A crypto whale’s high-stakes, 10x leveraged PEPE place on Hyperliquid faces mounting danger. The whale’s leveraged PEPE wager stays precarious, risking liquidation amid market instability.

With added margin however persistent losses, any antagonistic value transfer may set off cascading sell-offs and broader crypto turbulence.

Whale Opens 10X Leverage on PEPE

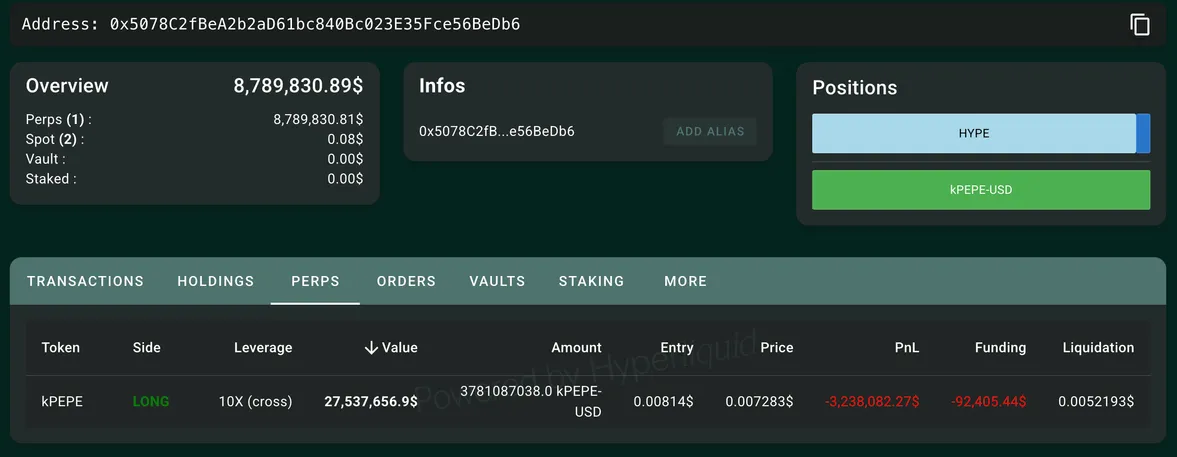

Crypto and DeFi analyst Ai revealed a notable gamble by a whale dealer, inserting a high-stakes wager on the PEPE meme coin. They opened a 10x leveraged lengthy place price $27.53 million on the Hyperliquid community.

Nevertheless, the commerce shortly turned towards them, with unrealized losses amounting to $3.238 million.

The whale, recognized by the handle 0x507…BeDb6 initiated the place on March 24 at an entry value of $0.00814 per 1,000 PEPE. Because it stands, they’re now susceptible to liquidation ought to the worth fall to $0.005219.

To stop compelled closure, they’ve added 3.818 million USDC in margin (roughly $3.8 million).

The precarious nature of the place raises issues in regards to the broader dangers to PEPE’s market stability and the implications for leveraged buying and selling on Hyperliquid.

Utilizing 10X leverage dramatically amplifies potential good points and losses, making this a extremely unstable wager. Even minor value fluctuations can result in important swings within the whale’s account stability.

If PEPE’s value continues to say no and reaches the liquidation threshold, Hyperliquid’s automated programs will forcibly shut the place.

This might additional drive down PEPE’s value. Such liquidations typically result in cascading sell-offs as different leveraged merchants get caught in a suggestions loop, exacerbating market volatility.

In the meantime, the whale’s determination to inject extra margin suggests they’re dedicated to defending their place. Nevertheless, this additionally indicators the strain they’re beneath to keep up solvency.

What Are the Perceived Dangers?

PEPE’s inherent volatility provides one other layer of danger. As a meme coin, its value actions are sometimes pushed by social sentiment relatively than elementary worth. This makes it significantly susceptible to fast value swings, which may hassle the whale’s place.

If damaging market sentiment prevails as a result of exterior elements equivalent to regulatory information or shifting dealer curiosity, PEPE’s value may decline additional.

On condition that the market has already been experiencing a downturn, the probability of extra value strain stays a big concern.

