- GameStop plans to lift $1.3 billion by means of a zero-interest convertible notes providing due in 2030.

- Proceeds might go towards normal use—together with Bitcoin purchases, per the corporate’s funding coverage.

- The notes can convert to money, inventory, or each, however aren’t registered for public sale within the U.S.

GameStop‘s again within the headlines—this time with a plan to lift some severe money. The corporate stated it’s trying to provide $1.3 billion in convertible senior notes due 2030, in a non-public sale geared toward massive institutional patrons. The providing? Topic to “market situations,” in fact—as a result of when isn’t it?

They’re calling these zero-coupon notes, which suggests no common curiosity funds. Nada. And the debt gained’t accrete both, which means what you see is what you get. The notes are set to mature in April 2030, until they’re transformed, redeemed, or repurchased earlier. So, there’s some wiggle room.

There’s additionally an choice within the deal—preliminary patrons may get to select up an further $200 million in notes inside 13 days of the difficulty date. As a result of hey, what’s a billion with no little extra on the facet?

Convertible… However Into What?

If holders resolve to transform the notes, GameStop says it’ll ship both money, shares of its Class A typical inventory, or a mixture of each—no matter works finest on the time. The specifics, just like the conversion charge and redemption particulars, will likely be hammered out throughout pricing.

Oh, and the reference worth for the inventory? That’ll be primarily based on the typical buying and selling worth between 1:00 p.m. and 4:00 p.m. Japanese Time on the day they lock all of it in. It’s all very… exact.

Sure, Bitcoin’s Concerned—Due to Course It Is

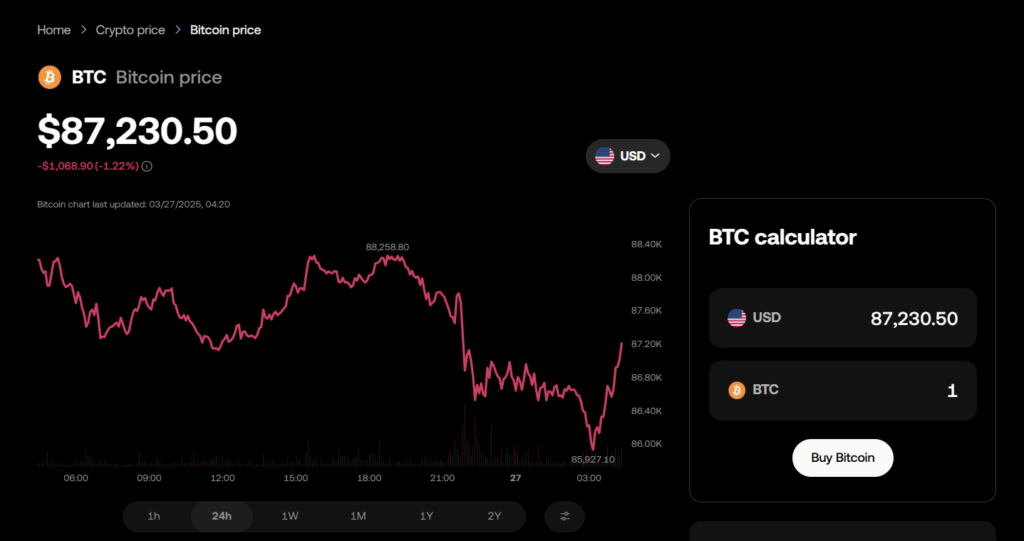

The cash raised is anticipated to go towards “normal company functions.” What does that even imply? Properly, a part of it, they are saying, will likely be used to purchase Bitcoin. Which tracks—GameStop not too long ago made waves by adopting crypto into its treasury technique. It’s the meme-stock-meets-macro play now, apparently.

A Few Authorized Issues (AKA the Nice Print)

Value noting—these notes, and any inventory that might come from changing them, haven’t been registered below the Securities Act. And doubtless gained’t be. So, until you’re a certified institutional purchaser or somebody working below an exemption, you’re out of luck for those who’re hoping to get in.

Additionally, GameStop was fast to say this launch isn’t some secret gross sales pitch. No provides, no gross sales, no stress. Only a heads-up.

The Greater Image

GameStop, headquartered in Grapevine, Texas (yep, nonetheless there), is holding on to its spot as a specialty retailer, largely promoting video games and leisure stuff throughout its on-line retailers and brick-and-mortar places.

And as all the time, they’re tossing within the traditional “secure harbor” language: Principally, all of this might change. The providing may not occur in any respect, or it might look very completely different as soon as finalized. There’s threat, there’s uncertainty, and market situations might throw the entire thing off monitor.

In different phrases? Keep tuned.