ONDO is dealing with notable draw back strain. It has been down over 5% within the final 24 hours and corrected greater than 19% over the previous 30 days. With its market cap now sitting round $2.5 billion, the coin is means beneath rivals like Chainlink and Mantra by way of market cap.

Current technical indicators and whale habits recommend that the present weak spot will not be over, regardless of a slight restoration in momentum.

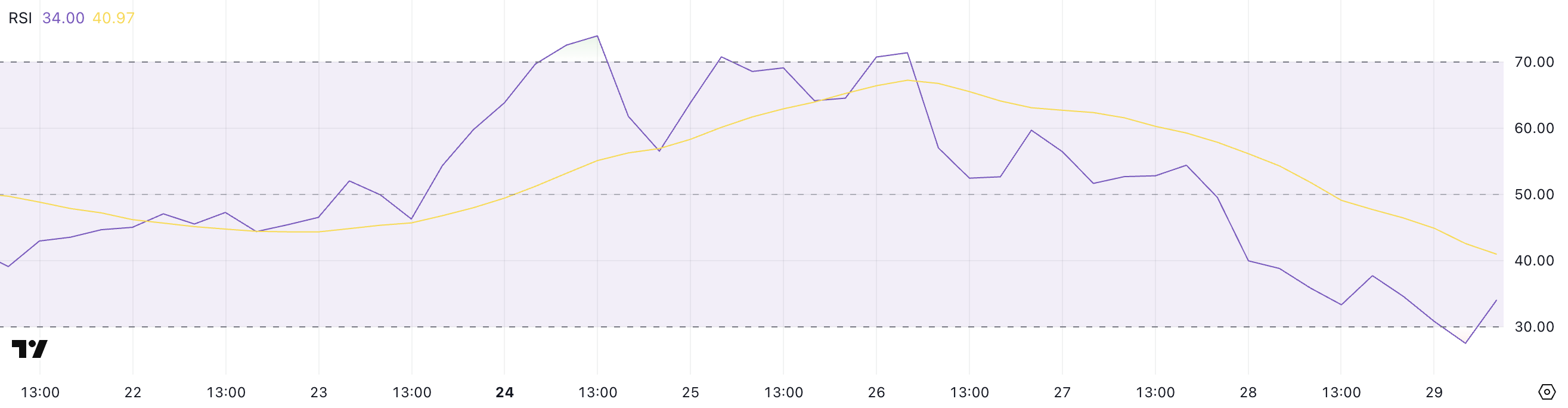

ONDO RSI Is Recovering From Oversold Ranges

ONDO’s Relative Power Index (RSI) is presently sitting at 34 after rebounding barely from an earlier dip to 27.5. Simply two days in the past, the RSI was at 54.39, indicating how rapidly momentum has shifted.

The RSI is a momentum oscillator that measures the velocity and magnitude of current worth modifications. It ranges from 0 to 100.

Readings beneath 30 are usually thought-about oversold, suggesting the asset could also be undervalued and due for a bounce, whereas readings above 70 are seen as overbought, indicating potential for a pullback.

With ONDO’s RSI now at 34, it has technically exited oversold territory however stays close to the decrease finish of the dimensions. This implies that whereas the sharpest promoting strain could have eased, the market continues to be fragile ,and sentiment stays cautious.

If the RSI continues to get better and climbs above 40 or 50, it may sign a shift towards extra bullish momentum.

Nonetheless, if promoting resumes and RSI falls again beneath 30, it could point out renewed draw back danger and potential for additional worth declines.

