Polymarket, a prediction market platform, is below hearth following probably the most extreme manipulation assault in its historical past.

A prediction market with a betting quantity exceeding $7 million produced an misguided final result, leaving customers with important losses.

Inside Polymarket’s $7 Million Market Manipulation: What Went Flawed

The most recent controversy considerations the market: “Ukraine agrees to Trump mineral deal earlier than April?” The market was speculated to run from February 2 to March 31, 2025.

It might resolve as “Sure” if the US and Ukraine reached an settlement involving Ukrainian uncommon earth components by the required deadline.

Guidelines on the Polymarket platform explicitly acknowledged that the decision could be based mostly on “official data from the US and Ukrainian governments.” Nonetheless, regardless of no official affirmation, the market was resolved as “Sure,” resulting in widespread accusations of manipulation.

“Polymarket has scammed its customers as soon as extra,” a person wrote on X.

He additionally famous that, prior to now, two markets with similar situations have been labeled as “No.” Notably, that they had a lot smaller betting volumes of $91,860 and $360,976. In distinction, the manipulated market boasted a betting quantity exceeding $7 million.

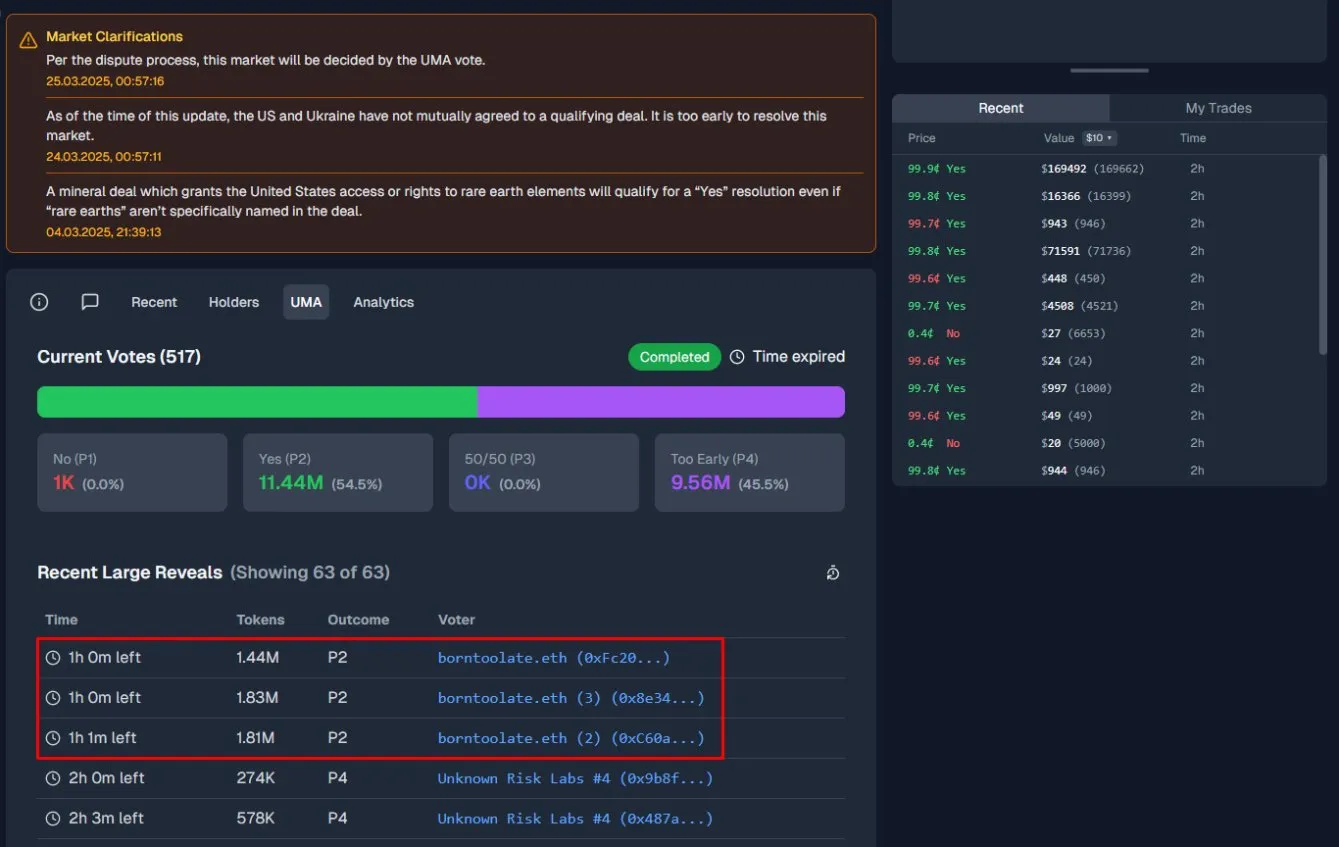

The person claimed {that a} group of influential customers referred to as UMA whales manipulated the end result. He additionally revealed {that a} whale used a number of accounts to solid a lot of votes, totaling 5 million tokens, which accounted for 25% of the entire votes.

Thus, the person successfully concentrated a good portion of the voting energy of their fingers, skewing the end result in favor of the “Sure” possibility.

Polymarket’s response has completed little to assuage person considerations. The workforce issued an announcement on their official Discord server, acknowledging the scenario. Nonetheless, they acknowledged that they may not problem refunds to affected customers as a result of the scenario was not a market failure.

