Hedera (HBAR) is displaying indicators of weak point after dropping 4% on Thursday. Its market cap is now hovering near the $8 billion mark. Latest technical indicators recommend that sellers could also be gaining management, particularly as directional power begins to shift.

The DMI and Ichimoku Cloud each level to a market caught in consolidation however leaning barely bearish. With key resistance holding agency and bearish patterns threatening to develop, HBAR’s subsequent transfer may very well be crucial.

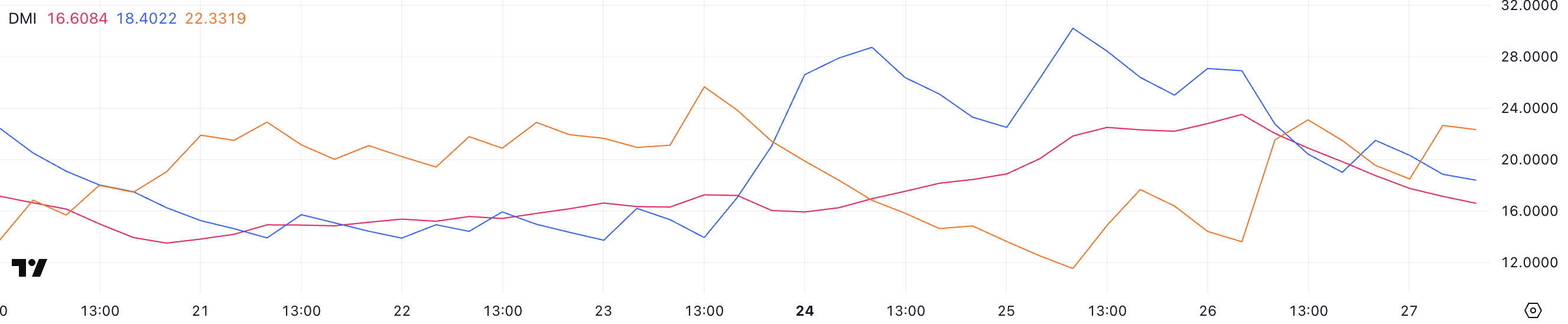

HBAR DMI Exhibits Sellers Are in Management

Hedera’s Directional Motion Index (DMI) chart exhibits that the Common Directional Index (ADX) is at present sitting at 16.6, a notable decline from yesterday’s 23.5.

The ADX is a key indicator used to gauge the power of a development, and a drop like this means that the momentum behind any latest transfer—bullish or bearish—is weakening.

An ADX under 20 usually factors to a scarcity of a transparent development or the presence of sideways motion, which aligns with HBAR’s latest consolidation section noticed over the previous few days.

The ADX itself doesn’t point out the course of the development, solely its power. Typically, values under 20 sign a weak or non-existent development, 20–25 point out a possible rising development, and values above 25 recommend a powerful development.

Alongside the ADX, the DMI’s +DI (Optimistic Directional Indicator) and -DI (Unfavorable Directional Indicator) give perception into course. At present, +DI is at 18.4, falling from 26.9 yesterday, whereas -DI has climbed to 22.33 from 13.61.

This flip in directional power suggests bearish momentum is growing whereas bullish momentum fades.

Coupled with a low ADX, this might indicate that though sellers are gaining the higher hand, the general development nonetheless lacks conviction. This reinforces the concept HBAR is prone to stay range-bound until a breakout confirms a brand new course.

