In style CryptoQuant analyst Maartunn stories that 8,000 Bitcoin (BTC) which have been dormant for 5 to seven years have been moved all of the sudden, including to present bearish considerations within the crypto. This improvement comes after a moderately adventurous week as BTC costs struggled to interrupt above $89,000, following an preliminary regular bullish climb, earlier than succumbing to heavy promoting pressures pushed by US President Donald Trump’s hawkish tariff coverage.

$674 Million In Previous BTC Transfers In Single Block – Trigger For Alarm?

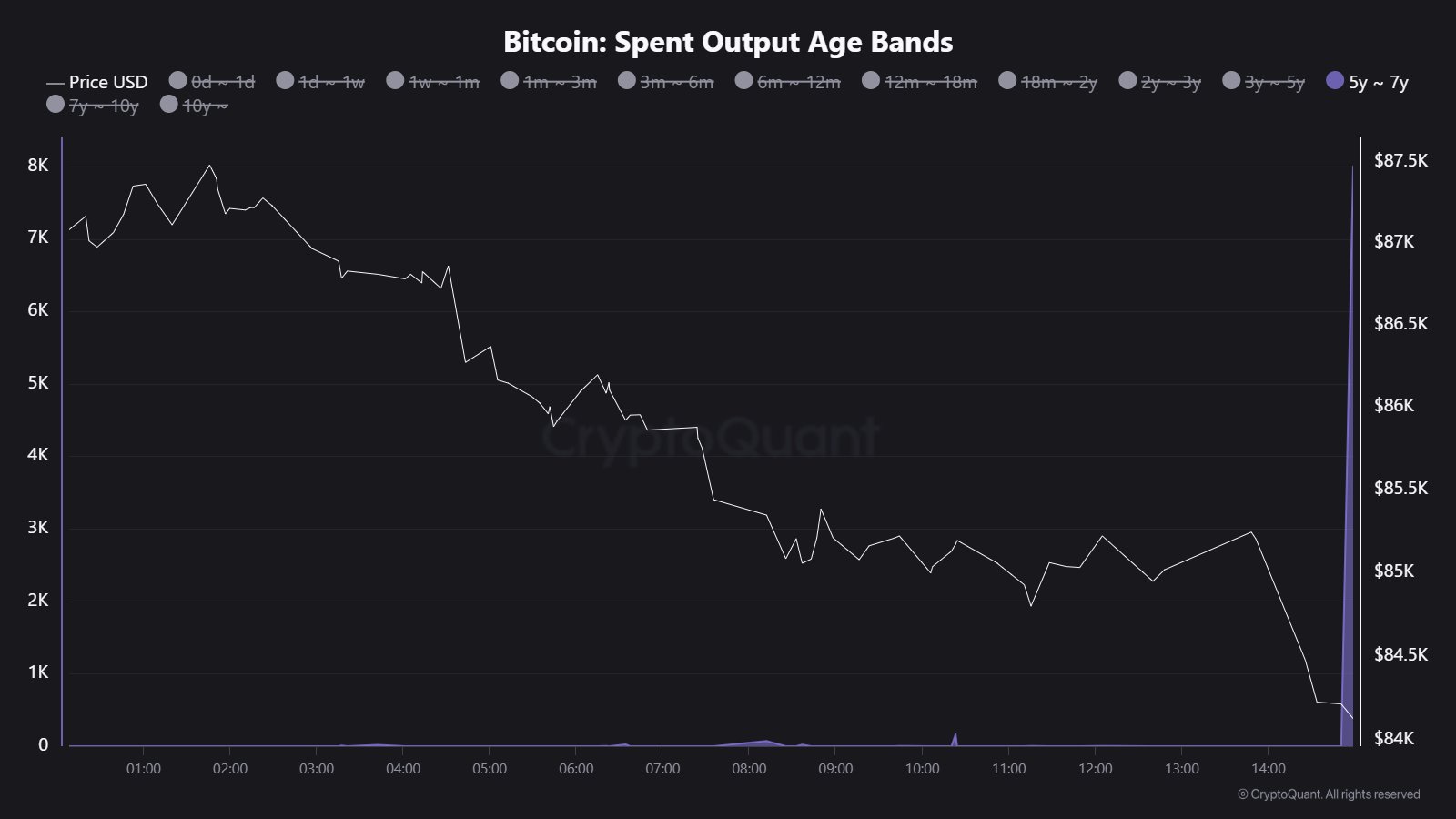

The Spent Output Age Bands is a vital metric to measure how lengthy Bitcoin tokens stay inactive earlier than shifting. Based on Maartuun in an X put up, this metric has lately revealed that 8,000 BTC price $674 million that was final transferred between 2018 and 2020 have been moved lately in a single block drawing important market consideration.

This switch follows a string of current activations of dormant Bitcoin stashes. On March 24, a 14-year inactive Bitcoin pockets all of the sudden moved 100 Bitcoin valued at $8.5 million. In the meantime, in early March, six historical Bitcoin wallets additionally transferred almost 250 BTC price $22 million.

Notably, the latest transaction reported by Maartuun is of far bigger measurement with doubtlessly robust implications for an unsure Bitcoin market. Typically, a motion of such a lot of BTC from long-term dormancy is often interpreted as a sign for incoming promoting strain resulting in main worth corrections.

Nevertheless, there are different potential non-bearish motives behind such transactions akin to inside pockets shuffling by institutional traders or giant holders in addition to a chilly storage reorganization. Presently, the homeowners of the brand new wallets receiving the 8000 is unknown thus lowering the potential of a bearish response from BTC holders.

Bitcoin Value Overview

Within the final day, Bitcoin costs declined by 4.00% after the US Authorities introduced intentions to impose a 25% tariff on auto imports and items from China, Mexico, and Canada ranging from April 3. This marks the newest unfavorable response of the crypto market to President Trump’s worldwide commerce insurance policies following comparable incidents in early February and mid-March.

These measures by the Donald Trump administration are flaming fears of a possible financial slowdown which may additional push high-risk property akin to BTC out of traders’ portfolios resulting in an additional draw back.

At press time, Bitcoin presently trades at $83,693 reflecting a decline of 0.72% and a pair of.53% within the final seven and 30 days respectively. In the meantime, the asset’s day by day buying and selling quantity is up by 19.38% and is valued at $31.58 billion. The BTC market cap now stands at $1.66 trillion and nonetheless represents a dominant 61.1% of the whole crypto market.

BTC buying and selling at $83,727 on the day by day chart | Supply: BTCUSDT chart on Tradingview.com