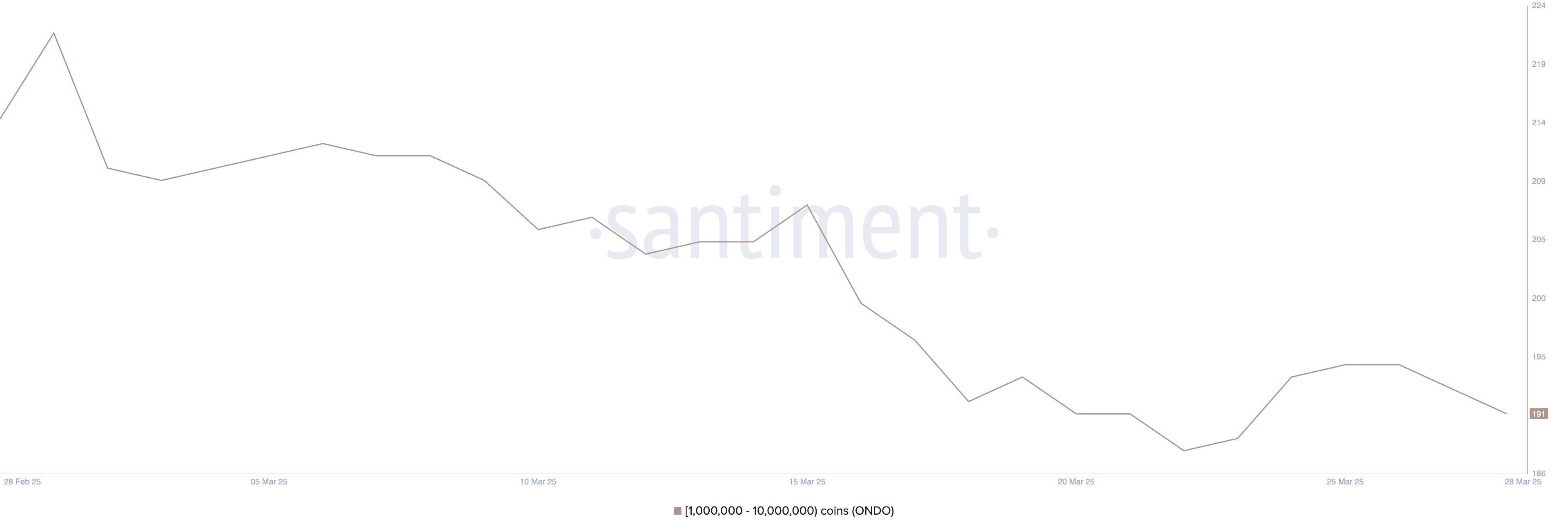

Whales Just lately Stopped Their Accumulation

The variety of ONDO whales—addresses holding between 1 million and 10 million ONDO—fluctuated in late March, initially rising from 188 to 195 between March 22 and March 26 earlier than declining to 191 in current days.

This whale exercise sample is important as these massive holders typically affect market sentiment and worth actions, with their accumulation or distribution phases probably foreshadowing broader market traits.

Monitoring whale addresses supplies worthwhile insights into how influential buyers are positioning themselves, which may help predict potential worth motion.

The failure of Whale addresses to keep up the breakout above 195 and the following return to 191 may sign bearish sentiment amongst bigger buyers.

This retreat would possibly point out that whales are taking earnings or decreasing publicity, which may create downward worth strain on ONDO within the quick time period.

When massive holders start to cut back their positions after a interval of accumulation, it typically precedes worth corrections, suggesting that ONDO could expertise resistance in sustaining upward momentum till whale confidence returns and accumulation resumes.

Will ONDO Fall Beneath $0.70 For The First Time Since November?

