Stellar (XLM) is up 11% over the previous seven days, bringing its market cap to just about $9 billion as bullish momentum continues to construct. After a interval of consolidation, current indicators recommend that XLM could also be getting ready for one more transfer larger.

Whereas technicals like RSI and DMI replicate rising purchaser power, the value has but to enter the overbought territory, signaling potential room for additional upside.

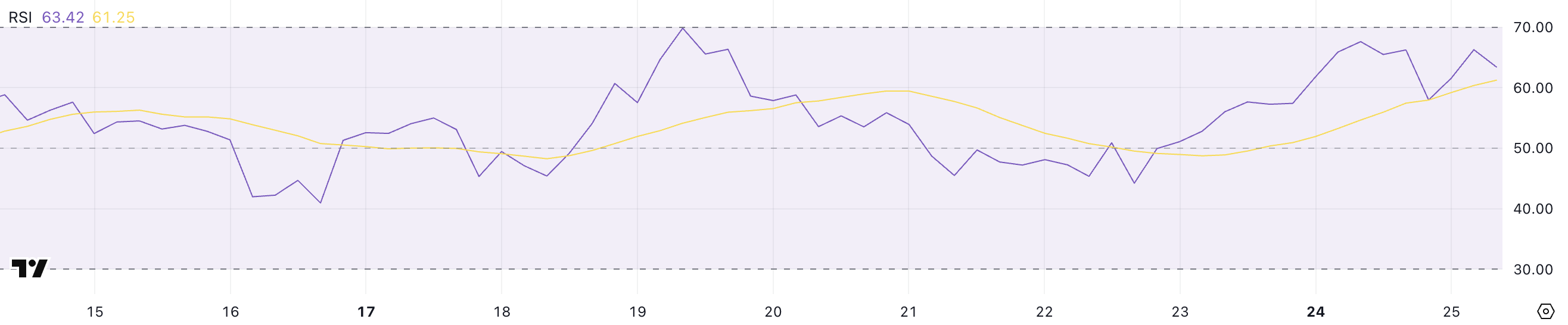

XLM RSI Paints A Bullish Image

Stellar’s Relative Power Index (RSI) is presently at 63.42, exhibiting a robust rise from 44.21 simply three days in the past. The indicator has been holding above 55 since yesterday, suggesting a notable shift in momentum towards bullish territory.

This current enhance factors to rising shopping for curiosity, probably positioning Stellar for a breakout if momentum continues constructing.

Nonetheless, regardless of the upward transfer, it’s value noting that Stellar’s RSI has not crossed the 70 mark since March 2. This means that whereas consumers are lively, the asset hasn’t entered overbought or high-momentum situations in almost a month.

RSI, or Relative Power Index, is a momentum oscillator that measures the velocity and magnitude of current worth modifications to evaluate overbought or oversold situations.

The RSI scale ranges from 0 to 100, with values above 70 indicating that an asset could also be overbought and due for a correction, and readings beneath 30 signaling oversold situations and potential for a rebound. Usually, values between 50 and 70 recommend average bullish momentum, whereas 30 to 50 means bearish.

With XLM’s RSI now at 63.42, the pattern seems optimistic, however the failure to breach 70 since early March might indicate a cautious market nonetheless ready for stronger conviction earlier than pushing larger.

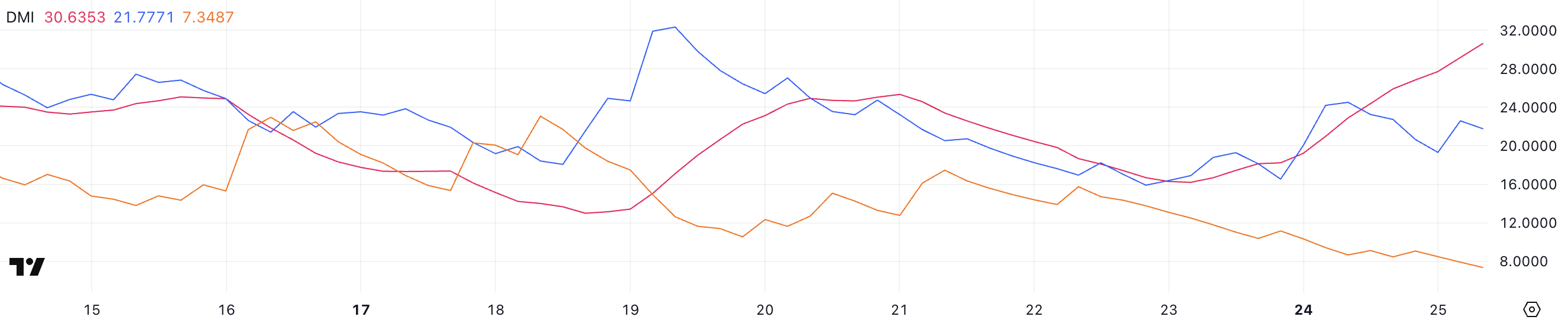

Stellar DMI Reveals Consumers Are In Full Management

Stellar’s DMI (Directional Motion Index) chart exhibits that its ADX is presently at 30.63, up sharply from 16.2 simply two days in the past.

This important rise within the ADX suggests {that a} pattern is strengthening, confirming that the present worth transfer—whether or not up or down—is gaining momentum. On the identical time, the +DI line, which tracks bullish strain, is at 21.77, barely down from 24.5 yesterday, whereas the -DI line, which displays bearish strain, has additionally declined from 8.65 to 7.34.

Regardless of the slight dip in shopping for power, the vast hole between the +DI and -DI strains nonetheless favors the bulls, indicating that the continued pattern is upward, although presumably cooling off in depth.

The ADX, or Common Directional Index, is a part of the DMI system and is used to quantify pattern power no matter course. Readings beneath 20 sometimes point out a weak or non-existent pattern, whereas values above 25 recommend a strengthening pattern and people above 30 affirm a robust one.

The +DI and -DI strains, then again, assist decide the course of that pattern—whichever is larger signifies whether or not consumers (+DI) or sellers (-DI) are in management.

With ADX rising above 30 and +DI comfortably above -DI, Stellar seems to be in a strong uptrend. Nonetheless, the current dip in +DI could also be an early signal of fading momentum, making the following few days essential for confirming whether or not bulls can maintain management.

Can XLM Break Above $0.40 In April?

Stellar’s EMA strains are exhibiting indicators of a possible surge, with short-term shifting averages nearing a crossover above longer-term strains.

If this crossover materializes, it is going to kind a bullish “golden cross” sample, typically seen as a robust sign for upward continuation.

This technical setup might permit Stellar worth to push larger towards the $0.30 stage, with further upside targets round $0.349 and $0.375 if momentum accelerates. This might probably pave the best way for an increase above $0.40 in April.

The convergence of those EMAs suggests constructing bullish strain, which, if confirmed by worth motion, might quickly lead to a breakout.

Nonetheless, if the anticipated golden cross fails to materialize and as an alternative a downtrend takes form, Stellar might discover itself testing the help stage round $0.27.

A break beneath that help might set off additional declines towards $0.25, and if promoting intensifies, even as little as $0.22.

Disclaimer

In step with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.