Ethereum (ETH) is beneath stress as soon as once more, dropping round 3% within the final 24 hours and falling beneath the $1,800 degree. This decline is placing a number of massive leveraged positions in danger, together with two huge whale vaults on Maker that collectively maintain over $235 million price of ETH.

With on-chain indicators flashing warning indicators and technical ranges being examined, the stakes are rising for each bulls and bears. As ETH hovers close to important help, the approaching days may show pivotal for its short-term value trajectory.

Ethereum Whales May Get Liquidated

Ethereum has dropped round 3% previously 24 hours, slipping beneath the $1,900 mark as soon as once more. This decline is placing stress on massive leveraged positions inside the DeFi ecosystem.

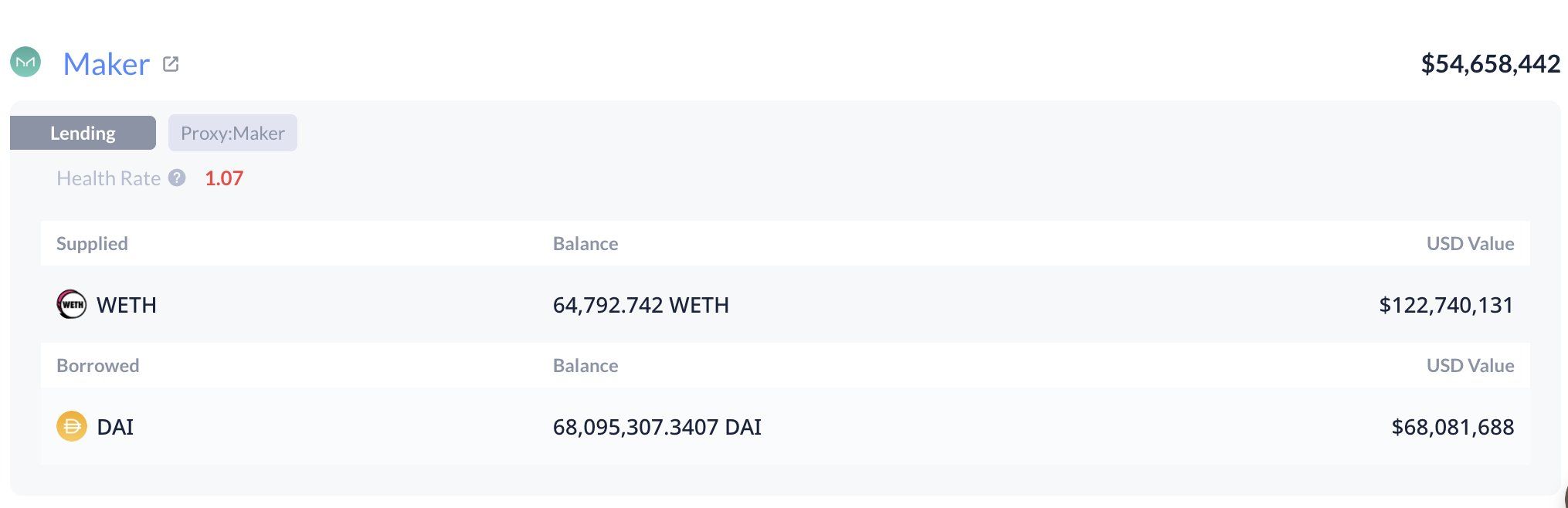

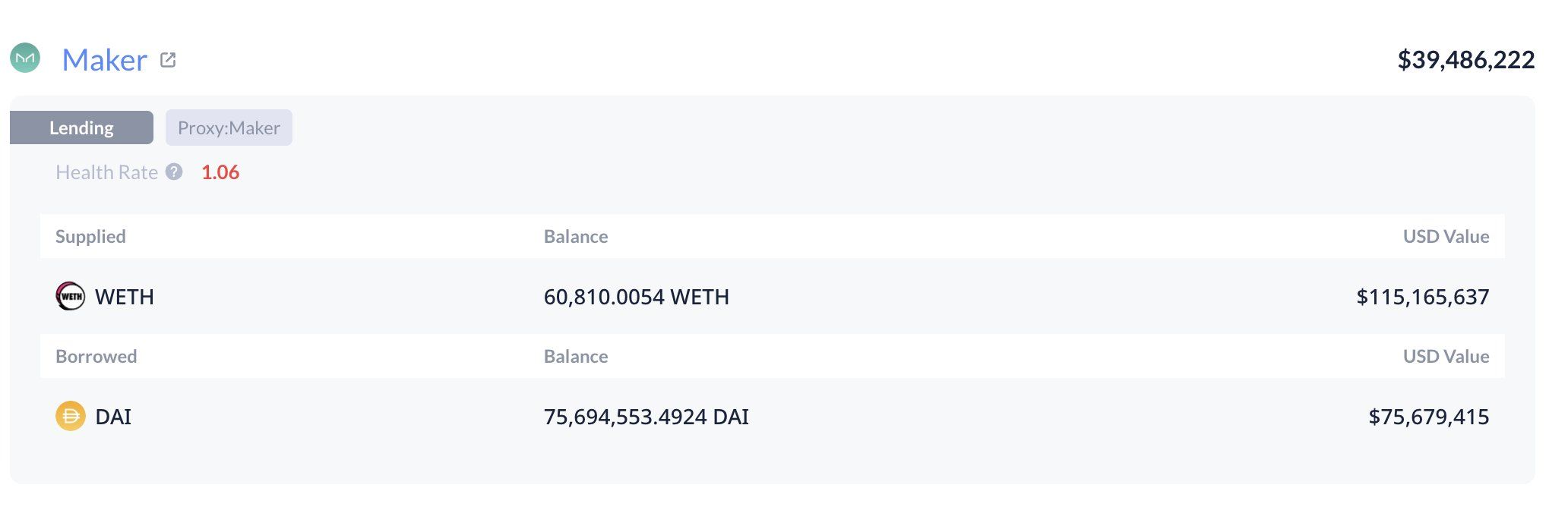

In accordance with on-chain information from Lookonchain, two main whale vaults on Maker—one of many main decentralized lending protocols—at the moment are approaching important ranges.

