XRP is underneath heavy promoting strain, down greater than 5% within the final 24 hours and over 12% up to now seven days. The latest downturn has been accompanied by more and more bearish technical indicators, together with a pointy spike in development power and a collapse in on-chain exercise.

With value momentum weakening and consumer engagement dropping, considerations are mounting over XRP’s means to carry key help ranges. Until sentiment shifts shortly, the trail of least resistance seems to stay to the draw back.

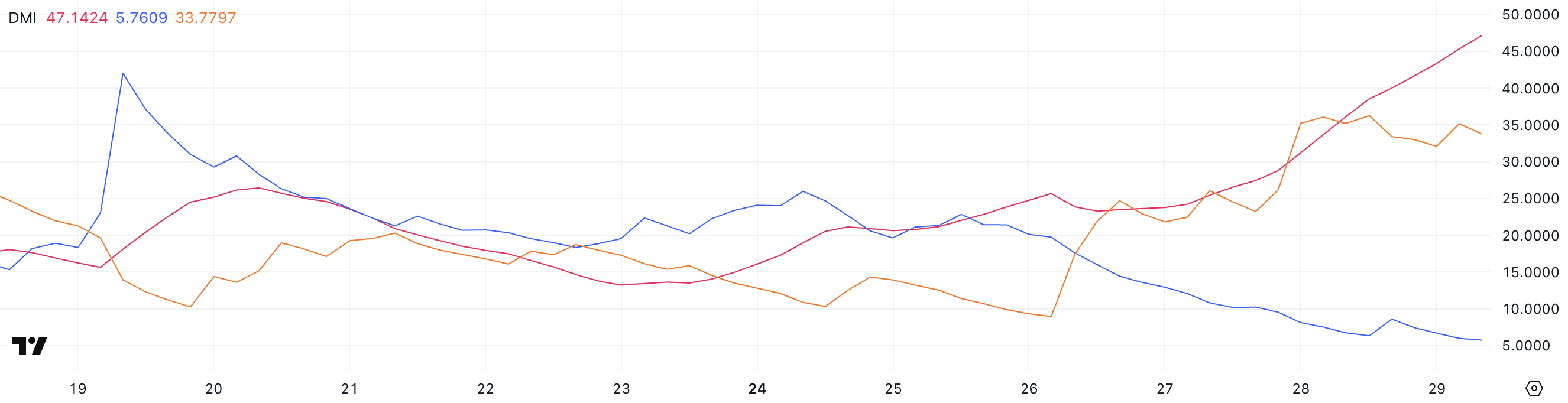

DMI Chart Reveals The Present Downtrend Is Very Sturdy

XRP’s Directional Motion Index (DMI) is presently flashing robust bearish alerts, with the Common Directional Index (ADX) surging to 47.14 from 25.43 only a day in the past.

The ADX measures the power of a development, no matter its course, and values above 25 typically point out {that a} development is gaining momentum.

A studying above 40—like XRP’s present stage—suggests a really robust development is in play. Provided that XRP is presently in a downtrend, this rising ADX factors to intensifying bearish momentum and a market leaning closely towards additional declines.

Digging deeper into the DMI elements, the +DI, which tracks upward value strain, has dropped sharply from 20.13 to five.76. In the meantime, the -DI, which tracks downward value strain, has surged from 8.97 to 33.77.

This stark divergence reinforces the bearish development, indicating that sellers are aggressively taking management whereas purchaser power fades.

With ADX confirming the power of this transfer and directional indicators tilting closely to the draw back, XRP’s value might stay underneath strain within the brief time period until a major reversal in sentiment happens.

