Bitcoin (BTC) has proven indicators of a aid rally this week, providing a glimmer of hope to buyers after the latest market downturn.

Regardless of this transient uptick, analysts are warning that the upward momentum could not final lengthy.

Will Bitcoin’s Rally Final?

In keeping with information from BeInCrypto, Bitcoin’s worth has recovered by 2.0% over the previous week. The positive factors have greater than doubled over the fortnight, with the coin appreciating by 5.0%. On the time of writing, the biggest cryptocurrency traded at $87,381, representing a slight 0.1% dip over the previous day.

Spot Bitcoin exchange-traded funds (ETFs) have additionally seen inflows for 9 consecutive days, based on information from SoSo Worth. Since final Friday, the ETFs have collectively attracted $944 million in inflows.

This sustained curiosity suggests rising confidence amongst institutional buyers. But, analysts are unconvinced of the rally’s potential.

In its newest Cryptocurrency Compass e-newsletter, analysis agency Fairlead Methods predicted that Bitcoin’s aid rally may persist for one more one to 2 weeks. Nevertheless, founder Katie Stockton warned {that a} worth drop could observe.

“Intermediate-term momentum is to draw back, and the weekly stochastics will not be but oversold, growing danger that the rebound is fleeting. We count on the identical for many danger belongings,” she wrote.

Regardless of the bearish outlook, Stockton acknowledged short-term positives. Bitcoin’s near-term momentum has improved, and the worth nonetheless has room to rise earlier than hitting overbought territory. Nonetheless, she cautioned that this window could shut by month’s finish.

This might probably set off a part of consolidation—or “digestion.” Which means that Bitcoin’s upward momentum would possibly decelerate or pause for an extended interval because the market adjusts and absorbs the latest positive factors.

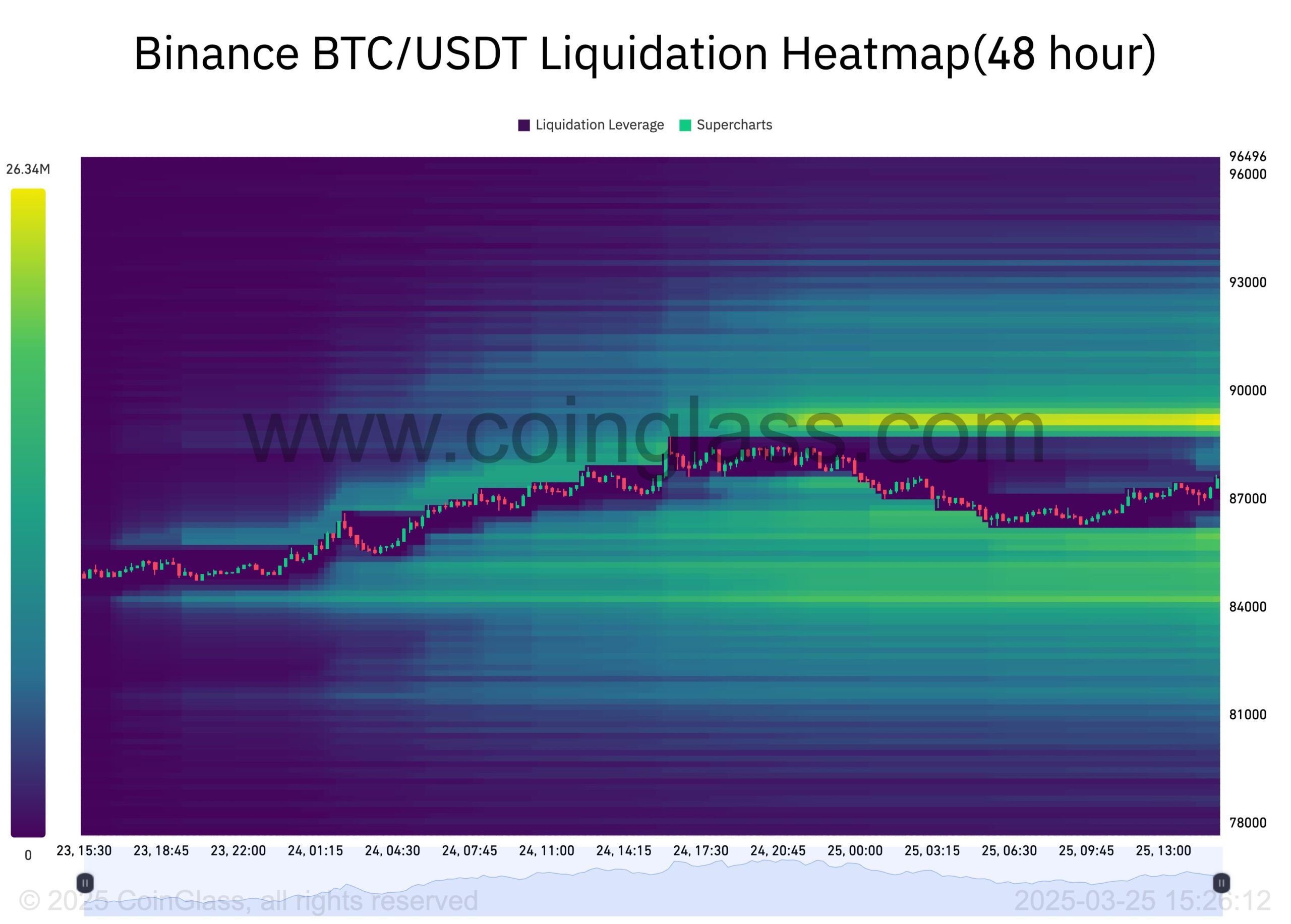

One other analyst additionally shared a cautious outlook. In a latest publish on X (previously Twitter), Koroush AK estimated Bitcoin’s potential worth actions utilizing a liquidation heatmap.

He famous that there’s vital promoting strain round $89,000 (main provide) and shopping for curiosity round $85,000 (demand).

“The concept of a HTF useless cat bounce remains to be legitimate if worth reverts on the highs across the ≈$90K key zone,” he wrote.

For context, a “useless cat bounce” refers to a brief restoration or transient upward motion within the worth of an asset after a chronic downtrend. That is adopted by a continuation of the downtrend. Nevertheless, he added that the bearish situation can be nullified if Bitcoin manages to interrupt previous the resistance degree.

In the meantime, altering macroeconomic situations are additionally a rising concern, significantly with US President Donald Trump’s tariff bulletins scheduled for April 2. Of their latest report, K33 Analysis harassed that though markets are at present steady, the upcoming tariff selections may set off appreciable volatility out there.

“Tariffs stay the first producer of market-moving headlines, rendering most merchants risk-averse as we strategy an enormous day of tariff bulletins on April 2,” the report learn.

The report additional suggested warning and really helpful avoiding leverage as a result of anticipated tariff-induced volatility.

Lately, BeInCrypto additionally explored how Trump’s tariff plans would possibly affect crypto markets. Excessive tariffs may strain danger belongings like Bitcoin, probably mirroring the market’s response in February. Conversely, if tariffs are delayed or utilized selectively, investor fears could ease. This, in flip, may result in a possible restoration in crypto costs.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.