A seemingly bullish Bitcoin (BTC) might find yourself being a entice, in keeping with current evaluation supplied by distinguished chartist Peter Brandt.

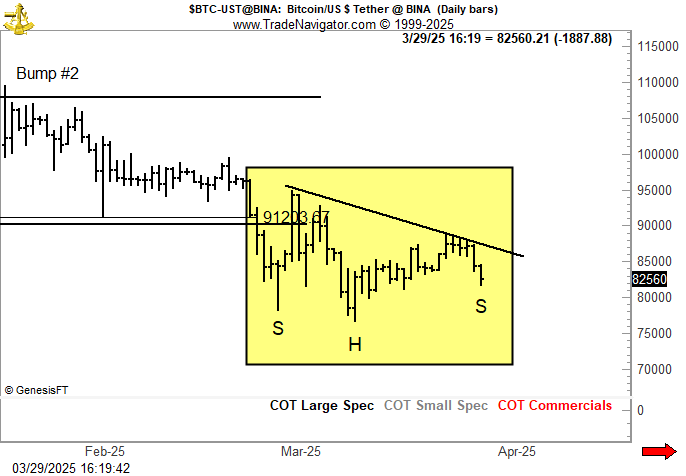

The most important cryptocurrency by market capitalization has now shaped the inverse head-and-shoulders sample on the each day chart, which is usually believed to be an indication of bullish reversal. Nonetheless, there’s a catch: the sample that the Bitcoin value is presently creating has a downward-sloping neckline.

Brandt, who has greater than 4 many years of expertise as a commodity dealer, says that he prefers H&S patterns with horizontal necklines since they’re considerably extra dependable.

The downward-sloping neckline implies that the cryptocurrency’s bullish momentum is presumably waning because of the lack of aggressive shopping for. Therefore, one mustn’t rule out that any future breakout will find yourself being a fakeout, with the worth plunging again under the neckline of the sample.

Plunging again to $60,000?

Distinguished dealer Josh Olszewicz has additionally taken notice of the bullish sample on the one-day chart in a current social media publish. He’s seemingly satisfied that this could possibly be the final alternative for the bulls to step up. In any other case, Bitcoin could possibly be liable to collapsing again to the $60,000-$70,000 vary.

In response to knowledge supplied by CoinGecko, Bitcoin is presently buying and selling at $83,091 after dropping 0.7% over the previous 24 hours. Earlier this Sunday, the cryptocurrency reached an intraday low of $81,769.

The cryptocurrency is struggling to revive its bullish momentum, with world commerce tensions placing excessive strain on risk-on property.