Solana has surged by 12% over the previous week, driving the broader market’s restoration try. At press time, the Layer-1 (L1) trades at $139.41.

Nonetheless, a key technical indicator has flashed a bearish divergence, elevating doubts concerning the power of this uptrend. This evaluation holds the main points.

Solana’s Rally Faces Headwinds as Bearish Divergence Emerges

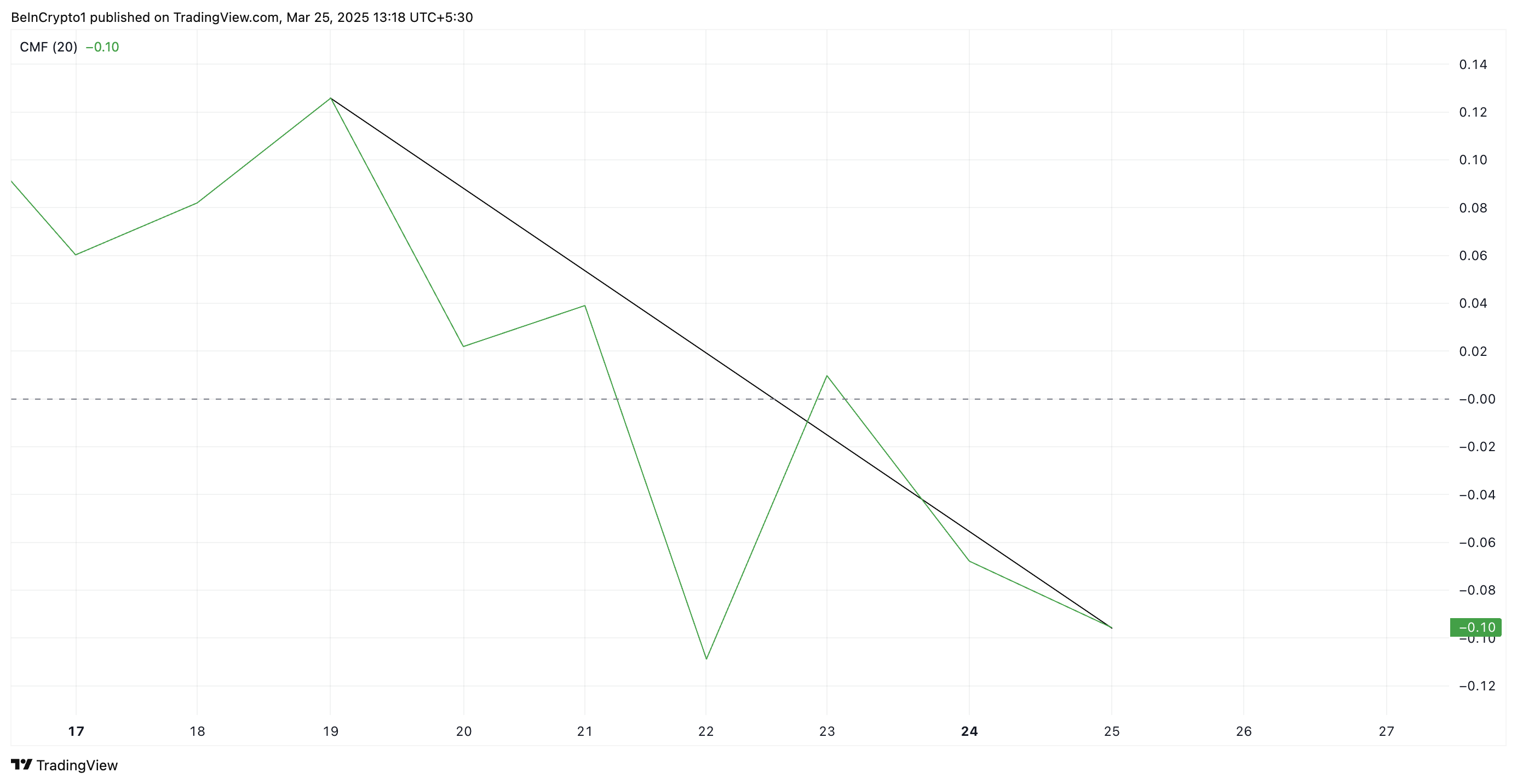

An evaluation of the SOL/USD one-day chart reveals that whereas SOL’s worth has climbed prior to now seven days, its Chaikin Cash Movement (CMF) has declined, forming a bearish divergence.

