Solana (SOL) is up almost 9% within the final 24 hours, climbing above $140 for the primary time since March 8, regardless of BNB surging to change into the largest chain in DEX quantity final week.

Whereas worth motion has strengthened, Solana’s market nonetheless reveals combined indicators, with some massive buyers remaining cautious. Merchants are actually watching key resistance and help ranges to gauge whether or not SOL can maintain its rally or face a possible pullback.

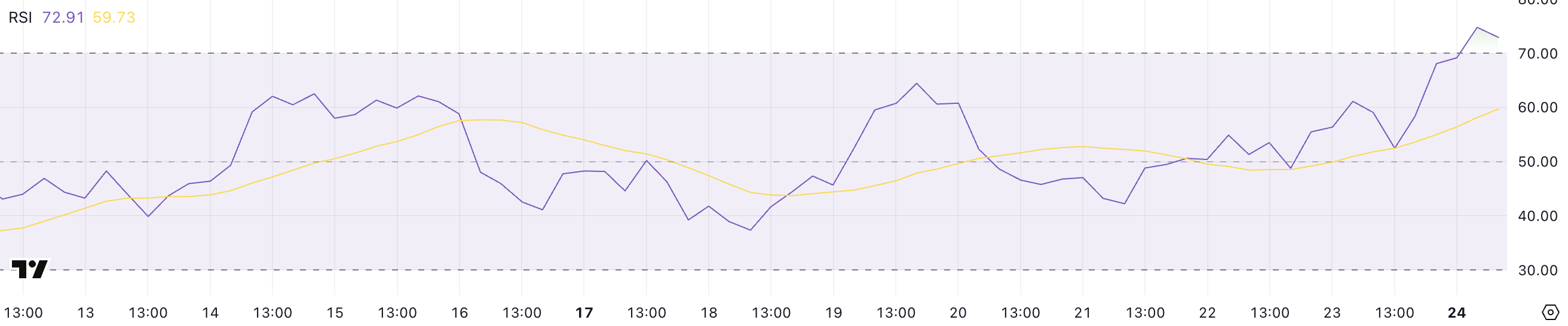

Solana RSI Rise Above 70 For The First Time Since March 2

Solana’s RSI has surged from 52.46 yesterday to 72.91 at this time, marking the primary time it has entered overbought territory since March 2.

This sharp rise indicators a sudden acceleration in shopping for momentum after almost two weeks of impartial readings hovering across the mid-50s.

The breakout above the 70 stage suggests a notable shift in sentiment, as merchants have pushed SOL right into a extra aggressive bullish stance.

The Relative Power Index (RSI) is a momentum oscillator that measures the velocity and alter of worth actions. It helps merchants establish potential overbought or oversold circumstances.

Sometimes, an RSI worth above 70 is taken into account overbought, indicating that an asset could also be due for a corrective pullback. Readings under 30 are considered as oversold, suggesting attainable upside reversals. Solana’s RSI, presently at 72.91, highlights a powerful bullish push but in addition raises warning a few potential short-term correction as BNB overtakes Solana in DEX quantity.

On condition that SOL had been buying and selling in a impartial zone for the previous 12 days, this sudden spike may both mark the beginning of a stronger rally or sign a short lived overheating in worth momentum.

SOL Whales Are Nonetheless Hesitant

The variety of Solana whales – wallets holding no less than 10,000 SOL – is presently at 5,019, barely down from the current peak of 5,041 recorded on March 18.

This fluctuation highlights ongoing shifts in large-holder conduct, as whale exercise has but to stabilize totally. Whereas the current whale rely stays elevated in comparison with earlier ranges this month, it nonetheless suggests hesitation amongst massive buyers to re-enter the market totally.

Monitoring whale exercise is essential as a result of these massive holders typically considerably affect market tendencies and liquidity. A rise in whale addresses can point out accumulation and rising confidence, whereas a decline could sign distribution or warning.

With the present whale rely exhibiting indicators of volatility and retreating barely from current highs, it means that main gamers are nonetheless unsure about Solana’s short-term path.

Till this quantity reveals extra constant development, it may indicate that SOL’s worth could stay delicate to fluctuations and lack the strong backing usually seen throughout stronger bullish tendencies.

Can Solana Maintain The Present Ranges?

Solana’s EMA traces just lately confirmed a golden cross, signaling the potential for a bullish continuation. Additional golden crosses could kind quickly.

If the present uptrend strengthens, Solana’s worth may rise to problem the resistance at $152.90 and, if momentum persists, lengthen beneficial properties towards the $180 mark.

Regardless of issues inside the neighborhood concerning the competitors between PumpFun and Raydium, Chris Chung, founding father of Solana-based swap platform Titan, argues that this rivalry may truly profit Solana’s broader ecosystem:

“Pump.enjoyable launching its personal DEX was inevitable as they imagine they’ve a powerful sufficient model now to eradicate the Raydium tech stack and accumulate AMM charges themselves. As well as, Raydium introduced plans for its personal launchpad, exhibiting that competitors within the Solana ecosystem is heating up – and quick. It’s nice to see new gamers enter with concepts to enhance the velocity and value of finish customers. Any such aggressive conduct helps construct strong monetary merchandise and DeFi protocols and easily makes Solana’s exercise develop,” Chung advised BeInCrypto.

Nonetheless, if bullish momentum weakens and the uptrend reverses, SOL may retest key help at $136.71.

A break under this stage may expose Solana to additional draw back, with a goal of $120 and doubtlessly $112 if promoting strain intensifies.

Disclaimer

According to the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.