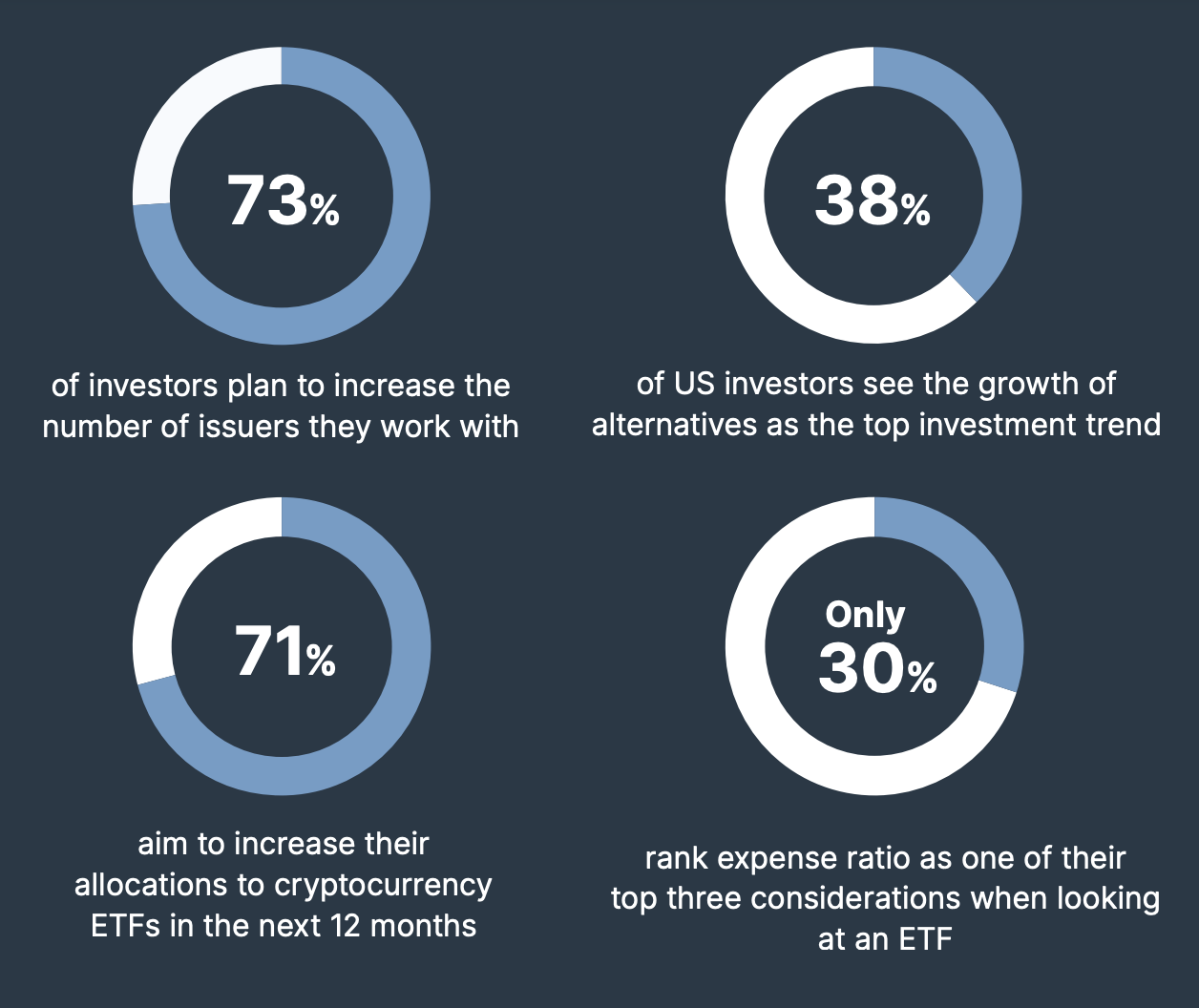

In line with a current survey by Brown Brothers Harriman, 71% of ETF buyers want to make investments extra in crypto this yr. This bullish sign comes because the crypto ETF market is starting to get better from current volatility.

The agency is likely one of the oldest and most prestigious funding banks within the US, including credibility to its claims. This information additionally aligns with different surveys that counsel rich buyers are taken with Bitcoin.

Crypto ETFs Are Changing into Widespread Amongst TradFi Traders

For the reason that Bitcoin ETFs had been first accredited in 2024, they’ve ushered in a profound transformation of the crypto market. BlackRock’s IBIT was so widespread that some specialists declared it the best ETF launch ever.

In line with a brand new survey from Brown Brothers Harriman, 71% of ETF buyers are planning to additional their allocations into crypto.

“Excellent news for the crypto crowd, 71% [of surveyed investors] stated they purpose to extend their allocation to crypto ETFs within the subsequent 12 months.. That’s increased than I’d have thought, I’d have guessed 40-50% and that i’m fairly bullish on this area, comparatively talking,” claimed Eric Balchunas, a outstanding ETF analyst.

This survey comes at a fortuitous time for the ETF area and crypto markets basically. Bearish fears have been dominating the area, and US spot Bitcoin ETFs lately took a severe beating.

Nonetheless, the market is already beginning to get better, and issuers have resumed massive BTC purchases. This survey reveals that extra buyers are keen to pour liquidity into the crypto market by way of ETFs.

Brown Brothers Harriman is likely one of the oldest and most prestigious funding banks within the US, and its survey is a reputable indicator of ETF sentiment. Moreover, different current surveys have drawn related conclusions.

For instance, earlier this month, a ballot of rich US buyers confirmed excessive curiosity in Bitcoin and different main altcoins.

In the meantime, Bitcoin ETFs have largely recovered this week after seeing internet outflow for 5 consecutive weeks. On the similar time, extra asset managers are submitting numerous ETF functions with the SEC. Given the present optimistic sentiment amongst institutional buyers, the long-term outlook is prone to be bullish for such funds.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.