“That is an unprecedented scenario, and we’ve been in warfare rooms all day internally and with the UMA workforce to ensure this received’t occur once more. This isn’t part of the long run we need to construct: we’ll construct up programs, monitoring, and extra to ensure this doesn’t repeat itself,” the assertion learn.

Is Polymarket Rigged? A Historical past of Insider Allegations

In the meantime, this isn’t the primary time Polymarket has been accused of manipulation. An in depth thread by an X person, Folke Hermansen, make clear a number of comparable situations.

“Polymarket is revealing itself to be revealing itself a completely fraudulent platform. Insiders write guidelines, place bets, and co-ordinate with verifiers to rig markets and rip-off their very own clients for hundreds of thousands every day,” he posted.

Hermansen disclosed that, in early March, manipulators resolved the “Gold lacking from Fort Knox” market as “No,” stealing $3.5 million. Moreover, in one other tariff-related market, he alleged that the dispute button disappeared in the course of the 2-hour window for customers to problem the decision. This allowed insiders to push the market to a “No” final result.

One other instance he gave was the “Will Trump say China throughout his crypto summit?” market. Polymarket issued a rule clarification after Trump talked about China, retroactively declaring it didn’t depend and resolving the market to “No.”

Hermansen elaborated that the manipulation of Polymarket markets occurs on account of a mix of things associated to UMA’s dispute decision system and the affect of insiders.

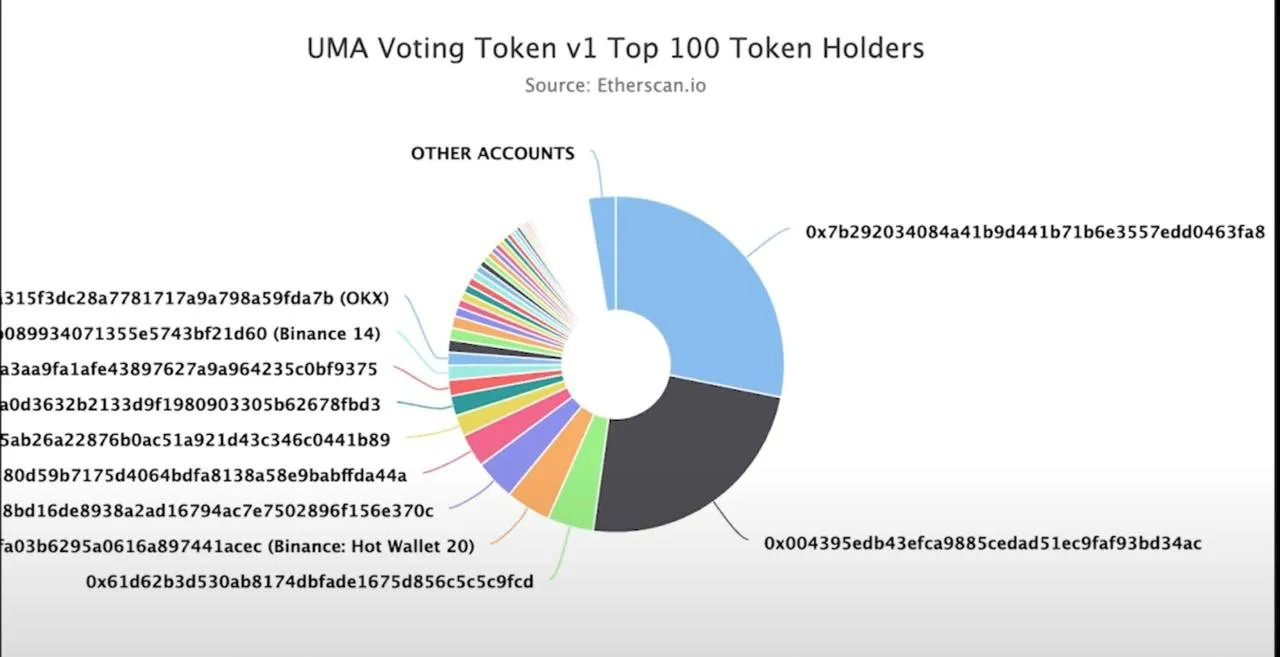

He added that UMA decision votes are extremely concentrated, with simply two whales controlling over half of the voting energy. Moreover, a person holds as much as 7.5 million of the 20 million staked UMA tokens.

Hermansen harassed that these whales are additionally energetic contributors in Polymarket, inserting massive bets on outcomes.

“UMA is, in idea, a impartial third-party blockchain protocol which incentivizes truth-seeking. In actuality, it incentivizes crowding in direction of no matter different persons are voting for,” he acknowledged.

In line with him, the UMA system incentivizes voters to comply with the bulk to keep away from dropping their staked tokens. Thus, massive holders’ actions drive voting relatively than an unbiased seek for the reality.

Moreover, he detailed that to suggest or dispute a market decision on Polymarket, customers should put up a bond, which is often $750 USDC. Insiders with important holdings can afford to stake massive quantities and put up bonds. In the meantime, worry of dropping their stake discourages others from difficult them.

In consequence, most disputes in UMA find yourself with near-unanimous resolutions, typically 95% or extra.

“It’s an open secret that UMA whales can arbitrarily resolve how markets resolve,” Hermansen claimed.

He additionally emphasised that the system’s design anonymizes voting and disputes. Due to this fact, this makes it troublesome to hint who’s accountable for incorrect resolutions, additional enabling insider manipulation.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.