The race for an XRP ETF (exchange-traded fund) within the US is heating up as prime monetary corporations, together with BlackRock and Constancy, are predicted to affix the competitors.

Brazil beat the US with an XRP ETF already operating after Hashdex secured approval a month in the past, successfully pioneering the nation’s monetary instrument.

Nate Geraci Says XRP ETF Solely A Matter of Time

Nate Geraci acknowledged that XRP ETF approval is “merely a matter of time.” In accordance with the president of the ETF Retailer, the XRP token is the third-largest non-stablecoin cryptocurrency by market capitalization, making it a lovely candidate for main ETF issuers.

He expects main asset managers like BlackRock and Constancy to enter the XRP ETF market. This is able to imply following the footsteps of different corporations like Bitwise, Canary Capital, WisdomTree, and Grayscale, who’ve already submitted filings.

“Ripple lawsuit coming to finish… Appears apparent that spot XRP ETF approval is solely a matter of time IMO. And sure, I anticipate BlackRock, Constancy, and many others. to all be concerned. XRP is at present third largest non-stablecoin crypto asset by market cap. Largest ETF issuers aren’t going to disregard this,” wrote Geraci.

Whereas Constancy’s place stays unclear, BlackRock just lately mentioned it could prioritize Bitcoin and Ethereum ETFs, citing their sturdy efficiency and market maturity. Particularly, regulatory uncertainty and low market share saved BlackRock from launching altcoin ETFs like Solana or XRP.

“We’re simply on the tip of the iceberg with Bitcoin and particularly Ethereum. Only a tiny fraction of our shoppers personal IBIT and ETHA, in order that’s what we’re centered on (vs. launching new altcoin ETFs),” Bloomberg’s Eric Balchunas acknowledged, citing Jay Jacobs, the top of BlackRock’s ETF division.

However, the rising confidence in an XRP ETF stems from current constructive developments in Ripple’s long-running authorized battle with the US SEC (Securities and Trade Fee). The securities regulator just lately dropped its lawsuit towards Ripple, marking a major victory for the blockchain firm.

As BeInCrypto reported, Ripple will retain $75 million from its settlement with the SEC because the case enters its remaining phases.

Ripple CEO Brad Garlinghouse has expressed renewed optimism in regards to the firm’s future within the US following this break. In his opinion, the authorized victory paves the way in which for additional institutional adoption.

5 months in the past, Garlinghouse predicted that an XRP ETF was inevitable. Latest regulatory readability has solely strengthened this perception.

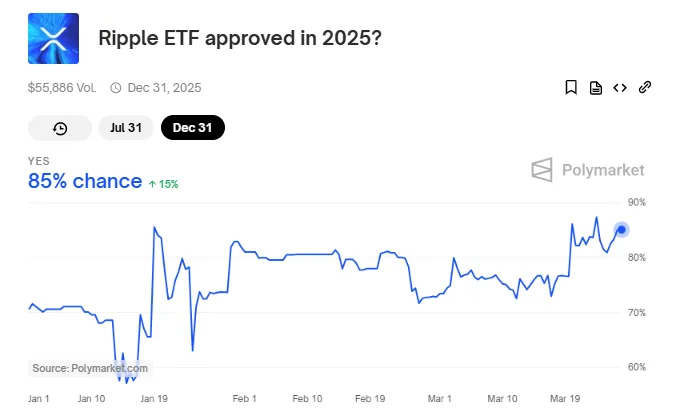

XRP ETF Approval Odds Soar to 82%

As of February, the SEC started a 240-day countdown to evaluate XRP ETF purposes, with approval odds growing considerably. In accordance with Polymarket knowledge, the chance of an XRP ETF approval in 2025 has surged to 82%. On the similar time, there’s a 41% likelihood of approval by July 31, 2025.

This rising confidence displays the SEC’s altering stance on crypto-based ETFs following the approval of spot Bitcoin ETFs earlier this 12 months.

JPMorgan analysts predict that XRP ETFs may appeal to between $6 and $8 billion in 6 to 12 months. This projection displays the sturdy demand for regulated crypto funding merchandise. That is significantly pronounced amongst institutional traders searching for publicity to digital belongings with out direct custody dangers.

Nevertheless, whereas the optics look good for XRP ETFs, investor demand for added merchandise past Bitcoin and Ethereum ETFs stays unsure.

Nic Puckrin, monetary analyst and founding father of The Coin Bureau, says the extra ETFs could also be pointless in a soon-to-be oversaturated market.

“…Trump Media’s new “Made in America” ETFs – that are set to incorporate US-made altcoins alongside shares – will carry nothing new to the desk. In all chance, their success shall be short-lived and their long-term efficiency shall be lackluster. Buyers will proceed selecting BTC ETFs over all this noise,” Puckrin instructed BeInCrypto.

BeInCrypto knowledge exhibits XRP was buying and selling for $2.47 as of this writing. This represents a modest surge of virtually 2% within the final 24 hours.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.