XRP has confronted a interval of stagnation in latest weeks, with its worth struggling to achieve vital path. After a collection of latest bullish developments, the altcoin’s macro-scale worth motion has proven indicators of saturation.

Regardless of the optimistic catalysts, XRP stays caught in a consolidation section, making it tough to foretell its subsequent transfer. Temujin Louie, CEO of Wanchain, spoke to BeInCrypto concerning the affect of those exterior catalysts however leaned in the direction of them failing to set off any rallies.

“Whereas the SEC dropping its years-long lawsuit towards Ripple Labs is undoubtedly a web optimistic, it hasn’t triggered a direct surge in XRP’s worth as a result of this improvement doesn’t immediately enhance utility or drive adoption. XRP stays immediately because it was earlier than and through the SEC lawsuit,” mentioned Louie.

The continuing hype and discussions surrounding XRP ETFs have additionally been impacting the volatility. Traders have been anticipating costs to surge owing to the potential of a brand new XRP ETF.

“Hypothesis round an XRP ETF hasn’t generated the identical pleasure as BTC or ETH ETFs. The market’s enthusiasm for crypto ETFs diminishes with every subsequent approval. The 4th, fifth and Sixth-approved asset simply develop into considered one of many, because the novelty of crypto ETFs wears off,” Louie famous.