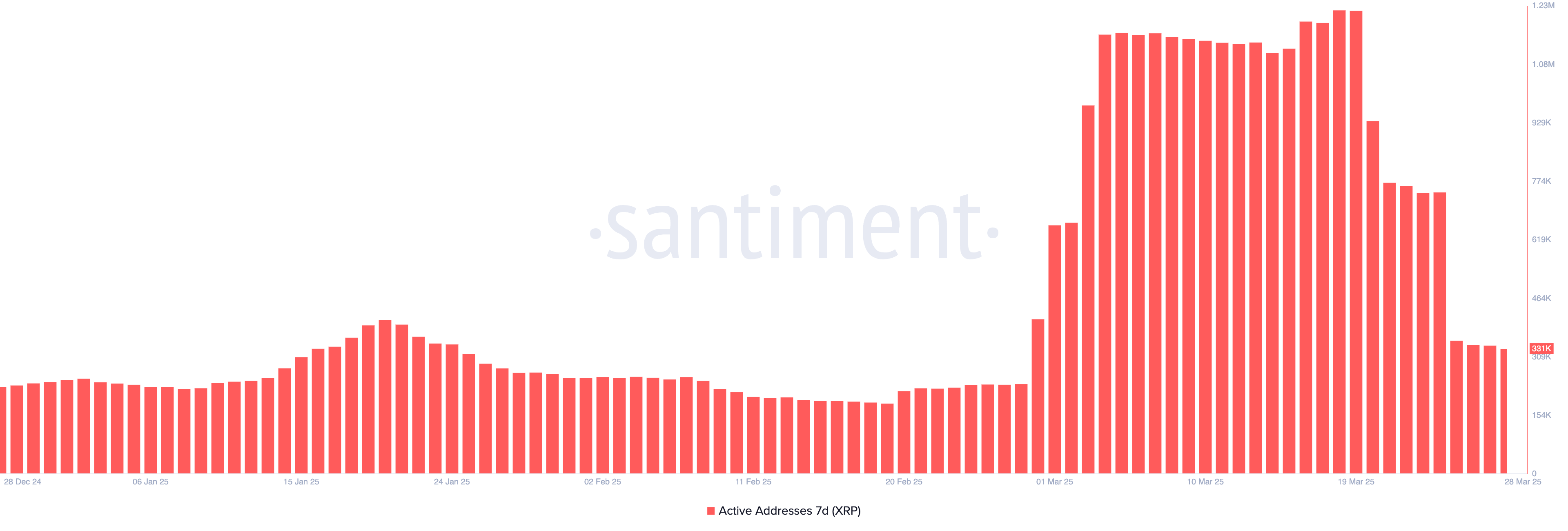

XRP Lively Addresses Are Closely Down

XRP’s 7-day lively addresses have seen a pointy decline over the previous week, following a latest surge to new all-time highs. On March 19, the metric peaked at 1.22 million, signaling robust community exercise and consumer engagement.

Nevertheless, since then, it has plummeted to simply 331,000—a drop of over 70%. This sudden fall means that curiosity in transacting on the XRP has cooled off considerably in a brief span of time.

Monitoring lively addresses is a key method to gauge on-chain exercise and general community well being. A rising variety of lively addresses sometimes displays rising consumer participation, elevated demand, and potential investor curiosity—components that may help value power.

Conversely, a pointy decline just like the one XRP is presently experiencing can level to weakening momentum and fading curiosity, which might put extra strain on value.

Until consumer exercise begins to rebound, this drop in community engagement could proceed to weigh on XRP’s short-term outlook.

XRP Might Drop Beneath $2 Quickly

XRP’s Exponential Transferring Common (EMA) traces are presently signaling a powerful downtrend, with the short-term EMAs positioned under the longer-term ones—a traditional bearish alignment.

This setup signifies that latest value momentum is weaker than the longer-term common, typically seen throughout sustained corrections. If this downtrend continues, XRP might retest the help stage at $1.90.

A break under that might open the door to a deeper drop towards $1.77 in April.

Nevertheless, if market sentiment shifts and XRP value manages to reverse course, the primary key stage to look at is the resistance at $2.22.

A profitable breakout above this level might set off renewed bullish momentum, probably driving the worth as much as $2.47.

If that stage additionally will get breached, XRP might push additional to check the $2.59 mark.

Disclaimer

In keeping with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.