Crypto markets have a lot to stay up for this week, which marks the tip of the primary quarter (Q1). As Q2 commences on Tuesday, a number of US financial information will drive Bitcoin (BTC) and crypto sentiment this week.

Merchants and buyers will watch a slate of US financial information releases that might ripple by means of Bitcoin and altcoin costs.

5 US Financial Knowledge To Watch This Week

These US macroeconomic indicators might drive volatility amid recent insights into the well being of the world’s largest economic system.

“Buckle up—volatility’s knocking. Proper on time for the month-to-month shake-up,” a person on X quipped.

JOLTS

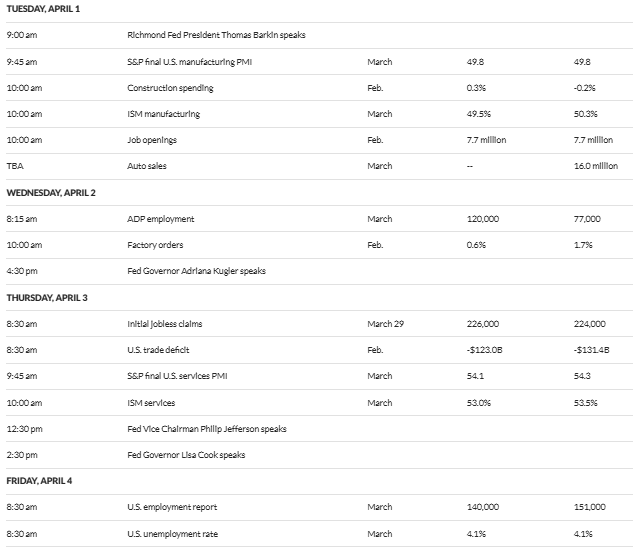

The primary is the Job Openings and Labor Turnover Survey, or JOLTS, due for launch on Tuesday, April 1. This report tracks out there job vacancies within the US, successfully providing a window into employer confidence and labor market demand.

A robust exhibiting, with openings exceeding latest traits of round 7.7 million, would counsel a robust economic system. Whereas this may strengthen the US greenback, it might dampen Bitcoin’s enchantment as a hedge towards weak point.

Conversely, a pointy drop in openings would possibly stoke expectations of Federal Reserve fee cuts to bolster the economic system. This final result would elevate threat property like Bitcoin and crypto as buyers search options to low-yield bonds.

ADP Employment

Including to the record of US macroeconomic indicators this week is the ADP Employment report on Wednesday, April 2. This report will present a private-sector payroll snapshot, serving as a preview of Friday’s primary occasion.

There’s a median forecast of 120,000 for March, following the earlier month’s 77,000 studying. If job development tops the consensus forecast, it might reinforce confidence in conventional markets, presumably pressuring crypto costs because the greenback positive aspects floor.

Alternatively, a weaker-than-expected determine, say beneath 77,000, would possibly trace at a slowdown. This may enhance Bitcoin’s attract as a secure haven amid uncertainty. Whereas not as authoritative because the official numbers, surprises right here usually set the tone for crypto merchants adjusting their positions.

Liberation Day

In the meantime, the stakes are excessive this week, with the US economic system enduring uncertainties like Trump-era insurance policies, together with tariffs and authorities streamlining efforts. BeInCrypto reported on the upcoming Liberation Day, which is predicted to carry new tariff bulletins focusing on nations imposing commerce obstacles.

“The final two months have already harm American companies and customers, however the April 2 deadline severely might make all of that appear to be a tempest in a teapot. We don’t know precisely what they’re going to do, however from what they’re saying, it sounds functionally like new tariffs on all US imports,” stated Joseph Politano, financial coverage analyst at Apricitas Economics.

Analysts predict excessive market volatility, with potential inventory and crypto crashes reaching 10-15% if Trump enforces broad tariffs.

“April 2nd is just like election night time. It’s the largest occasion of the 12 months by an order of magnitude. 10x extra vital than any FOMC, which is quite a bit. And something can occur, “Alex Krüger predicted.

Preliminary Jobless Claims

On Thursday, April 3, crypto markets will watch the Preliminary Jobless Claims report, which exhibits the variety of US residents submitting for unemployment insurance coverage. Launched weekly, this can be a near-real-time pulse on layoffs and labor market stability.

Fewer claims, underneath the earlier week’s 224,000 studying, might counsel resilience, supporting the greenback however tempering crypto enthusiasm. Nonetheless, doubtlessly exceeding the median forecast of 226,000 would possibly increase purple flags about financial well being.

Such an final result would drive demand for decentralized property to hedge towards potential turmoil. Given its weekly cadence, this report tends to spark fast reactions within the crypto market, particularly when amplified by broader narratives like authorities effectivity cuts or tariff impacts in 2025.

US Employment Report

The week’s crescendo arrives Friday, April 4, with the US Employment Report, broadly often known as Non-Farm Payrolls. This complete labor market replace—together with jobs added, the unemployment fee, and wage development—is a linchpin for markets worldwide.

A robust report, greater than the earlier studying of 151,000 jobs and a gentle 4.1% unemployment fee, might bolster religion within the economic system. This might curb crypto positive aspects if the greenback rallies.

Nonetheless, robust wage development exceeding 0.3% month-over-month (MoM) would possibly rekindle inflation fears, not directly supporting Bitcoin as a retailer of worth.

Conversely, a disappointing tally—underneath the median forecast of 140,000 jobs with unemployment ticking past 4.1%—might ignite recession worries. This may ship buyers flocking to Bitcoin and crypto.

Vital deviations from consensus forecasts, usually by 50,000 jobs or extra, have traditionally triggered sharp Bitcoin strikes of 1-2% or larger.

“BofA [Bank of America] Securities expects a pickup in job development for March. Control these numbers,” crypto researcher Orlando famous.

For crypto market individuals, the sport plan is evident: observe consensus estimates on financial calendars, watch real-time reactions, and brace for swings. Nonetheless, this week’s information might dictate Bitcoin’s subsequent transfer in Q2 2025, significantly in April.

Fed Chair Jerome Powell will even deal with the financial outlook on the SABEW Annual Convention on Friday at 11:25 a.m. EST.

BeInCrypto information exhibits BTC was buying and selling for $82,192 as of this writing, down by over 1% within the final 24 hours.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.