In an unique interview with BeInCrypto, former US CFTC Commissioner Timothy Massad explains how President Trump’s crypto ventures and political energy have considerably overlapped in his first two months on the White Home.

Shortly earlier than assuming workplace for the second time, US President Donald Trump dove head-first right into a flurry of crypto experiments. From endorsing World Liberty Monetary (WLFI) to launching his meme coin, Trump is elevating severe considerations over conflicts of curiosity. Tim Massad, the twelfth CFTC Chairman, who served below Barack Obama, shares his ideas.

A Historic President For Many Causes

Earlier than assuming his first time period in workplace in 2016, President Trump broke with trendy precedent by departing from established conflict-of-interest norms. An actual property mogul with a trademark for a final title, Trump could be getting into the Oval Workplace because the chief of a multi-billion greenback empire.

Whereas former presidents like Jimmy Carter and George W. Bush took measures to separate themselves from their companies by putting their belongings in a blind belief, the sitting President took a distinct strategy.

As a substitute, Trump handed day-to-day administration selections over to his sons however didn’t divest in his possession stake.

Although he obtained a lot backlash throughout his first time period over battle of curiosity considerations, Trump refused to relinquish possession of the Trump Group earlier than assuming workplace for the second time.

Nonetheless, the ‘battle of curiosity’ has reached a brand new stage this time, in comparison with 2016. Right this moment, his ventures lengthen far past actual property. Trump has now secured a big footing within the crypto trade.

Given Trump’s favorable stance towards digital asset coverage growth, gamers inside and outdoors the trade have begun to wonder if his selections are based mostly on the sector’s finest pursuits or are designed to learn his personal ventures.

How Deep is Trump’s Involvement in World Liberty Monetary?

Although Trump doesn’t have a direct function in WLFI, he seems on the whitepaper’s record of supporting groups as “Chief Crypto Advocate.” His three sons, Eric, Donald Jr., and Barron, are additionally on the record.

Stories additional unveiled that the Trump household holds a 75% stake within the platform’s web income and a 60% stake within the holding firm. On the similar time, Trump and his associates personal 22.5 billion of the corporate’s tokens.

For former CFTC Commissioner Tim Massad, regardless of Trump’s casual function in WLF’s governance, his stake within the platform’s efficiency raises severe conflicts of curiosity.

“I believe it’s unprecedented and plainly mistaken for a President of the USA to interact in business ventures or have his household and associates interact in business ventures that may be immediately influenced by the insurance policies he adopts as President or the statements he makes about these insurance policies,” Massad informed BeInCrypto.

In the meantime, the tokens themselves are non-transferrable, limiting monetary flexibility. Although the venture goals to supply token holders entry to a variety of DeFi-related services, it has but to launch them. Within the meantime, token holders must wait till the time comes to make use of their tokens.

“I’ve but to see any actual enterprise case or utility that’s of worth to individuals who make investments. So I believe all of it simply has a personality of making the most of individuals,” Massad added.

The trade has additionally grown weary over how WLF and different Trump-endorsed initiatives may very well be used to realize the President’s favor.

Business Leaders Voice Issues Over World Liberty Monetary’s Legitimacy

Shortly earlier than Trump launched World Liberty Monetary, many distinguished figures within the crypto sector warned that the venture may trigger Trump additional authorized troubles. In the meantime, Alex Miller, CEO of Web3 platform Hiro, described the venture as an “apparent pump scheme.”

In the meantime, Alex Miller, CEO of Web3 platform Hiro, described the venture as an “apparent pump scheme.”

Different trade leaders, resembling Mark Cuban, Max Keiser, and Anthony Scaramucci, additionally criticized Trump’s choice to proceed with WLF’s token gross sales. Trump’s involvement within the venture heightened fears that crypto’s fragile public picture and controversial repute could be smeared additional.

Massad agreed with this final level, including that crypto coverage growth is alive and properly at the moment greater than ever. The continued growth of stablecoin rules, open talks of a nationwide crypto strategic reserve, and a Senate-driven digital asset working group are solely a number of the present institutional initiatives.

“He, the Trump Group and his members of the family shouldn’t be participating in business ventures that pose such blatant conflicts of curiosity, given the truth that crypto regulation and issues like a possible Bitcoin reserve are essential coverage points at the moment. A US president shouldn’t be participating in these items in any respect, for my part,” Massad mentioned.

Because the venture’s launch six months in the past, a number of examples validating these considerations have emerged. Essentially the most notable one has targeted on Tron founder Justin Solar.

Justin Solar’s Controversial Funding in WLFI

TRON founder Justin Solar turned World Liberty Monetary’s largest investor in November after shopping for $30 million price of WLF tokens.

The transfer was extremely controversial. Regardless of Trump’s endorsement, WLFI struggled to satisfy its $30 million fundraising goal throughout its first public sale. The token’s availability was restricted, excluding basic buying and selling and limiting purchases to non-US and accredited US traders.

Solar’s funding turned WLFI’s luck round. Quickly after that, he additionally turned one of many venture’s advisors. Then, on the day of Trump’s inauguration, Solar invested a further $45 million within the venture, bringing the whole sum to $75 million.

