Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin (BTC) climbed almost 5% prior to now week, reclaiming key assist ranges over the previous three days. The current bullish momentum has despatched BTC towards the $88,000 mark, with some analysts suggesting a reclaim of its earlier value vary could possibly be close to.

Associated Studying

Bitcoin Restoration May Set off 14% Surge

After being rejected from the $84,000-$85,000 zone a number of occasions prior to now two weeks, Bitcoin reclaimed this vary over the weekend. The flagship crypto has surged 4.7% from final week’s ranges, closing the week above the $86,000 mark.

Through the start-of-week pump, BTC eyed the $89,000 resistance, hitting a biweekly excessive of $88,765, however didn’t retest the following essential zone as bullish momentum slowed. Nonetheless, the cryptocurrency has held its present vary, hovering between the $86-000-$88,000 assist zone for the previous 24 hours.

Analyst Alex Clary affirmed that Bitcoin’s momentum “appears superior” for a break above the $88,000-$90,000 assist zone because the cryptocurrency reveals a Relative Power Index (RSI) bullish divergence, a V-shaped restoration, and has damaged above its downtrend resistance.

Per the publish, a breakout and reclaim of the essential $90,000 resistance degree may propel BTC to leap between 8 to 14% from present costs to the $95,000-$100,000 ranges misplaced in February.

In the meantime, Daan Crypto Trades famous that Bitcoin “has not moved a lot prior to now few weeks relative to SPX.” Based on the dealer, BTC’s value has been correlated to the S&P 500 (SPX) and “has principally been shifting hand in hand with one another,” which may clarify the flagship crypto’s current dump and bounce.

Nonetheless, he affirmed that Bitcoin remains to be buying and selling “at a stable spot premium throughout this bounce,” suggesting {that a} transfer to new native highs is feasible if BTC maintains the present ranges and reclaims the post-US election breakout vary above $90,000.

BTC Should Maintain This Stage By Week’s Finish

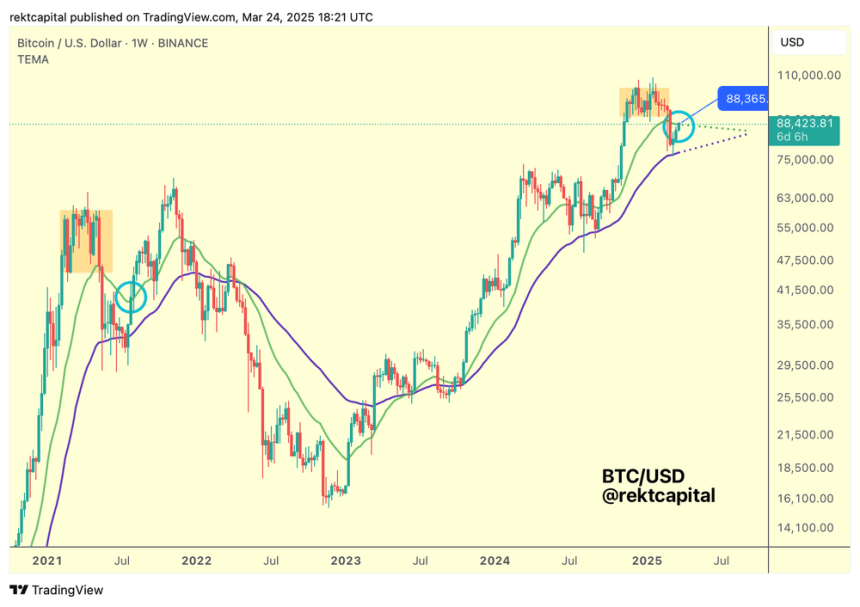

Amid Monday’s market restoration, Analyst Rekt Capital warned that Bitcoin wants weekly closes above $88,400 and $93,500 to finish its draw back deviation interval.

The analyst defined that, over the previous 5 weeks, BTC has been consolidating between the 2 largest bull market Exponential Shifting Averages (EMAs), the 21-week and 50-week EMAs.

Its value motion has just lately gotten nearer to the 21-week EMA, at round $88,400, prepared “for a significant development resolution.” Based on the analyst, Bitcoin wants a weekly shut above this degree and a retest into assist to focus on its Macro Vary.

“This was the precise affirmation that Bitcoin wanted again in mid-2021 when the value crashed -55%,” Rekt Capital famous, suggesting that “issues may get risky each on the upside (trapping FOMO patrons within the upside wick) and the draw back (with panic sellers promoting right into a draw back wick),” if historical past repeats.

A weekly shut above it “may kickstart an uptrend continuation in direction of the Re-Accumulation Vary Low of $93,500.” Furthermore, after reclaiming the 21-week EMA, Bitcoin will want a weekly shut above the re-accumulation vary low to “resynchronize with the Vary.”

Associated Studying

Regardless of this, he warned that “the Publish-Halving Re-Accumulation Vary has proven that easy Weekly Closes above $93,500 might not suffice” as it might want “a profitable post-breakout retest of the Re-Accumulation Vary Low” to verify resynchronization with the vary.

He concluded that failing to efficiently retest and ensure the brand new assist may trigger BTC’s value to lose this important degree and deviate to the draw back once more.

Featured Picture from Unsplash.com, Chart from TradingView.com