Bitcoin (BTC) has been buying and selling under the $90,000 mark since March 7, struggling to regain upward momentum amid shifting market sentiment.

In the meantime, technical indicators such because the Ichimoku Cloud and EMA strains counsel the development stays bearish, although a possible reversal shouldn’t be off the desk.

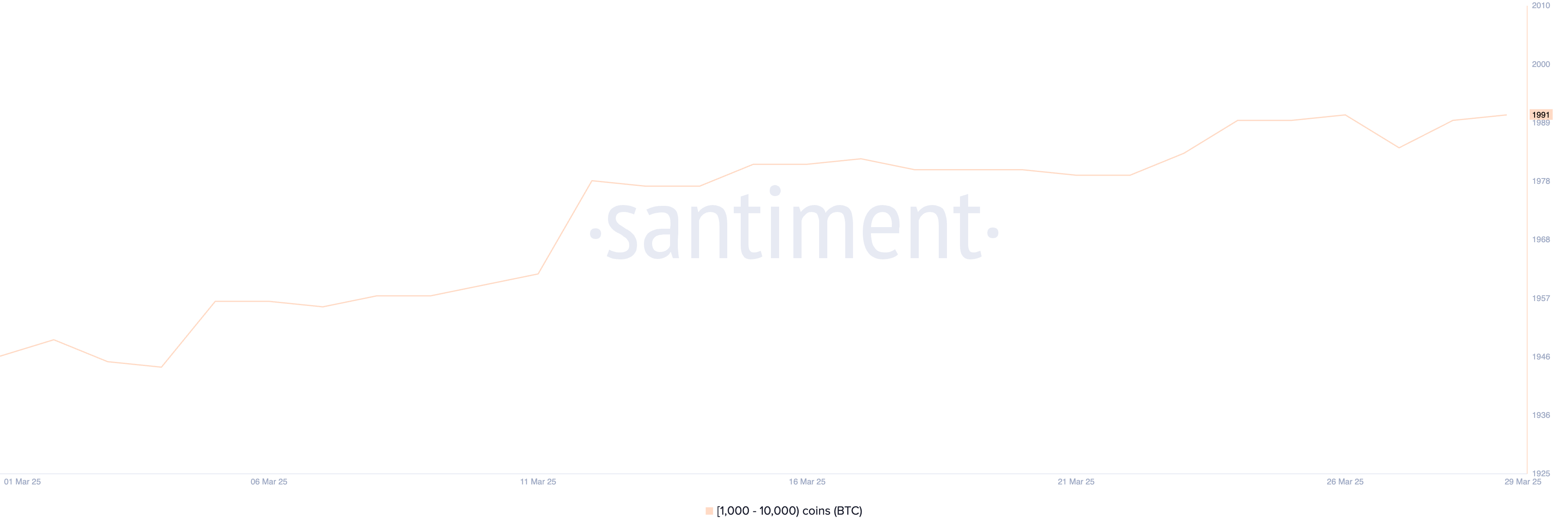

Bitcoin Whales Simply Hit Its Highest Degree In Extra Than 3 Months

The variety of Bitcoin whales—wallets holding at the least 1,000 BTC—has been steadily growing in latest weeks. On March 22, there have been 1,980 such addresses, and that determine has since climbed to 1,991.

Whereas a change of 11 might sound modest at first look, it represents a significant uptick in large-scale accumulation, particularly contemplating that is the best variety of BTC whales recorded in over three months.

Monitoring Bitcoin whales is crucial as a result of these giant holders usually have the ability to affect worth actions because of the sheer measurement of their positions. A rise in whale addresses can sign rising confidence amongst institutional buyers and high-net-worth people.

When extra whales accumulate quite than distribute, it usually suggests bullish sentiment and diminished promoting strain.

With the present whale rely hitting a multi-month excessive, it may indicate that important gamers are positioning forward of a possible upward transfer in Bitcoin’s worth.