This funding introduced various levels of scrutiny. Whereas some questioned his fast transition from investor to advisor, others pointed to Solar’s previous as a possible motive for his contributions.

In March 2023, the SEC filed fraud expenses and different securities regulation violations towards Solar and his corporations. This regulatory baggage has led some trade leaders to query the knowledge of his affiliation with World Liberty Monetary.

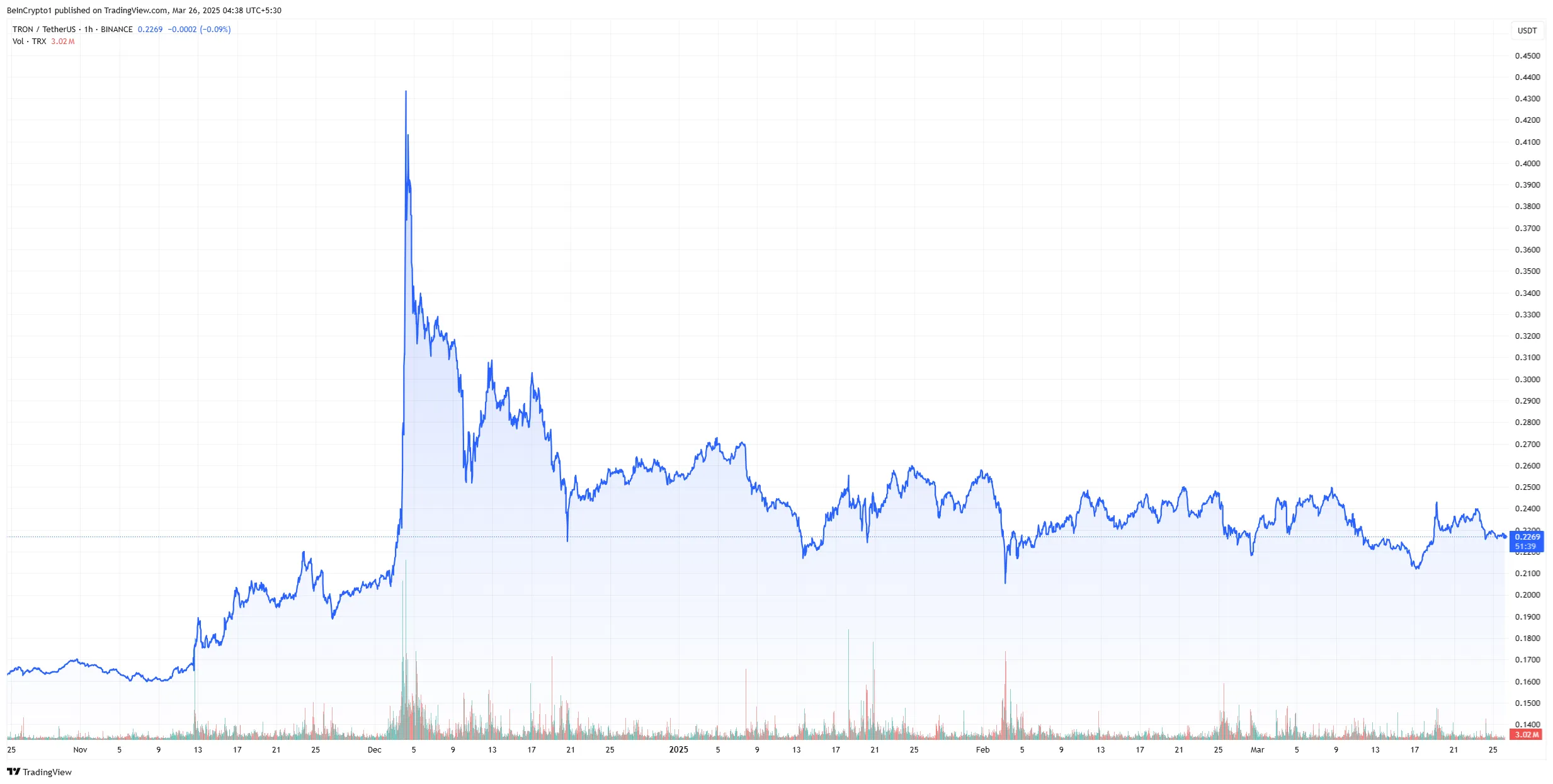

In the meantime, Tron’s worth soared following Solar’s newest WLF funding. Tron, which had been experiencing lagging costs up till that time, was in a position to jumpstart its buying and selling actions.

Nonetheless, these conflicts of curiosity will not be simply restricted to Solar’s funding.

Potential Binance Stake and Additional Conflicts

Lower than two weeks in the past, reviews surfaced that the Trump household had held talks to accumulate a monetary stake in Binance’s US division. Although Binance’s founder, Changpeng Zhao, discredited these reviews, flirting with the idea comes simply.

Zhao may additionally profit from an settlement. In 2023, he pleaded responsible to federal expenses for failing to implement sufficient anti-money-laundering measures at Binance.

Following his plea, Zhao resigned as Binance’s CEO. Motive-driven speculations level towards the opportunity of a possible presidential pardon.