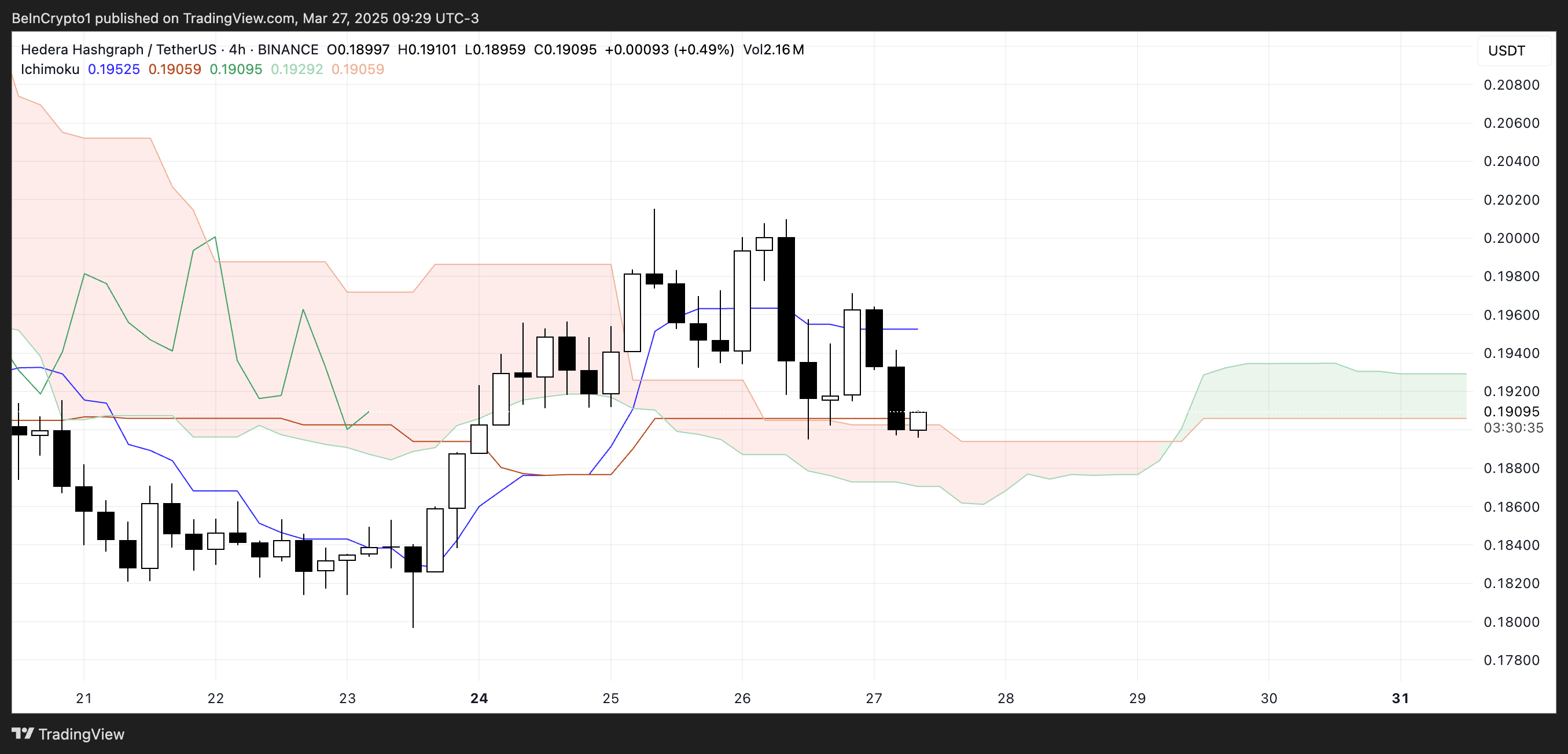

Hedera Ichimoku Cloud Signifies a Bearish Development May Come up Quickly

Hedera’s Ichimoku Cloud chart reveals a market in equilibrium, with value hovering close to the decrease boundary of the cloud. The latest candlesticks present a transparent hesitation round this space, reflecting the continued consolidation.

The Kijun-sen (blue line) has turned flat, indicating a lack of momentum and a possible pause in development course. Equally, the Tenkan-sen (purple line) is sloping downward, suggesting short-term bearish stress.

Regardless of this, the ahead cloud has flipped to a bullish twist, signaling a doable shift in sentiment—however that outlook stays unconfirmed until HBAR can set up clear separation above the cloud.

The cloud itself—the Kumo—stays comparatively flat and skinny, reinforcing the present consolidation section.

A skinny cloud usually signifies weak assist or resistance, making it simpler for value to maneuver by way of however tougher to belief any breakout until accompanied by sturdy quantity and momentum. The Chikou Span (lagging line) seems to be tangled inside previous value motion, which additionally suggests a scarcity of development readability.

Total, the Ichimoku indicators level to indecision out there, with a slight bearish lean within the brief time period and a possible for development improvement if consumers can acquire management.

Can Hedera Break Above $0.20?

Hedera has lately confronted sturdy resistance, struggling to interrupt previous the $0.199 stage—failing twice over the previous few days. This repeated rejection has created a ceiling that’s proving robust to breach.

In the meantime, its EMA traces are tightening, and there’s the looming chance of a dying cross forming, which might sign a possible bearish shift. If that crossover is confirmed, it may speed up downward stress. This might lead HBAR to retest its subsequent key assist stage close to $0.184.

A breakdown under would open the door for additional draw back, probably extending the transfer towards the decrease assist area round $0.179. If that assist can be misplaced, HBAR may go under $0.17 for the primary time since November 2024.

Nevertheless, if momentum can flip, the bulls nonetheless have a case. Ought to the Hedera value handle to regain power and kind a sustainable uptrend, a 3rd problem of the $0.199 resistance may very well be on the desk.

A profitable breakout above that stage would doubtless set off a transfer towards the subsequent resistance zone round $0.21.

And if the bullish momentum continues to construct, there’s potential for an prolonged rally towards the $0.258 stage.

Disclaimer

In keeping with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.