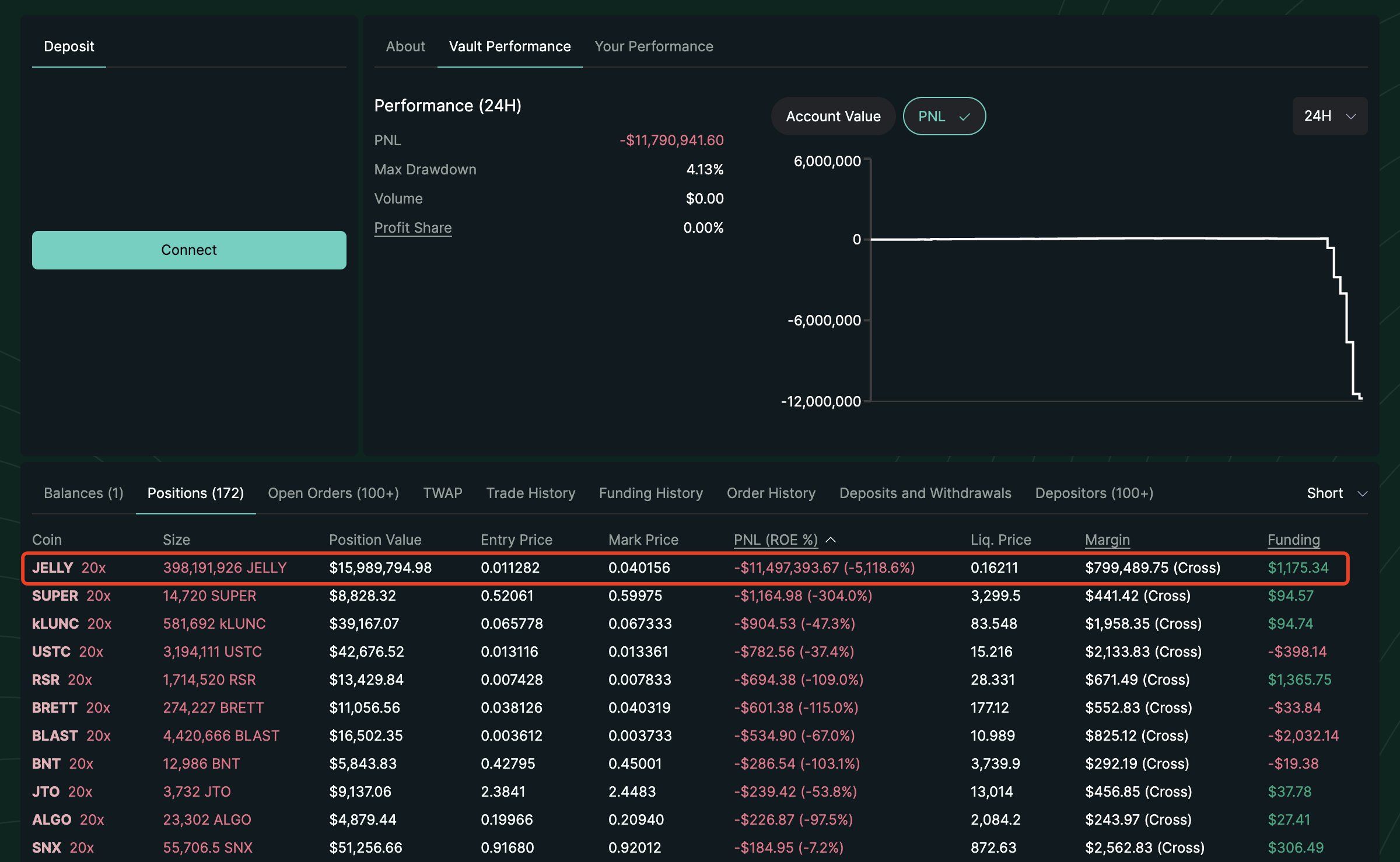

Hyperliquid (HYPE) is going through heavy promoting stress after a significant brief squeeze of the JELLY meme coin triggered widespread considerations throughout the platform. A whale manipulation led to almost $12 million in losses for Hyperliquidity Supplier (HLP), forcing the change to delist the token.

Following the change’s actions, market confidence took a success, inflicting HYPE to drop over 14% up to now 24 hours. With its market cap now under $5 billion, will HYPE proceed to droop?

JELLY Delisting Crashes Hyperliquid Value

Hyperliquid is beneath intense scrutiny after a whale holding 124.6 million JELLY started manipulating the token’s value to use Hyperliquidity Supplier (HLP).

The whale first dumped the tokens, crashing the value and forcing HLP into a large passive brief. Then, by rebuying and driving the value again up, the whale triggered a lack of almost $12 million for HLP.

This exploit sparked main considerations across the platform’s danger publicity and safety mechanisms.

In response, Hyperliquid introduced the delisting of JELLYJELLY to forestall what might have change into a $230 million loss.

Nevertheless, the injury to investor confidence was already executed, inflicting HYPE’s value to drop over 10% up to now 24 hours. Its market cap has now fallen under $5 billion because the market reacts to fears of additional instability and the potential for comparable exploits.