The CMF indicator measures the power of shopping for and promoting stress by analyzing quantity and worth actions over a particular interval. It ranges between -1 and +1, with optimistic values indicating sturdy shopping for stress and unfavorable values signaling promoting dominance.

A bearish divergence happens when the worth of an asset is rising, however the CMF is falling, suggesting that the rally lacks sturdy shopping for help. Which means regardless of SOL’s increased costs, capital inflows are weakening, hinting at a possible reversal or slowdown within the coin’s uptrend.

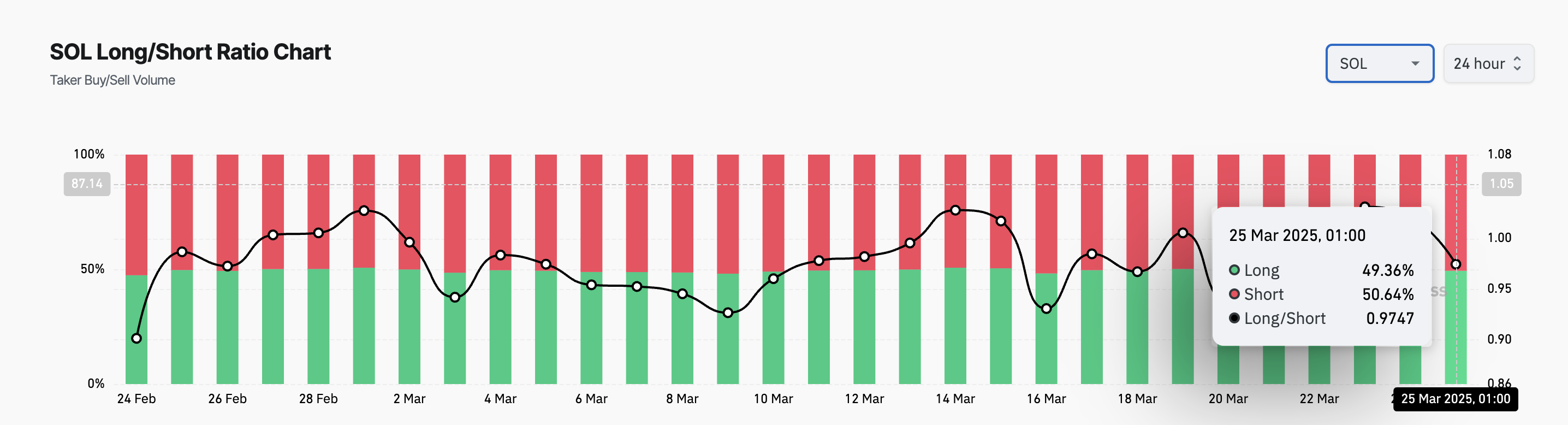

Solana’s lengthy/brief ratio additional helps this bearish outlook. At press time, it rests at 0.97, reflecting a excessive demand for brief positions amongst derivatives merchants.

The lengthy/brief ratio measures the proportion of lengthy positions (bets on worth will increase) to brief positions (bets on worth declines) available in the market. A ratio under one like this implies there are extra brief positions than lengthy ones. This means that merchants are bearish on SOL and are betting in favor of short-term worth dips

Solana Faces Pivotal Second as Bulls and Bears Battle

As of this writing, SOL trades at $139.41, resting above help fashioned at $136.92. As soon as shopping for stress wanes and SOL sellers consolidate their dominance, the coin’s worth may try to check this help degree.

Ought to the worth zone fail to carry, downward stress on SOL would intensify, doubtlessly driving its worth all the way down to $130.82.

Conversely, a resurgence in precise demand for SOL would invalidate this bearish outlook. In that case, the coin’s worth may rise to $152.87.

Disclaimer

According to the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.