XRP Is Repeating Historical past

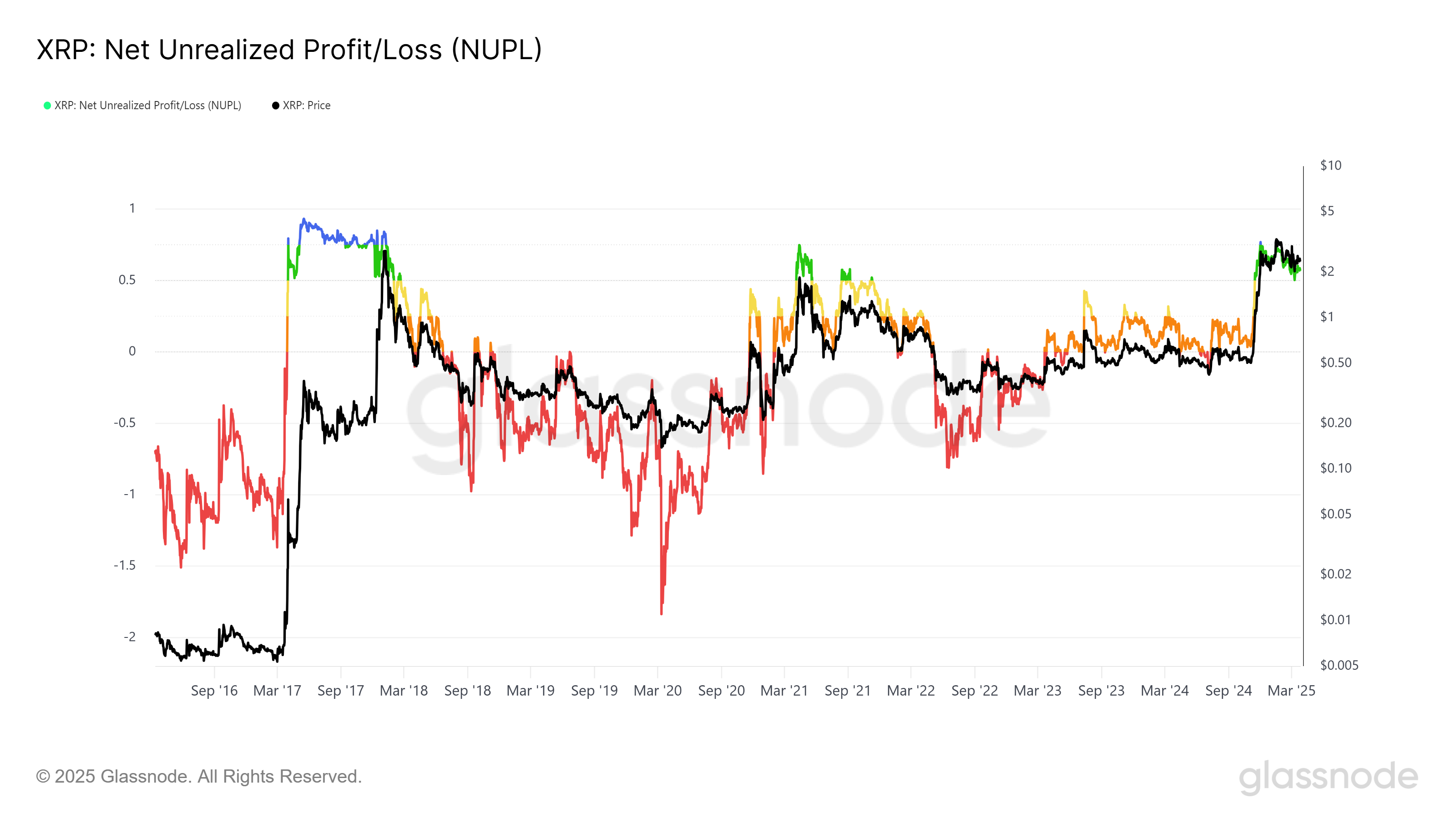

XRP’s Community Utilization and Revenue/Loss (NUPL) indicator reveals that the altcoin is at the moment saturating. This implies that there was little progress when it comes to worth motion, and XRP wants robust market cues to take a transparent path. Traditionally, XRP has skilled related consolidation phases.

Again in 2017, the coin consolidated for 9 months earlier than a large growth that noticed costs surge. Nonetheless, after breaching key ranges, XRP entered a interval of consolidation adopted by a pointy decline. The identical sample might be taking place now, with XRP going through a four-month consolidation interval, which can sign a possible correction within the close to future.

Following into Bitcoin’s footsteps is one other factor that XRP did again within the day, however Hank Huang, Chief Government Officer at Kronos Analysis hinted in a unique path.

“Regardless of its liquidity remaining skinny throughout the altcoin market, lagging behind the depth of Bitcoin. XRP is neither totally following Bitcoin’s ETF-fueled ascent nor carving a transparent unbiased path. The latest Ethereum ETF outflows, noticed not too long ago, underscore a market tilt towards Bitcoin, as buyers seem to favor BTC’s perceived stability and ‘digital gold’ narrative over altcoins. This shift means that bullish sentiment is consolidating round Bitcoin quite than dispersing throughout the broader altcoin market, leaving XRP struggling to draw the institutional momentum wanted to interrupt out of its present rut,” Huang acknowledged.

