Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

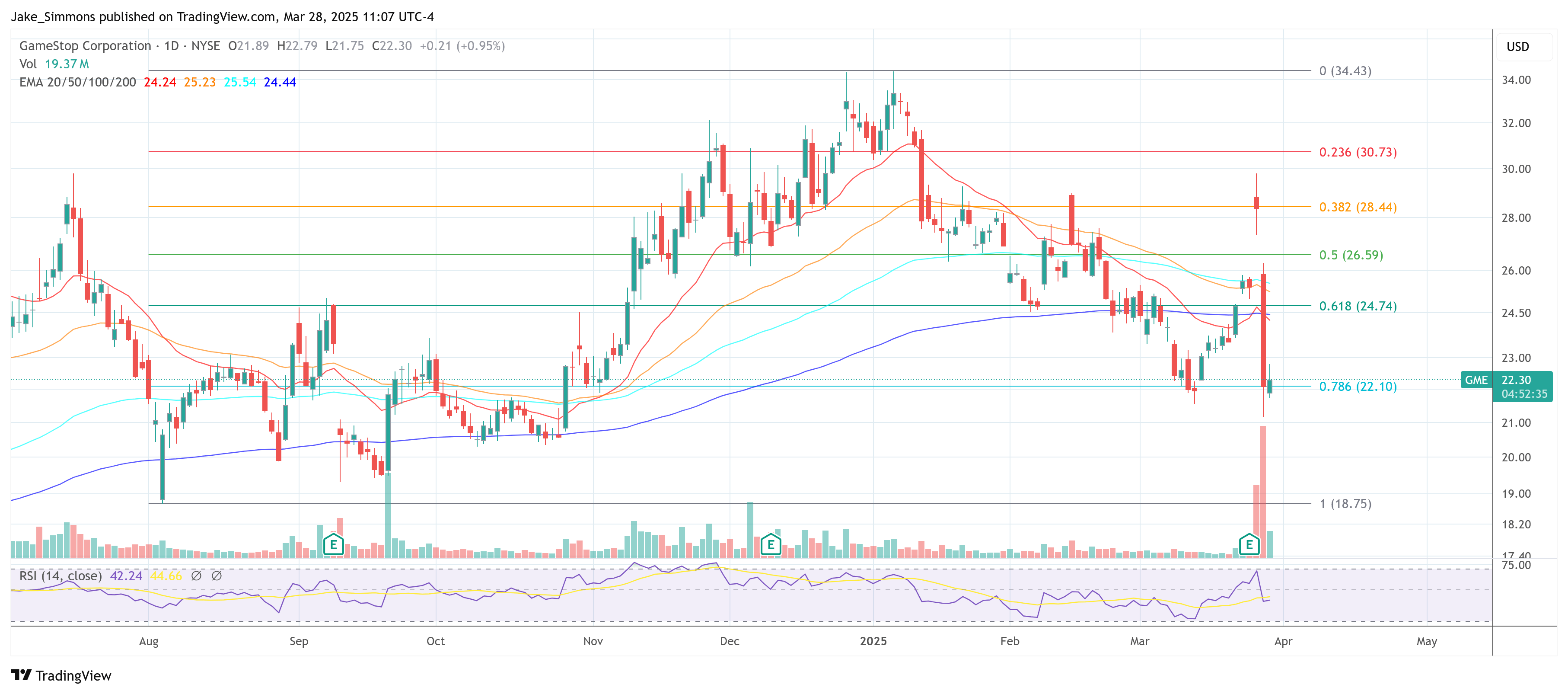

GameStop (NYSE: GME) suffered a pointy 25% drop yesterday, a sudden downturn that adopted a 16% rally on March 26. The catalyst? A daring determination by the gaming retailer’s board to determine a Bitcoin treasury—becoming a member of the ranks of MicroStrategy, Metaplanet, and different firms. Initially, the information despatched GME shares hovering, as buyers considered the transfer as a bullish sign. Nonetheless, the inventory shortly reversed course and now finds itself in turbulent waters.

