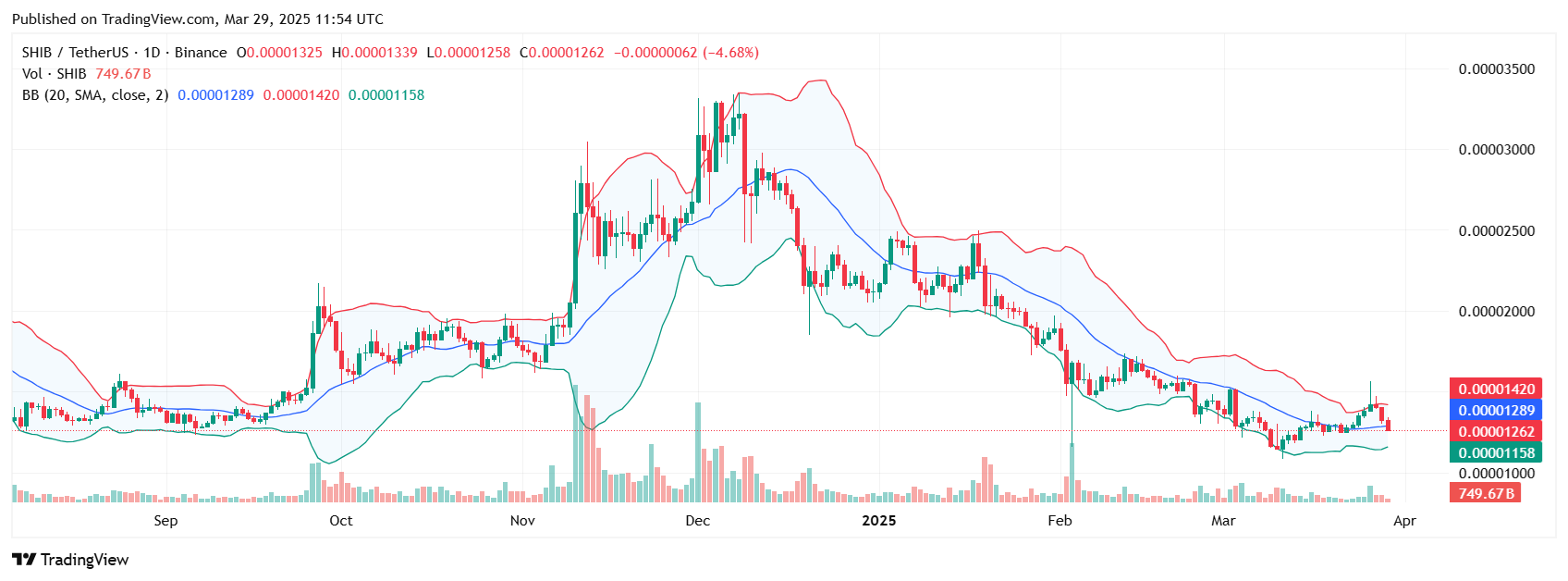

Shiba Inu (SHIB) may witness a rally quickly, given the flashing indicators of its technical indicators. If the market aligns with the indicators from the Bollinger Bands, the bearish turbulence that the meme coin has confronted might abate.

SHIB finds assist amid bearish stress

As per CoinMarketCap knowledge, throughout the final 24 hours, SHIB has plummeted from $0.00001332, crashing by way of a number of assist ranges earlier than halting at $0.0000126, the place the value reversed.

Analysts say the SHIB Bollinger Bands maintain out hope for buyers within the dog-themed meme coin.

Notably, the higher and decrease Bollinger bands tighten, lowering bearish stress. Any longer, the SHIB market may witness much less volatility.

For readability, SHIB’s worth at the moment lies within the center, a degree that ordinarily reveals neutrality and will both escape or hunch.

Nevertheless, for SHIB, that is teasing a possible bullish experience in the long run, as a token after retesting the decrease band might rebound. Therefore, analysts see a breakout forward as they look ahead to time unraveling the indicators within the crypto market.

Might Shiba Inu hit $0.00001520?

Some predictions see SHIB soar to $0.00001520 if a breakout happens, driving on sturdy bullish momentum. Nevertheless, it might depend upon shopping for momentum, resembling renewed investor curiosity and an uptick within the deflationary mechanism.

In current neighborhood assist, the burn mechanism noticed over 14 million SHIB despatched to lifeless wallets. That is the ecosystem’s method of stabilizing costs by way of lowered circulating provide.

In the meantime, the Shiba Inu crew has sparked optimism amongst buyers as they put together to launch Shib Finance, a DeFi platform that may create a number of utilities resembling lending, borrowing and saving providers.

Whereas the neighborhood awaits these developments, market contributors anticipate a worth restoration and rebound to increased ranges.

As of this writing, SHIB is altering fingers at $0.00001272, representing a 4.44% decline within the final 24 hours.