Hedera (HBAR) is up practically 5% within the final 24 hours because it makes an attempt to interrupt above the $0.20 mark for the primary time in 2 weeks. The latest value rally comes amid bettering technical indicators that trace at a possible shift in pattern.

Regardless of the continuing restoration, HBAR nonetheless faces key resistance ranges and a bearish backdrop that has dominated in latest weeks.

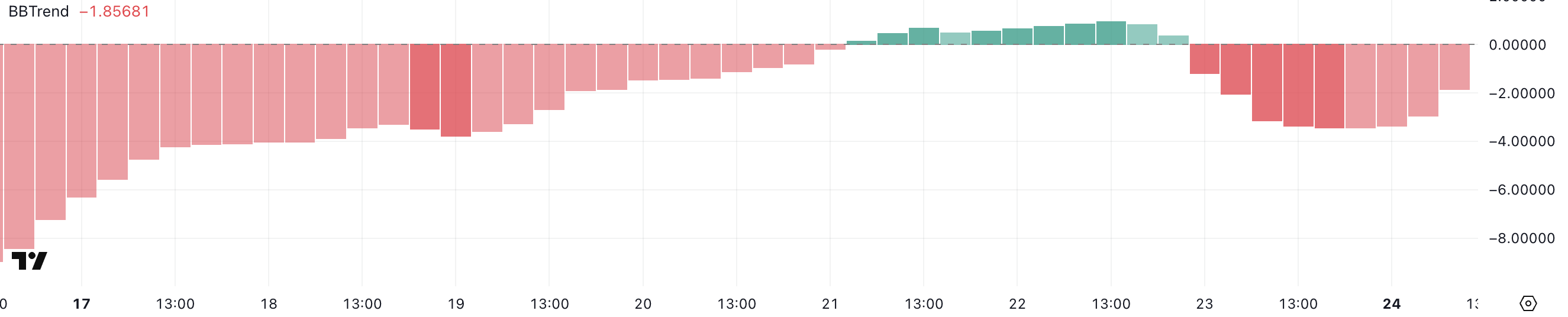

Hedera BBTrend Is Recovering, However Nonetheless Unfavourable

Hedera’s BBTrend is presently sitting at -1.85, displaying a restoration from -3.44 yesterday, although it was not too long ago as excessive as 0.96 two days in the past.

This latest motion suggests some short-term enchancment in value momentum after latest draw back stress. Nevertheless, the general pattern nonetheless leans unfavourable as Hedera struggles to maintain any lasting bullish indicators.

The indicator highlights how the token is trying to recuperate however stays caught in a broader sample of weak momentum.

The BBTrend (Bollinger Band Development) indicator measures how far value motion deviates from the middle of the Bollinger Bands, serving to to evaluate pattern power and course.

Sometimes, values above 0 recommend bullish situations, whereas values beneath 0 level to bearish momentum. With Hedera’s BBTrend presently at -1.85, it suggests bearish stress remains to be current, regardless of the latest bounce.

Extra importantly, Hedera has proven problem sustaining robust constructive ranges for an prolonged interval – the final time BBTrend crossed above 10 was on March 6, highlighting how fleeting bullish momentum has been in latest weeks.

HBAR Ichimoku Cloud Exhibits The Development May Be Shifting, However There Are Challenges Forward

Hedera’s Ichimoku Cloud chart is displaying some early indicators of restoration, as the value has damaged above the blue Tenkan-sen line and is now testing the underside of the pink Kumo (cloud).

The value motion has moved into the cloud after buying and selling beneath it for an prolonged interval, which could be seen as a shift from bearish to extra impartial situations.

Whereas the value trying to climb into the cloud means that promoting stress is weakening, it nonetheless faces resistance from the thicker a part of the Kumo simply above present ranges.

The cloud’s bearish (pink) coloration signifies that the broader pattern stays beneath stress, regardless of the latest upside transfer.

The Ichimoku Cloud, or Kumo, is a multi-component indicator that highlights assist, resistance, pattern course, and momentum multi functional look. When costs are beneath the cloud, it suggests bearish situations, whereas costs above the cloud sign bullish sentiment.

Buying and selling contained in the cloud sometimes signifies a consolidation section or market indecision.

In Hedera’s case, the token’s present positioning throughout the cloud indicators that it’s trying to neutralize the latest bearish momentum however has not but shifted into a transparent bullish pattern.

Till HBAR can firmly break above the higher fringe of the cloud, upside potential might stay capped by resistance.

Will A Golden Cross Make Hedera Surge?

Hedera’s EMA strains are nonetheless displaying a bearish setup total as long-term EMAs proceed to pattern downward. Nevertheless, short-term EMAs are starting to slope upwards and will quickly cross above the longer-term averages, doubtlessly forming a golden cross.

If this bullish crossover happens, it could set off a stronger upward transfer, with the primary resistance stage sitting at $0.199. A break above this stage may open the trail for additional good points towards $0.215, and if the bullish momentum accelerates, Hedera value may even intention for $0.258 within the coming classes.

Alternatively, if the short-term upside momentum fades and the golden cross fails to materialize, bearish stress may resume. On this situation, HBAR might revisit key assist ranges at $0.184 and $0.178.

A decisive break beneath these ranges could lead on the token again beneath $0.17, reinforcing the bearish construction.

Disclaimer

In keeping with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.