Cronos (CRO) has been gaining severe momentum in current weeks after Trump Media introduced a partnership with Crypto.com. The information helped drive CRO’s value above the $0.10 mark for the primary time since early February, triggering a wave of bullish technical indicators.

Indicators like RSI, BBTrend, and EMA alignment all level towards robust upward momentum, with CRO even changing into the top-performing altcoin up to now 24 hours. As merchants eye key resistance and help ranges, the query now’s whether or not this rally has sufficient gasoline to hold CRO towards $0.20.

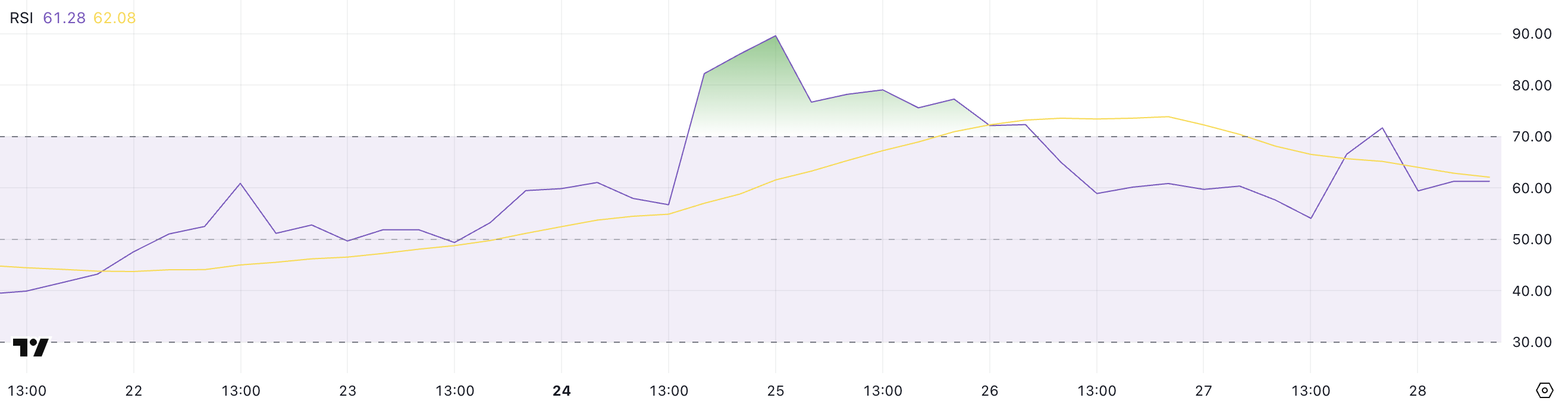

CRO RSI Is Again To Impartial After Reaching Its Highest Ranges In Years

Cronos has captured market consideration in current weeks, particularly following the announcement of a partnership between Trump Media and Crypto.com.

This surge in curiosity drove CRO’s Relative Power Index (RSI) to a peak of 89.64 simply three days in the past—its highest stage in over a 12 months—signaling intense shopping for stress.

Since then, the RSI has cooled all the way down to 61.2, as the worth consolidates after its robust rally. Regardless of the slight RSI drop, Cronos stays the top-performing altcoin up to now 24 hours, with a 7% value improve, displaying that momentum remains to be in its favor.

The RSI (Relative Power Index) is a momentum indicator used to evaluate whether or not an asset is overbought or oversold. It ranges from 0 to 100, with ranges above 70 usually suggesting overbought circumstances, and ranges beneath 30 indicating oversold territory.

With CRO’s RSI now at 61.2, the asset is now not in an overbought state however nonetheless reveals wholesome bullish momentum. This means the worth might proceed climbing, particularly if renewed curiosity or information catalysts emerge.

On the similar time, the cooldown from excessive RSI ranges could also be giving the market room to construct a extra sustainable rally.