For Massad, maneuvers like these are pure when a president immediately includes himself in crypto ventures.

“I believe there’s a enormous threat of conflicts of curiosity and corruption by advantage of the President and other people related to him promoting crypto belongings—whether or not that’s via World Liberty Monetary or the meme cash. It creates the potential for ongoing conflicts, as a result of individuals who would possibly need to curry favor with the administration may purchase the cash,” Massad informed BeInCrypto.

All of the whereas, Trump advantages his crypto ventures each time he makes a pro-crypto announcement.

Is Trump Manipulating the Crypto Market?

Every week into March, Trump signed an govt order to ascertain a Crypto Strategic Reserve and a US Digital Asset Stockpile. In his authentic announcement, Trump mentioned the reserve would come with Bitcoin, Ethereum, and altcoins like XRP, ADA, and SOL.

The crypto market responded instantly, with all 5 cryptocurrencies posting robust good points. But, Trump’s announcement rapidly raised considerations over potential market manipulation.

With Bitcoin, Ethereum, and XRP in its treasury, WLF’s holdings grew in worth as these belongings appreciated. This development may have boosted investor confidence, resulting in increased demand for WLF tokens.

The crypto market’s total surge and a focus to Trump-related initiatives additionally generated better investor curiosity in WLF, contributing to its worth appreciation.

In the meantime, Trump’s meme coin surged following the President’s reserve announcement. Whereas TRUMP’s worth stood at $13.55, with a buying and selling quantity of just about $1.2 billion on March 2, these numbers surged to $17.46 and $3.6 billion, respectively, following the information a day later.

On March 4, TRUMP’s worth and buying and selling quantity plummeted beneath the numbers they registered solely two days earlier.

“I believe the meme cash have appeared like a basic pump-and-dump scheme or cash seize. I don’t assume the problem ought to be, why not let individuals put money into these items in the event that they need to? In fact they need to have the correct to put money into no matter they need. The problem is the propriety of the President of the USA promoting issues that capitalize on his being the President,” mentioned Massad.

Even Ethereum Co-Founder Vitalik Buterin touched on the damaging results of political meme cash in a social media publish printed 5 days after TRUMP’s launch.

“Now could be the time to speak about the truth that large-scale political cash cross an additional line: they don’t seem to be simply sources of enjoyable, whose hurt is at most contained to errors made by voluntary individuals, they’re automobiles for limitless political bribery, together with from overseas nation states,” Buterin mentioned.

Given Trump’s energetic participation within the crypto trade over the previous a number of months, an important query stays: Why hasn’t Trump been held accountable over these obvious conflicts of curiosity?

The reply stays quick and bitter: He can’t be.

Can Trump Be Held Accountable?

The potential conflicts of curiosity arising from Donald Trump’s involvement within the cryptocurrency trade have drawn the eye of assorted political figures, significantly these targeted on authorities ethics and oversight.

US Senator Elizabeth Warren has been probably the most vocal opponent of Trump’s dealings within the crypto trade.

A day earlier than the White Home Digital Belongings Summit, Warren despatched an in depth letter to Trump’s crypto czar, David Sacks.

“I write at the moment to request details about the way you, as President Trump’s ‘Crypto Czar,’ have addressed your conflicts of curiosity, and the way you’ll forestall the President and different personal people from immediately profiting off of the Trump Administration’s efforts to selectively pump the worth of sure crypto belongings, drop crypto asset-related enforcement actions, and decontrol the crypto asset trade. These actions have the potential to learn billionaire traders, Trump Administration insiders, and speculators on the expense of middle-class households,” Elizabeth Warren wrote.

Nonetheless, not a lot else might be accomplished past letters that demand responses and clarifications from the Trump administration.

The Authorized Loophole

US Presidents are largely exempted from battle of curiosity provisions. This exemption has been based mostly on authorized interpretations that argue these legal guidelines may impede the President’s means to meet their constitutional duties.

“The issue is, the POTUS is just not topic to the conflict-of-interest legal guidelines that apply to most different govt department officeholders. There’s the Overseas Emoluments Clause within the Structure, which prohibits accepting items from overseas international locations. There’s additionally a home clause that prohibits accepting items from the federal government. However past that, he’s not topic to the standard conflict-of-interest requirements. So, it’s unlucky that we don’t have these requirements relevant to a president. I believe, had some other president accomplished these items, there could be much more outrage,” Massad informed BeInCrypto.

Given the authorized circumstances, public scrutiny and political strain are the very best methods to carry a president accountable for potential conflicts of curiosity.

But, regardless of the authorized exemptions for sitting presidents, the moral implications of Trump’s crypto dealings stay simple.

Because the traces between political energy and private revenue proceed to blur, the need for clear moral requirements, even with out authorized mandates, turns into more and more pressing.

Failing to take action would possibly erode public belief within the crypto trade, producing doubtlessly irreversible penalties.

Disclaimer

Following the Belief Undertaking pointers, this function article presents opinions and views from trade specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its employees. Readers ought to confirm data independently and seek the advice of with an expert earlier than making selections based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.