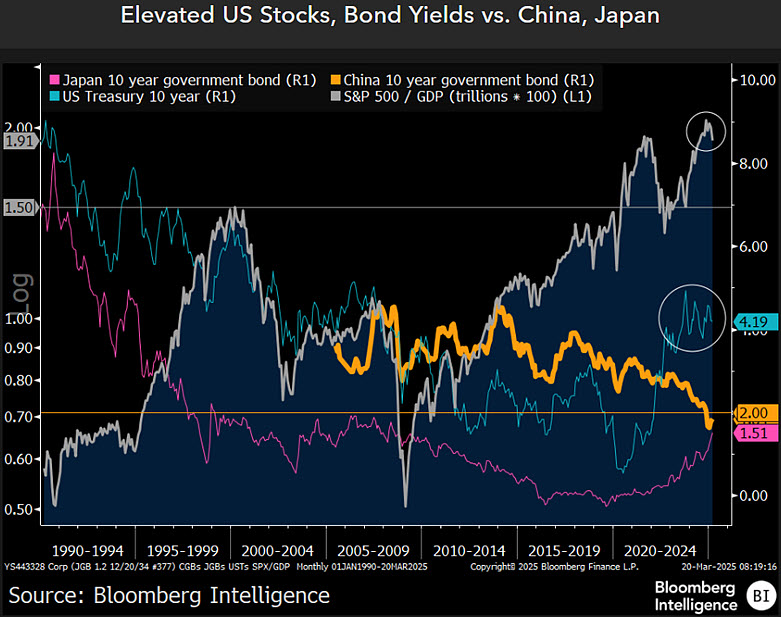

One key issue supporting this outlook is the potential for decrease U.S. Treasury yields. At the moment round 4%, these yields might expertise additional declines, particularly when in comparison with their a lot decrease counterparts in China and Japan, which stay beneath 2%. A drop in yields would possible make gold extra enticing to buyers trying to find options to conventional monetary belongings.

On the identical time, the inventory market stays in a precarious place, with buyers cautious of potential downturns. Whereas equities have proven resilience in latest periods, broader considerations persist, significantly surrounding financial insurance policies and ongoing commerce tensions. Ought to shares face renewed promoting strain, gold’s standing as a safe-haven asset might entice elevated capital flows, reinforcing its upward momentum.

Moreover, McGlone factors out that if riskier investments, together with cryptocurrencies, battle to keep up their worth, capital might shift towards gold. This redirection of funds could present additional help for the metallic’s climb towards the $4,000 milestone. He beforehand warned that if the outflow from belongings like Bitcoin continues, the main digital foreign money might retreat to as little as $10,000.

Regardless of its sturdy efficiency, gold has momentarily paused its rally after touching $3,000. On the newest replace, it was buying and selling at $3,023, reflecting a slight day by day decline of 0.68%, although nonetheless up 1.2% over the previous week.

Technical indicators recommend gold is at an important juncture. Analyst Aksel Kibar highlights that the metallic is at the moment testing resistance close to the higher boundary of its rising development channel. A failure to interrupt via might result in a pullback towards $2,500, however a profitable breakout could clear the trail for even larger valuations.

Geopolitical tensions, significantly ongoing conflicts and financial instability, proceed to gas bullish sentiment round gold. As buyers search stability amid world uncertainty, the dear metallic stays a popular hedge in opposition to volatility, with many watching intently to see if it will possibly maintain its historic climb.