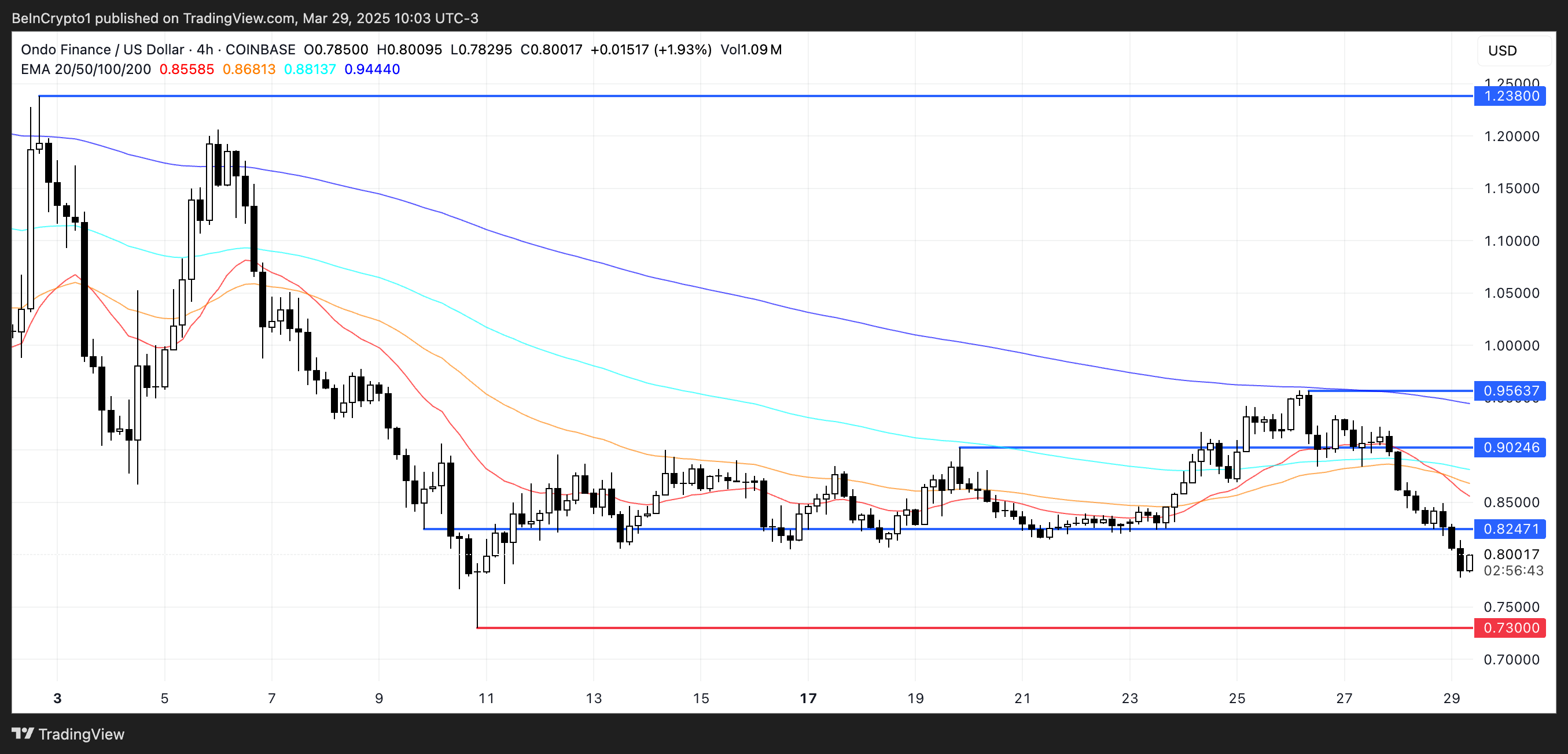

ONDO’s Exponential Shifting Common (EMA) traces are presently aligned in a bearish formation, suggesting the continuing downtrend could persist. If this weak spot continues, ONDO may drop to check the important thing help degree at $0.73.

A break beneath that will be vital, probably sending the worth below $0.70 for the primary time since November 2024.

The token has been struggling to maintain tempo with different Actual World Asset (RWA) cash like Mantra, and this underperformance provides additional strain to ONDO’s short-term outlook.

Nonetheless, if sentiment shifts and ONDO manages to reverse its pattern, the primary key degree to observe is the resistance at $0.82.

A breakout above this degree may set off a broader restoration, with worth targets at $0.90 and $0.95.

If the RWA sector as an entire regains momentum, ONDO may even rise above the $1 mark and goal for the following main resistance at $1.23.

Disclaimer

In keeping with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.