HYPE Indicators Present The Affect Of The Information

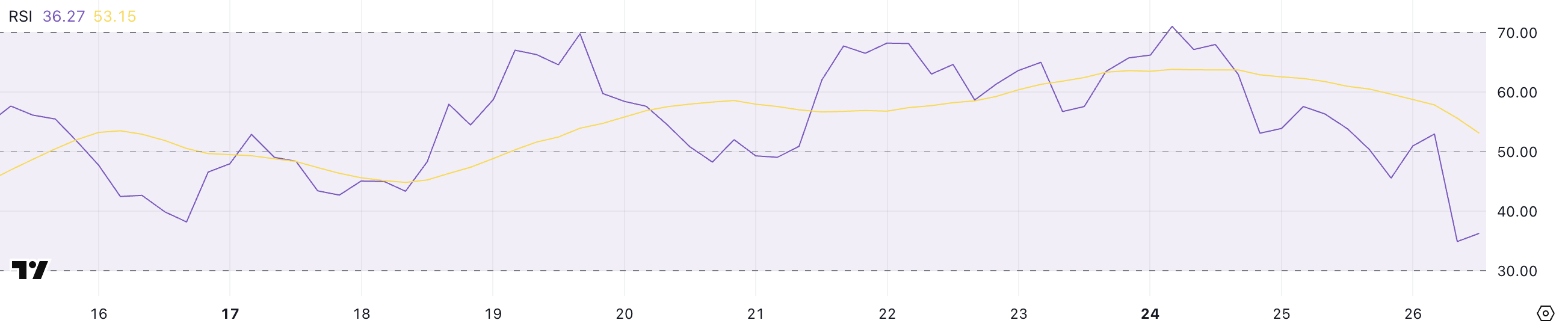

HYPE’s RSI has dropped to 36.27, down sharply from 71 simply two days in the past. This decline displays a fast shift in momentum following the exploit information that despatched the value decrease after a quick restoration try.

The RSI (Relative Power Index) measures value momentum on a scale from 0 to 100. Readings above 70 sign overbought situations, whereas values under 30 recommend oversold territory. Ranges between 30 and 50 point out bearish stress.

With RSI now at 36.27, HYPE is approaching oversold ranges, suggesting sellers have taken management. Whereas not excessive but, it indicators weak spot and will level to additional draw back if sentiment doesn’t enhance.

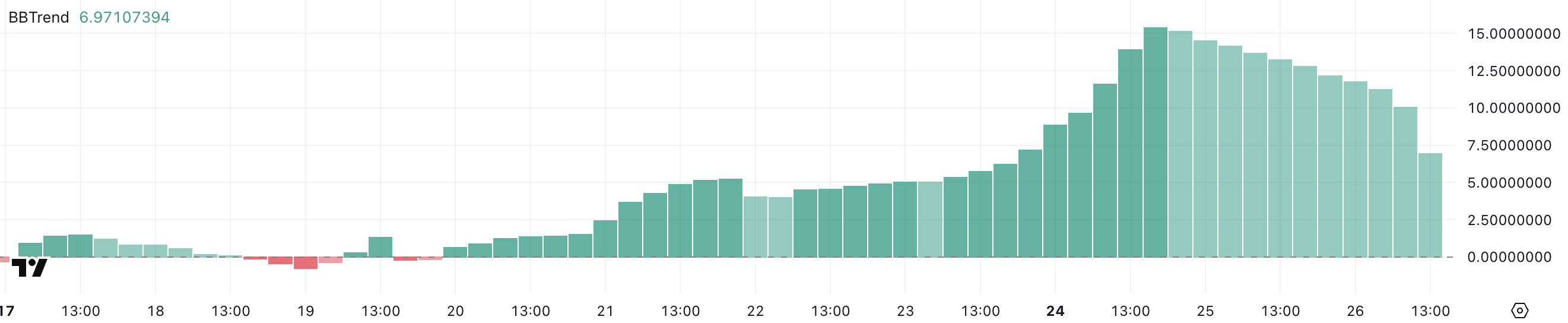

In the meantime, HYPE’s BBTrend dropped from 10 to six.97 after the exploit however has remained in constructive territory for six straight days. BBTrend, or Bollinger Band Pattern, measures the energy of value developments primarily based on the enlargement of Bollinger Bands.

Values above 3 present robust momentum, whereas these under 1 recommend sideways motion. The drop from 10 to beneath 7 exhibits development energy is weakening, however nonetheless intact.

If BBTrend continues to fall, it could affirm a slowdown in bullish momentum. Mixed with the low RSI, this might preserve HYPE beneath stress except a reversal takes form.

Can Hyperliquid Get well From The Crash?

If the present correction continues, HYPE might quickly check the important thing assist at $13.91. This transfer may very well be accelerated by the formation of a loss of life cross, which the EMA strains recommend could occur quickly.

Dropping the $13.91 stage would seemingly add extra promoting stress. The following helps are $12.82 and $12.06. A break under these might deepen the downtrend additional.

On the flip aspect, if HYPE can get well from the latest detrimental sentiment, it could retest the $17.03 resistance. It tried this stage simply three days in the past however failed to interrupt via.

If $17.03 is damaged and momentum builds, HYPE might push increased to $21, and even $25.87. That might mark its first time buying and selling above $24 since February 22.

Disclaimer

According to the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.