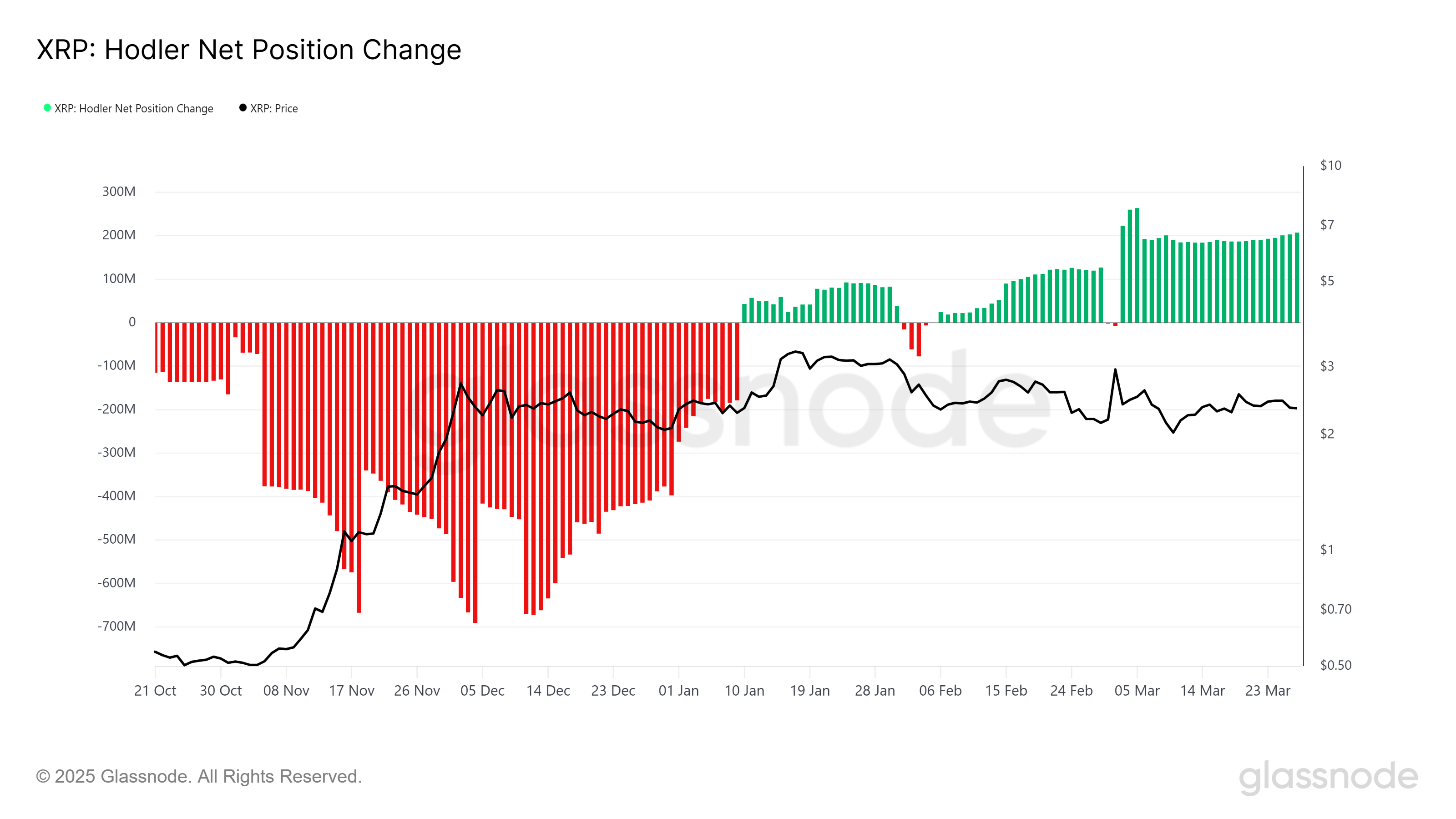

The HODLer Place Change metric, which tracks long-term holders’ habits, reveals that LTHs (Lengthy-Time period Holders) have been accumulating XRP throughout this consolidation section. This accumulation means that LTHs are assured that XRP will ultimately capitalize on a future worth improve.

Their ongoing conviction has helped assist XRP’s worth regardless of the stagnation and market uncertainty. This accumulation might be an indication that, when the market situations enhance, XRP may even see a surge in worth, as these holders aren’t trying to promote within the close to time period.

This accumulation by LTHs acts as a stabilizing issue, stopping the value from dipping considerably regardless of the market’s lack of robust path.

Will XRP Fail This Essential Breach Once more?

On the time of writing, XRP is buying and selling at $2.20, having didn’t breach the important thing resistance stage of $2.56 final week. This resistance has confirmed to be a big barrier over the previous 4 months, limiting any main upward motion for the altcoin. Till XRP can break by this stage, it’s going to probably stay trapped inside its present vary.

With blended alerts from the market, XRP might face challenges in gaining momentum. If market situations don’t enhance in Q2 2025, the altcoin might expertise a decline in the direction of $2.02 or doubtlessly decrease if it falls by the $2.14 assist stage. Such a decline would point out {that a} corrective transfer might observe the saturation section.

For the bearish outlook to be invalidated, XRP must breach and flip the $2.56 resistance into assist. Doing so would open the door for a worth improve, pushing XRP past the $2.95 and $3.00 ranges. This might additionally deliver XRP nearer to its all-time excessive (ATH) of $3.40, signaling that the altcoin might lastly resume its bullish trajectory after the interval of consolidation.

Disclaimer

In keeping with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.