The stablecoin market has skilled a big surge in latest months. Its complete market capitalization is up by 90% since late 2023, surpassing the $230 billion threshold.

As stablecoins play an more and more very important position in international finance, specialists are figuring out key methods for retail buyers to capitalize on this rising development.

How Retail Buyers Can Revenue from the Stablecoin Growth

Patrick Scott, a decentralized finance (DeFi) skilled, outlined three major methods for buyers seeking to profit from the stablecoin growth.

“There are 3 methods to play the stablecoin growth: 1) Chains stablecoins are issued on 2) Stablecoin issuers 3) DeFi protocols stablecoins are utilized in,” Scott defined.

In line with Scott, the very best alternatives lie in investing within the blockchains that host stablecoins, particularly exploring tasks that subject stablecoins with investable tokens and taking part in DeFi protocols the place stablecoins are actively used.

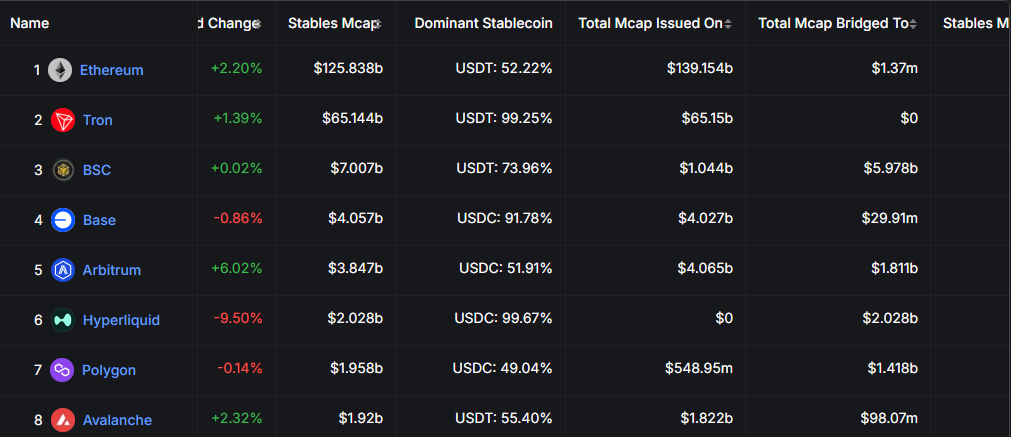

A serious part of the stablecoin ecosystem is the foundational blockchains that facilitate their issuance and operation. Ethereum (ETH) and Tron at present lead the market relating to stablecoin provide.

Ethereum hosts roughly $126 billion in stablecoins, whereas Tron (TRX) follows with $65 billion. Each networks have reached all-time highs in stablecoin circulation.

Tron’s progress has been extra constant, pushed by its widespread adoption of peer-to-peer (P2P) transactions, significantly in creating areas.

As stablecoin adoption continues to rise, investing in native tokens like ETH and TRX may provide profitable alternatives for buyers looking for publicity to the stablecoin market’s growth.

“…inside a number of years it will likely be apparent in hindsight that one of the simplest ways to spend money on the approaching stablecoin growth was merely simply to purchase ETH the place probably the most stablecoins are and can be settled and in the end a key beneficiary of the financial exercise which emerges round them,” analyst DCinvestor added.

Notably, the main stablecoin issuers, Tether and Circle, stay privately held and don’t provide direct funding alternatives. Nonetheless, different rising tasks current viable options. Stablecoins akin to Ethena (USDe), USDY (Ondo), HONEY (Berachain), and crvUSD (Curve) present governance or utility tokens that enable buyers to take part of their progress.

These tokens usually include advantages akin to voting rights or revenue-sharing mechanisms. Such incentives enable retail buyers to revenue because the stablecoin sector expands.

Rising Attract of Stablecoins in DeFi

Stablecoins play an important position within the DeFi ecosystem, serving as a major technique of liquidity, lending, and yield era. Main DeFi protocols with robust stablecoin integration embrace Aave, Morpho, Fluid, Pendle, and Curve.

Buyers can interact with these platforms by offering liquidity or taking part in lending and borrowing actions. Primarily based on transaction charges and rates of interest, they may earn engaging returns.

The surge in stablecoin adoption has not gone unnoticed, with a number of main monetary gamers coming into the house, together with Financial institution of America. Constancy Investments is reportedly creating its stablecoin as a part of a broader initiative to develop its digital asset choices.

As well as, Wyoming has taken a pioneering step by launching its state-backed stablecoin, WYST. Equally, World Liberty Monetary, a agency linked to the Trump household, has formally launched USD1. The US authorities treasuries and money equivalents will absolutely again this stablecoin.

Regardless of the optimism surrounding stablecoins, considerations have emerged about potential dangers. Particularly, the potential of a monetary disaster is much like the 2008 financial institution run situation. If buyers rush to redeem their stablecoins throughout market instability, issuers could also be pressured to liquidate their reserve belongings. This might set off wider disruptions within the monetary system.

Regulatory efforts, together with proposals just like the GENIUS and STABLE Acts, intention to mitigate these dangers by imposing stricter oversight and requiring issuers to keep up absolutely backed reserves.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.