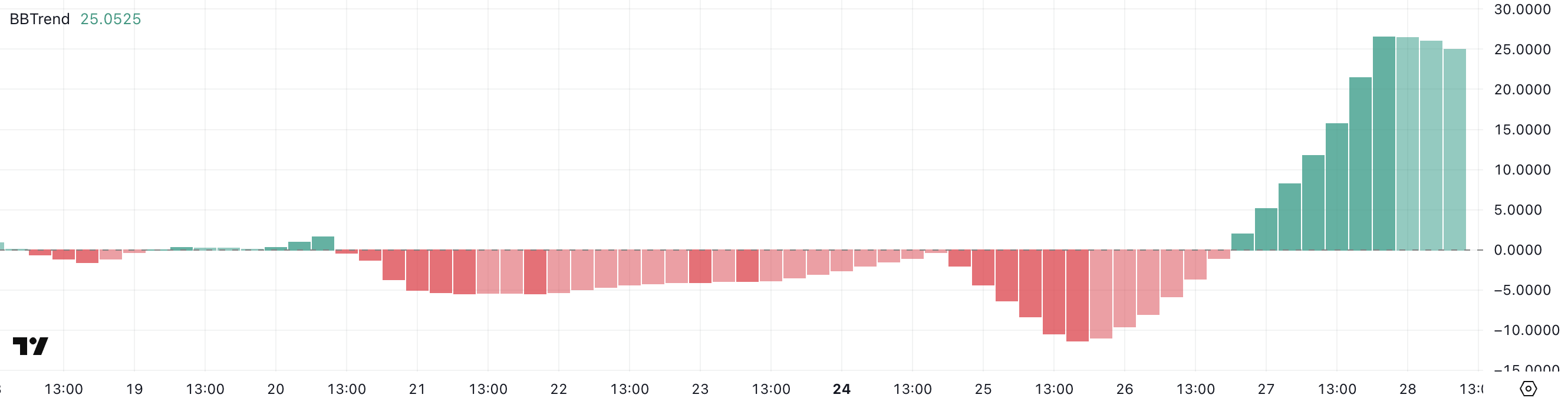

Cronos BBTrend Is Nonetheless Very Optimistic, However Down From The Latest Peak

Cronos has not too long ago flipped its BBTrend indicator again into optimistic territory, at the moment sitting at 25.05—down barely from a current peak of 26.56 reached simply yesterday.

This shift comes after 5 consecutive days of detrimental BBTrend values, suggesting a notable change in market momentum.

The transfer into optimistic territory signifies that bullish stress has returned, aligning with the broader uptick in value and sentiment surrounding CRO following its current surge in visibility and buying and selling exercise.

BBTrend, or Bollinger Band Pattern, is a momentum indicator that helps determine whether or not an asset is trending upwards, downwards, or shifting sideways.

A optimistic BBTrend worth typically signifies bullish momentum, whereas a detrimental worth factors to bearish sentiment. The upper the worth, the stronger the development.

With CRO’s BBTrend at 25.05, the asset is displaying robust bullish momentum, although the slight drop from yesterday’s peak might sign early indicators of a cooldown or transient consolidation.

Nevertheless, so long as the BBTrend stays above zero, the upward bias stays intact, supporting the potential for additional CRO value appreciation.

Can Cronos Rise 100% In The Subsequent Weeks?

Cronos value not too long ago climbed above the $0.10 mark for the primary time since early February.

The EMA (Exponential Transferring Common) indicators are portray a bullish image, with short-term EMAs positioned above the long-term ones and sustaining a wholesome distance between them—typically an indication of robust upward momentum.

If this development holds, CRO might goal the following resistance ranges at $0.12, adopted by $0.149 and $0.166.

Within the case of a very robust rally, a transfer towards $0.20 is on the desk. This may mark its highest value for the reason that finish of 2024, as conversations a couple of potential CRO ETF might acquire extra traction quickly.

Nevertheless, if bullish momentum begins to wane, CRO might pull again towards key help at $0.093. A break beneath that might speed up the correction, with $0.082 and $0.068 as the following potential draw back targets.

Disclaimer

In step with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.