Collectively, these vaults maintain 125,603 ETH, valued at roughly $235 million. With ETH’s value nearing their liquidation thresholds, each vaults are vulnerable to being forcibly closed if the downward development continues.

In Maker’s system, customers can deposit ETH into vaults as collateral to borrow the DAI stablecoin. To keep away from liquidation, the collateral should keep above a sure well being ratio—basically a security buffer.

When that buffer will get too low, the protocol mechanically sells off the collateral to cowl the debt. On this case, the well being ratio of the whale positions has fallen to simply 1.07, dangerously near the minimal threshold.

One vault faces liquidation at an ETH value of $1,805, and the opposite at $1,787. If ETH continues to dip, these vaults may set off vital promote stress, doubtlessly accelerating the downward transfer.

Indicators Recommend The Downtrend May Proceed

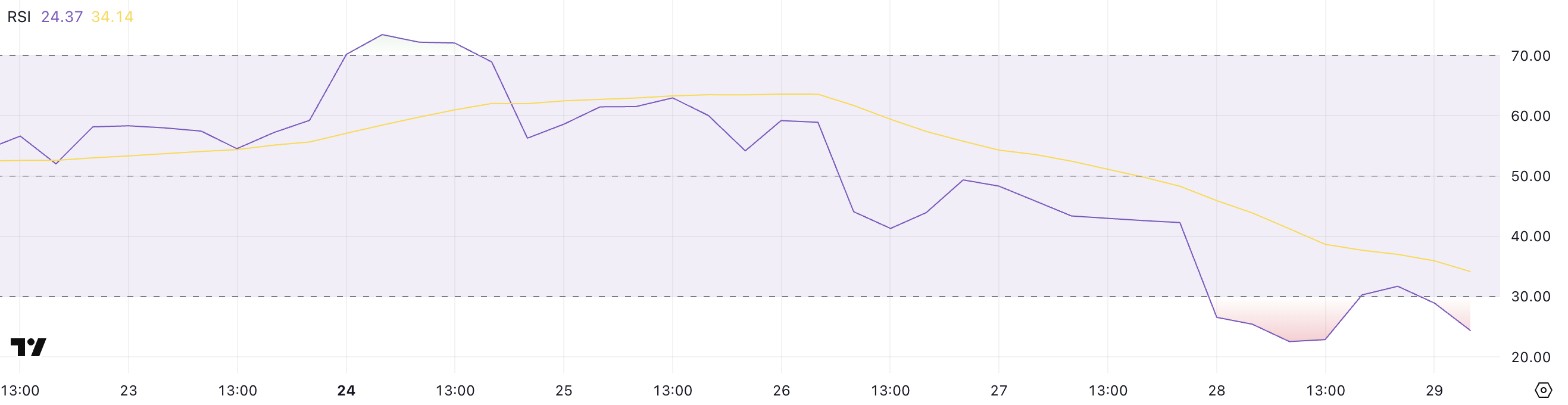

Ethereum’s latest value drop has pushed its Relative Power Index (RSI) again into oversold territory, presently sitting at 24.37. Simply three days in the past, the RSI was at 58.92, indicating how rapidly sentiment has shifted.