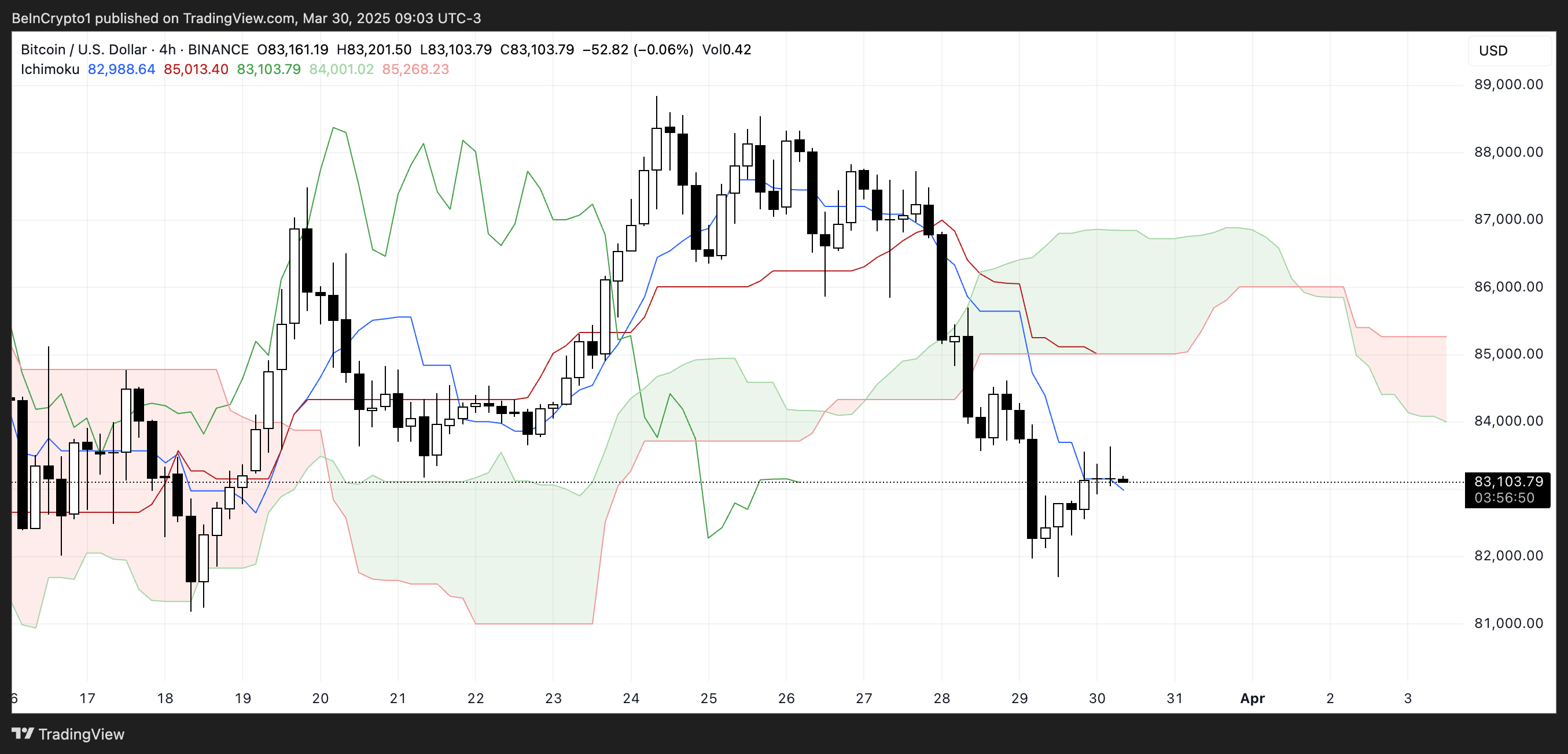

BTC Ichimoku Cloud Reveals Challenges Forward

The Ichimoku Cloud chart for Bitcoin exhibits the value consolidating just under the Kijun-sen (crimson line) after a robust downward transfer.

The Tenkan-sen (blue line) stays under the Kijun-sen, indicating short-term bearish momentum. Worth motion is making an attempt to stabilize however has but to point out a decisive shift in development.

The Lagging Span (inexperienced line) trails under each the value and the cloud, reinforcing a bearish outlook from a historic perspective.

The Kumo (cloud) forward is bearish, with the Senkou Span A (inexperienced cloud boundary) positioned under the Senkou Span B (crimson cloud boundary), and the cloud itself projecting downward.

This implies resistance overhead and restricted bullish momentum until worth manages to interrupt via the cloud decisively.

The skinny construction of the present cloud, nonetheless, hints at potential vulnerability—if consumers step in with energy, there could possibly be a window for a reversal.

However for now, the general setup favors warning, because the prevailing development stays bearish based on Ichimoku ideas.