One other essential difficulty is the potential for whale-induced market manipulation. Massive-scale merchants have the ability to sway market developments, both by direct trades or by influencing sentiment.

By constantly including margin to keep away from liquidation, the whale might try and prop up PEPE’s value and forestall a significant sell-off.

Nevertheless, such efforts can solely go up to now. If the whale in the end exits their place, it may set off panic amongst smaller merchants, resulting in a fast decline in PEPE’s worth.

The broader influence on retail traders intently monitoring whale exercise may exacerbate instability.

The dangers related to liquidation cascades additionally can’t be ignored. Hyperliquid’s decentralized liquidation mechanism permits environment friendly order processing.

Nevertheless, a big liquidation can spark a series response in extremely leveraged markets.

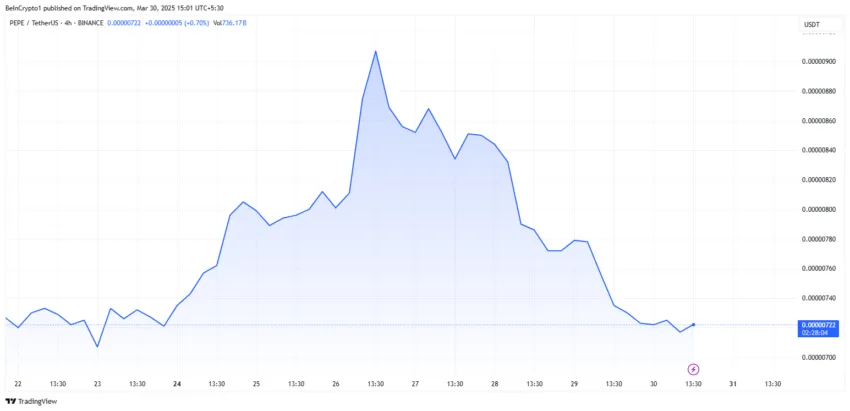

The PEPE value has fallen by over 5% within the final 24 hours and was buying and selling for $0.00000721 as of this writing.

If PEPE’s value nears the whale’s liquidation level, different merchants might start preemptively promoting to keep away from losses, making a snowball impact.

This might lead to PEPE experiencing sharp value declines shortly, doubtlessly affecting different meme cash and broader crypto markets.

KOL Opens Comparable Leverage Place for Ethereum

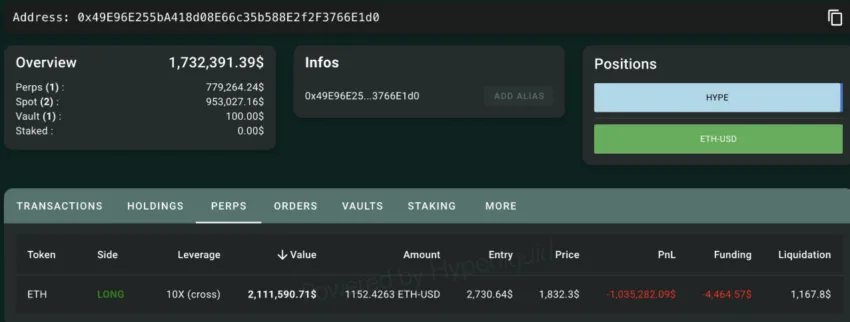

The dangers will not be restricted to PEPE alone. An analogous scenario is unfolding with one other distinguished dealer, CBB, a Key Opinion Chief (KOL) on X. They opened a 10X leveraged lengthy place on Ethereum (ETH) price $2.11 million.

At present, they’re going through an unrealized lack of $1.035 million as a result of an entry value of $2,730. Given present market circumstances, this has confirmed to be too excessive.

Nevertheless, not like the PEPE whale, this dealer has a extra comfy margin buffer, with a liquidation value of $1,167.8.

Whereas not in fast hazard, this case additional displays the precarious nature of extremely leveraged buying and selling in unstable markets.

The unfolding drama surrounding these positions highlights the dangers of extreme leverage, significantly in a declining market.

With PEPE’s whale struggling to keep up their place and Ethereum’s lengthy merchants going through mounting losses, the broader crypto market may see elevated volatility within the coming days.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.