Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin has dropped under the $85,000 degree as promoting strain returns throughout the crypto market. After a number of days of tight consolidation slightly below the $88K resistance zone, bearish momentum has regained management, dragging costs decrease and signaling the tip of a short-lived interval of stability. The broader monetary panorama stays tense, with commerce warfare fears and mounting uncertainty persevering with to weigh closely on danger belongings — and Bitcoin isn’t any exception.

Associated Studying

International markets are going through rising volatility, pushed by geopolitical tensions and fragile investor sentiment. As conventional markets falter, the crypto area has adopted go well with, exhibiting indicators of weak point amid macro headwinds. Many merchants are actually anticipating indicators of deeper corrections throughout the board.

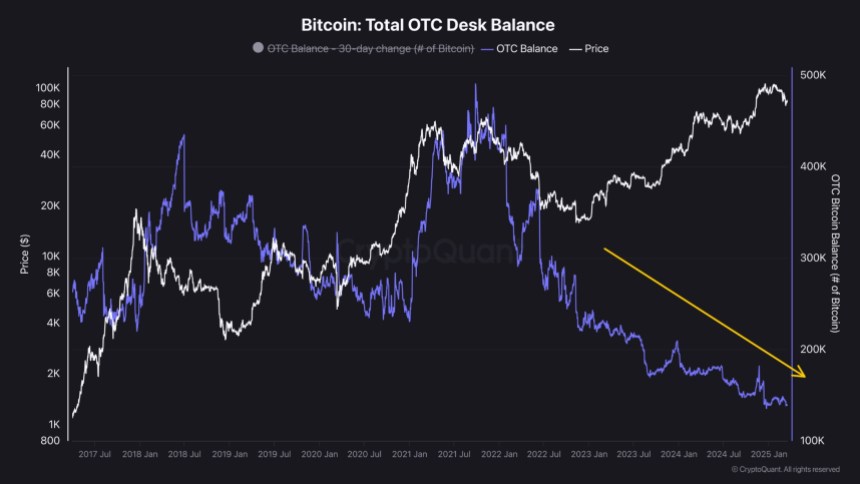

Regardless of the pullback, there could also be a silver lining. Based on recent knowledge from CryptoQuant, OTC (Over-the-Counter) desks are draining at a quick tempo. This development typically signifies elevated institutional accumulation — as OTC transactions are sometimes utilized by bigger gamers to keep away from slippage on exchanges. Whereas short-term value motion stays bearish, the discount in OTC provide might be an early sign of long-term confidence constructing below the floor. For now, Bitcoin should discover stability earlier than bulls can try a significant rebound.

Bitcoin Holds $84K As Analysts Debate Market Course

Bitcoin is at a vital level, with bulls struggling to reclaim the $90,000 degree however managing to carry agency above the $84,000 help zone. This tight vary displays rising uncertainty available in the market, as value motion stalls and sentiment turns into more and more divided. Some analysts argue that the bull market has run its course, pointing to fading momentum and macroeconomic strain as indicators {that a} deeper correction is underway. Others consider that that is merely a wholesome pause in a longer-term uptrend, with new all-time highs nonetheless forward.

High analyst Quinten Francois has weighed in, pointing to a key on-chain metric that will help the bullish case. Based on Francois, the entire stability held by OTC desks has been steadily draining since January 2022 — a development that has continued into 2025.

A declining OTC desk stability sometimes indicators rising demand from large-scale patrons, resembling establishments or high-net-worth buyers. These desks are used to facilitate massive trades off-exchange to keep away from slippage, so when their balances development down, it typically means massive gamers are shopping for straight and transferring belongings into chilly storage or long-term holdings. This will cut back circulating provide and act as a quiet type of accumulation during times of uncertainty.

Whereas short-term value motion stays unsure, the continued OTC desk outflows recommend that giant buyers are positioning for long-term positive factors. For now, all eyes stay on the $84K–$90K vary. A breakdown under help might set off deeper losses, however a breakout above resistance might reignite bullish momentum — particularly if institutional curiosity continues to develop behind the scenes.

Associated Studying

BTC Struggles To Reclaim Larger Provide Ranges

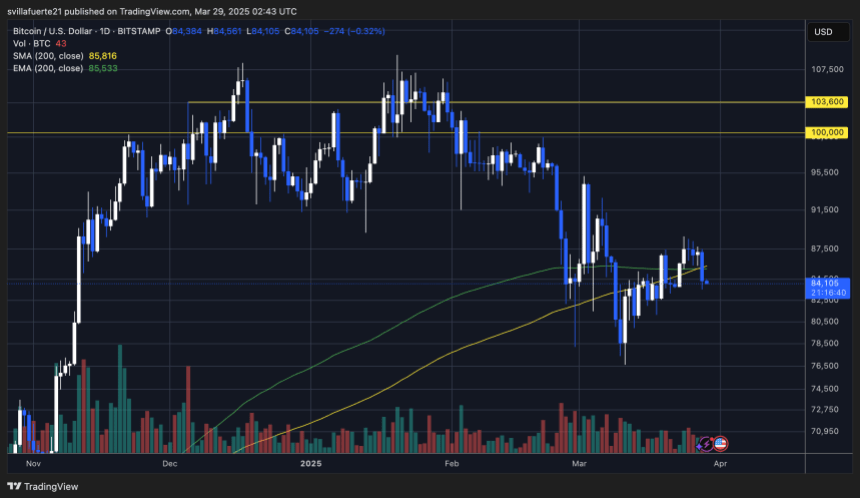

Bitcoin is buying and selling at $84,100 after shedding the 200-day transferring common (MA) and exponential transferring common (EMA), each of which had been positioned round $85,500. This breakdown has weakened the bullish construction and positioned BTC in a weak place, with momentum now clearly favoring the bears. For bulls to regain management, they have to maintain above the $82,500 help degree within the coming periods.

Sustaining this degree would sign stability and will pave the way in which for a rebound towards the important thing resistance zone between $89,000 and $91,000. Reclaiming that space could be a major step towards restoring bullish sentiment and doubtlessly reigniting the broader uptrend.

Nevertheless, if BTC fails to carry above the $82,000 mark, the market might see intensified promoting strain and a pointy drop under $80,000. A break of that psychological degree would doubtless affirm a deeper correction and shift sentiment additional in favor of the bears.

Associated Studying

With volatility rising and macroeconomic uncertainty nonetheless shaking international markets, the following few days might be vital for Bitcoin’s short-term path. Bulls must act shortly to keep away from additional draw back and re-establish momentum above the $85K mark.

Featured picture from Dall-E, chart from TradingView