Bitcoin’s current value motion has proven some regarding indicators. The crypto king has failed to interrupt by means of key resistance ranges, leaving it weak to additional declines.

As Bitcoin inches nearer to testing the $80,000 assist stage, the potential for a Loss of life Cross looms, growing bearish sentiment available in the market.

Bitcoin Traders Are Skeptical

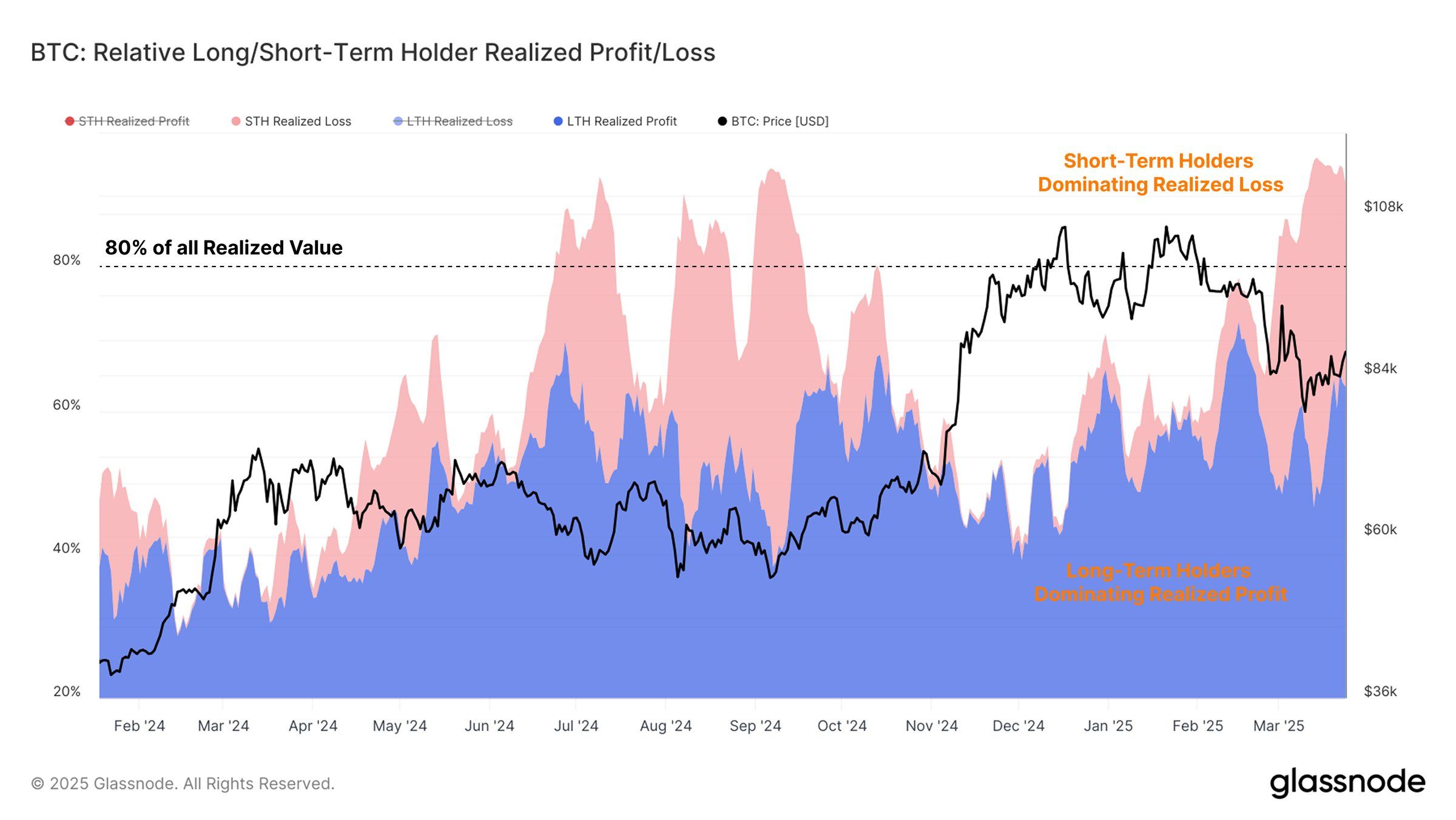

Brief-Time period Holders (STHs), who purchase at larger costs, are primarily liable for the continuing losses. These buyers have been actively noting losses in response to Bitcoin’s risky market situations, reflecting the unpredictable surroundings that has made it troublesome for brand spanking new buyers to navigate.

In the meantime, Lengthy-Time period Holders (LTHs) proceed to understand earnings, benefiting from their prolonged market presence. Nonetheless, the present market situations present stagnation in new capital inflows, with LTH earnings offset by STH losses. This creates weaker demand and resistance, signaling a possible slowdown in value momentum.

Sustaining bullishness available in the market sometimes requires constant capital inflows, however the market now appears to be missing that essential assist. The general sentiment displays a impartial stance, with each profit-taking and loss-realization balancing out.

The crypto king’s macro momentum is displaying extra indicators of bearish stress, notably with the Exponential Shifting Averages (EMAs). The 200-day EMA is lower than 3% away from crossing the 50-day EMA, which might end in a Loss of life Cross. This technical sample has traditionally signaled vital corrections in value, marking a possible finish to Bitcoin’s 18-month-long Golden Cross.

Because the EMAs strategy this important level, merchants and buyers are carefully awaiting any indicators of a correction. The concern of a Loss of life Cross brings additional concern to Bitcoin’s value stability. If the 50-day EMA crosses beneath the 200-day EMA, it may set off extra sell-offs, intensifying the bearish sentiment available in the market.

Is BTC Value Primed For Additional Decline?

Bitcoin is presently buying and selling at $82,248, nearing the important thing psychological assist stage of $80,000. Regardless of makes an attempt at a breakout, Bitcoin has failed to maneuver past the two-month-long broadening descending wedge sample. This sample means that Bitcoin may very well be on the point of additional decline.

If the downward momentum persists, Bitcoin is prone to fall by means of the $80,000 assist stage and strategy $76,741. This state of affairs would reinforce the bearish outlook, particularly contemplating the technical indicators and the dearth of sturdy shopping for assist. A breakdown beneath these ranges may sign a deeper correction, with the potential for additional declines.

Nonetheless, this short-term bearish thesis could be invalidated if Bitcoin’s value manages to reclaim $82,761 as assist. If Bitcoin breaks by means of the $85,000 barrier, it may escape of the present sample, signaling a possible reversal. A robust rally above $86,822 would counsel a resumption of the bullish pattern, invalidating the bearish momentum that presently dominates the market.

Disclaimer

In step with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.