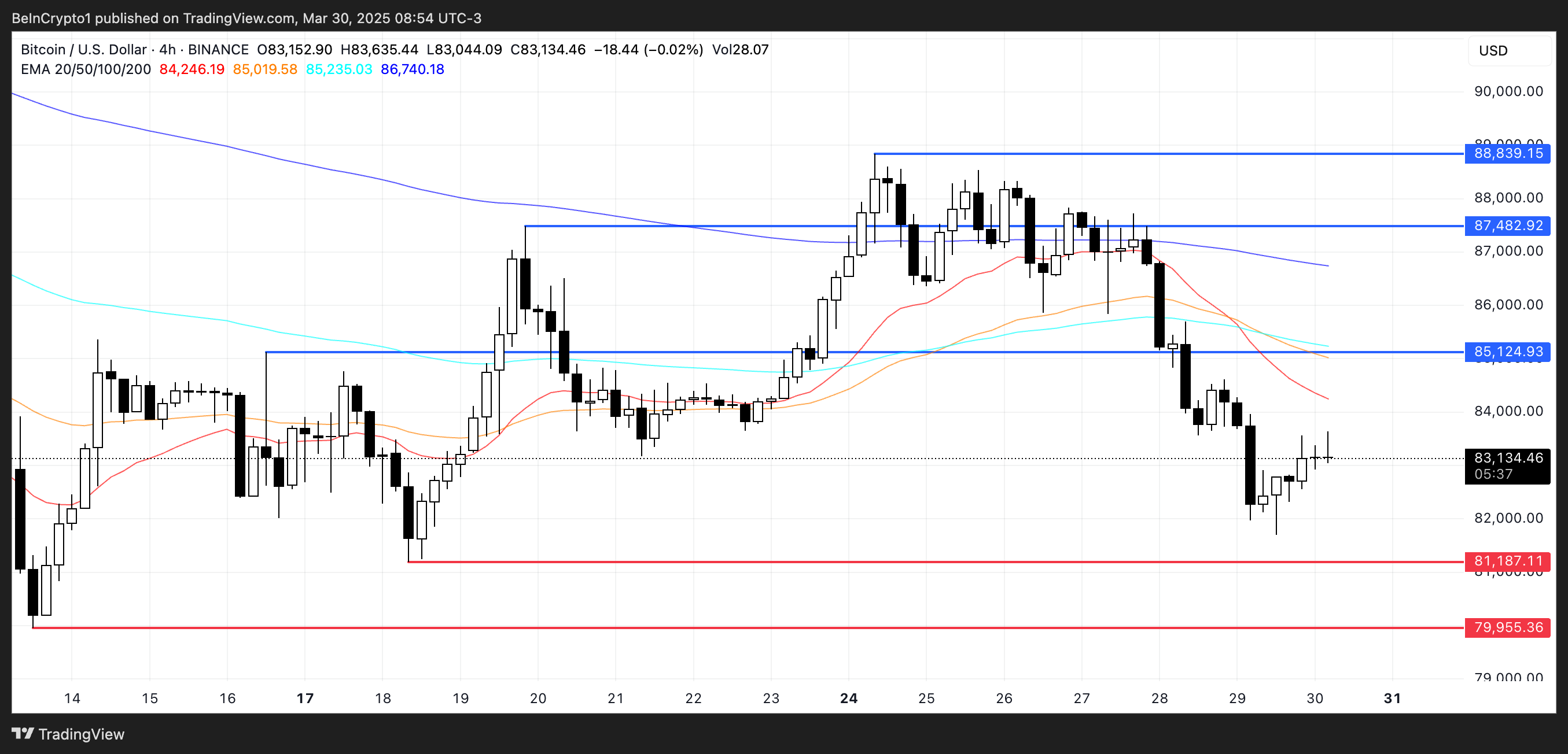

Can Bitcoin Rise To Take a look at $88,000 Quickly?

Bitcoin’s EMA strains proceed to point a downtrend, with short-term shifting averages positioned under the longer-term ones. This alignment suggests bearish momentum stays dominant for now.

Nevertheless, if consumers can regain management and set up an uptrend, Bitcoin worth could climb towards the following key resistance ranges.

The primary problem could be the resistance close to $85,124—if damaged, this might open the trail to $87,482 and probably $88,839, assuming bullish momentum strengthens and sustains.

On the flip facet, failure to construct upward momentum would reinforce the present bearish construction.

In that case, Bitcoin may revisit the help degree round $81,187.

A breakdown under this level would additional validate the downtrend, probably dragging the value right down to $79,955.

Disclaimer

Consistent with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.