The RSI is a momentum indicator that measures the velocity and alter of value actions, with readings beneath 30 sometimes signaling that an asset is oversold.

Whereas this implies that Ethereum could also be due for a short-term bounce or aid rally, historic information reveals that RSI can stay oversold for prolonged durations—and even drop additional—if bearish momentum stays robust.

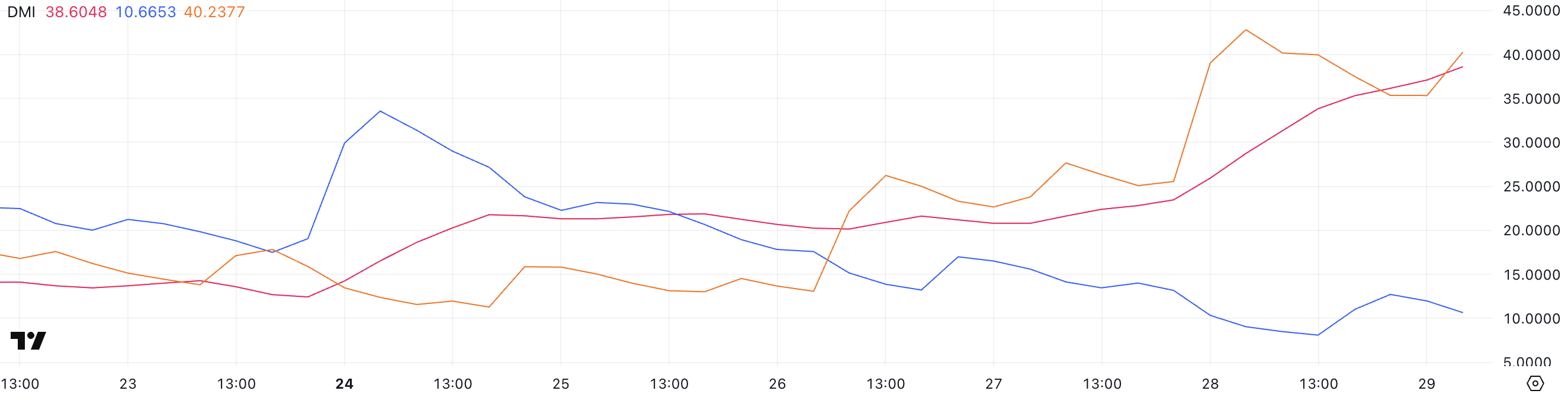

Ethereum’s Directional Motion Index (DMI), which alerts a powerful downtrend, provides to the bearish outlook. The Common Directional Index (ADX), which measures the power of a development, surged to 38.6 from 23.47 only a day in the past, indicating rising momentum behind the present transfer.

In the meantime, the +DI (constructive directional indicator) has fallen to 10.6, whereas the -DI (detrimental directional indicator) has spiked to 40.23, exhibiting that sellers are firmly in management.

This mixture—rising ADX, excessive -DI, and falling +DI—sometimes suggests an intensifying bearish development, that means Ethereum’s value may stay beneath stress within the close to time period regardless of already being technically oversold.

Will Ethereum Fall Under $1,800 Quickly?

If Ethereum’s downtrend continues, the following key degree to observe is the help at $1,823. A break beneath this degree may rapidly push the worth down towards $1,759—a transfer that will set off the liquidation of two main whale vaults on Maker, that are already hovering close to their thresholds.

These potential liquidations may amplify promote stress, making it even tougher for Ethereum value to stabilize within the quick time period. Given the present bearish momentum and weak technical indicators, this situation stays an actual danger if bulls fail to step in.

Nonetheless, if sentiment shifts and the development reverses, Ethereum may regain floor and check the resistance degree at $1,938.

Breaking above that would open the trail towards $2,104, a degree that has beforehand acted as each resistance and help. Ought to shopping for momentum strengthen additional, ETH may proceed climbing towards $2,320 and doubtlessly even $2,546.

Disclaimer

Consistent with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.