Investor optimism over GameStop’s Bitcoin play was palpable at first. The announcement sparked pleasure just like when MicroStrategy started accumulating Bitcoin. But the preliminary rally gave solution to heavy promoting strain, erasing almost $3 billion in market worth. Whereas the corporate has not totally detailed its technique or timeline for Bitcoin acquisitions, the market’s whiplash response has prompted widespread debate.

GameStop’s ‘Convertible Arbitrage’ Issue

On X, analyst Han Akamatsu supplied an evidence rooted in parallels to MicroStrategy’s previous financing strategies. He started by noting: “Let me clarify to you why GameStop is falling at the moment, so far as I perceive based mostly on my MSTR expertise.”

In keeping with Akamatsu, when MicroStrategy beforehand issued convertible notes, massive institutional patrons used a method often called convertible arbitrage: “When MSTR issued convertible notes, institutional patrons used convertible arbitrage: They purchased the bonds, shorted MSTR inventory to hedge [and] waited for the bond to both convert or mature.”

He emphasised that this course of created “synthetic quick strain” on the inventory—regardless of MicroStrategy’s personal bullish outlook on Bitcoin. Akamatsu then referenced MicroStrategy’s 2021 issuance: “In 2021, MSTR issued $1.05B of 0% convertible notes, the inventory dipped after the announcement on account of hedging shorts, however later exploded when Bitcoin ripped and the arbitrage unspooled.”

Akamatsu went on to attach these dots to GameStop’s present state of affairs: “GME is following the identical blueprint now:Challenge $1.3B in 0% convertibles, possible going to purchase Bitcoin [and] establishments at the moment are shorting GME to hedge.”

He identified that if GME or Bitcoin rises considerably, the quick positions set as much as hedge the convertibles may very well be unwound en masse: “If GME or BTC goes up lots, the commerce will get very fascinating as we’ve got a squeeze alternative right here.”

He additional defined the everyday ratio of shorts concerned: “A standard apply is to quick 50–70% of the bond’s notional worth in inventory. They earn money on the arbitrage between the bond conversion value and the inventory value, even when the inventory stays flat or drops.”

Lastly, Akamatsu famous that the volume-weighted common value (VWAP) would affect the conversion value: “VWAP pricing window conduct, they’ll need the inventory low to get favorable conversion. Conversion value shall be based mostly on GME’s VWAP […] from 1:00 PM to 4:00 PM EDT on the pricing day.”

Criticism Over the Threat

Some market watchers have criticized GameStop’s board for incurring what seems to be self-inflicted promoting strain. One consumer on X questioned whether or not Chairman Ryan Cohen (typically referred to by the initials RC) had miscalculated: “Hello Han, nice evaluation as typical… nonetheless, almost $3bn market worth is worn out at the moment. RC ought to actually ask himself whether it is value it or he miscalculated. The hedge is meant to mitigate danger in nature. However itself creates far more danger.”

Akamatsu stood by his take, asserting: “Calculated and all going in keeping with plan. In the event you’re probably not into the MSTR playbook, I like to recommend you to examine their technique.”

In one other put up, Akamatsu drew comparisons to a setup he noticed with Celsius Holdings (NASDAQ: CELH): “GME has an analogous sample with what CELH had after I claimed this was a simple 100% setup.”

He referenced chart analyst Thomas Bulkowski’s work on wedge patterns, hinting {that a} retracement would possibly provide a shopping for alternative: “If GME begins retracing after that stable breakout, textbook Bulkowski says that 7/10 occasions value exams the wedge once more after which has a better takeoff.”

The analyst reassured merchants to not panic if the inventory dips additional, stressing it may very well be an ordinary technical transfer: “So, in the event you see GME retrace … don’t panic as this shall be regular. You’ll have one other probability at a terrific entry when this exams the wedge once more.” He concluded on a hopeful observe: “I’m having my fingers crossed it will merely skyrocket.”

At press time, GME stood at $22.30.

Featured picture created with DALL.E, chart from TradingView.com