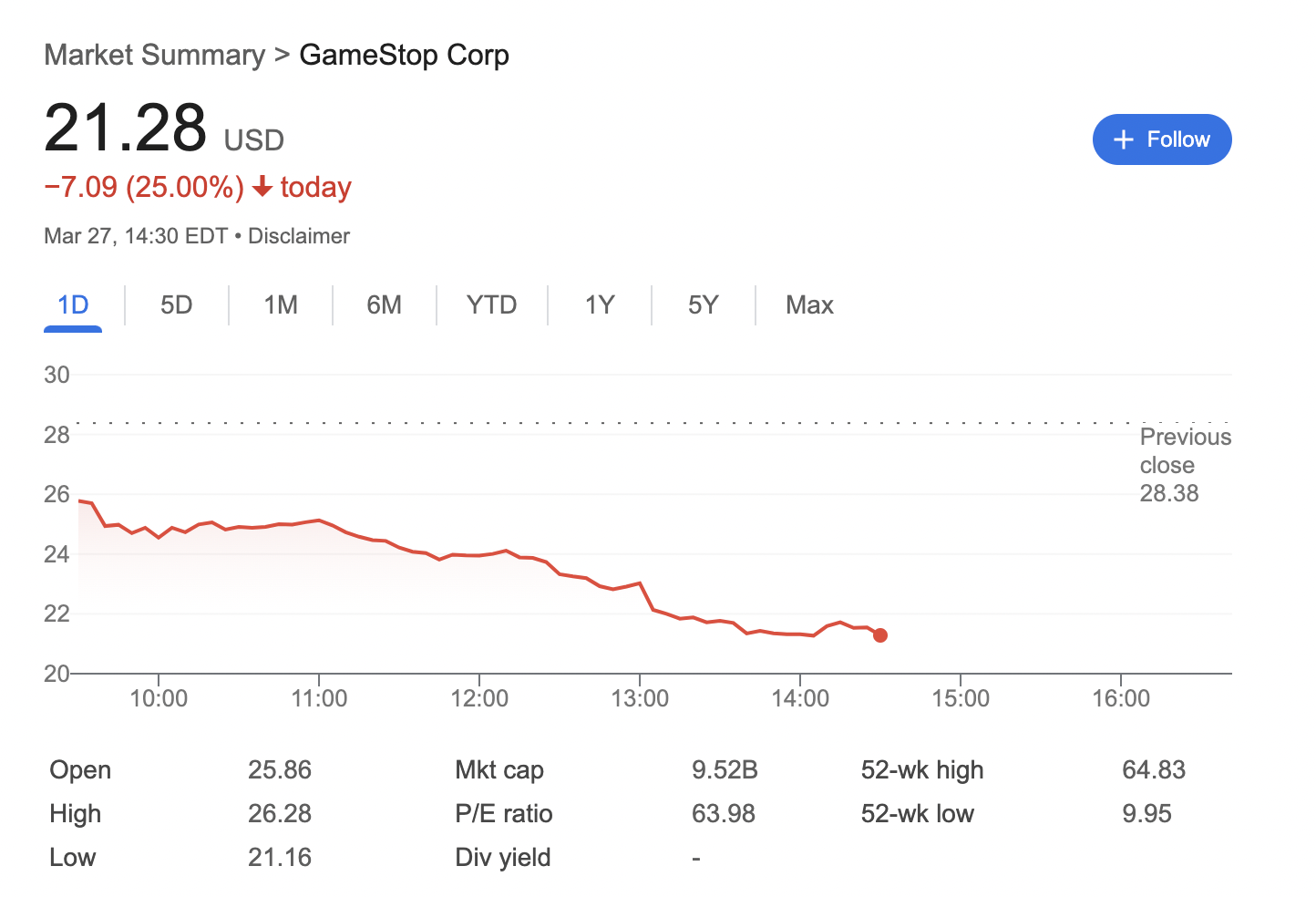

The shares of GameStop (GME) have already collapsed by greater than 25% this Thursday.

This comes after the controversial videogame retailer introduced a $1.3 billion convertible notice providing so as to purchase Bitcoin.

The corporate has copied Technique’s debt-for-bitcoin playbook (colloquially often called the “infinite cash glitch”).

Nevertheless, many have criticized the transfer, with billionaire Clifford Asness lately lambasting the corporate as a rip-off. A few of GameStop’s shareholders are additionally disillusioned by the transfer, which is clear based mostly on the relentless plunge of the corporate’s shares.

Vertical Analysis Advisory managing associate Kip Herriage believes that GameStop ought to put at the very least $2.5 billion into Bitcoin. Herriage has predicted that GME may in the end surge to $100.

The shares of the videogame retailer are at the moment buying and selling at $21.33. In the course of the peak of the GameStop mania in early 2021, its shares surged to $81.25.

It’s unclear what number of Bitcoins GameStop intends to purchase. With a complete of 506,000 cash, Technique is at the moment the largest Bitcoin holder by an infinite margin. Mining big Marathon Digital is at the moment in second place with 46,000 cash.

In a current publish, Technique stated that “MARA might have some competitors quickly,” doubtlessly hinting at GameStop taking its place with large Bitcoin purchases. Nevertheless, there are additionally some

Fold co-founder and CEO Will Reeves claims that the GME plunge just isn’t essentially a nasty factor. “Identical to 2021: recreation flippers obtained changed by revolutionaries. Now, some promote as a result of the revolution simply obtained greater they usually don’t perceive it but,” he stated.