|

Bitcoin mining shadow tenants depart Malaysian landlords with million-dollar electrical energy nightmares

Landlords throughout Malaysia are dealing with large monetary losses after their tenants illegally mined cryptocurrency to rack up electrical energy payments earlier than leaving property house owners to bear the associated fee.

In a single case, a landlord recognized as “Jason” was reportedly handed a 1.7 million Malaysian ringgit (about $382,000) penalty by electrical energy supplier Tenaga Nasional Berhad (TNB) after a tenant stole electrical energy to energy their secret crypto mining operations. After 4 years of authorized battles, the advantageous was decreased to 825,000 ringgit ($185,722).

His ordeal started in July 2020 when he rented out his property to a tenant who claimed to work with computer systems. Three months later, all the constructing suffered energy outages resulting from illegally put in energy cables used for crypto mining. When authorities found the theft, Jason was held liable, whereas the tenant had vanished.

Jason tried to combat the advantageous in court docket, arguing that he was not accountable for his tenant’s unlawful actions. However after two years of litigation, he misplaced the case, leaving him to take care of mounting authorized charges and a 5% rate of interest on the excellent quantity. Now, he’s getting ready to enchantment.

Jason’s case is just not remoted. Forty-five householders and enterprise operators have reported a mixed 8.5 million ringgit ($1.9 million) in fraudulent electrical energy payments, with tenants utilizing stolen identities to hold out unlawful Bitcoin mining. Some solely realized the deception after receiving notices from TNB, leaving them financially crippled.

One sufferer, a 57-year-old landlord who depends on rental earnings, now faces a 300,000 ringgit ($67,720) invoice after his tenant used a pretend identification to lease his property. One other sufferer was blindsided by a 73,000 ringgit ($16,386) invoice and has already paid 70,000 ringgit ($15,756).

Malaysia has been grappling with the difficulty of stolen electrical energy, with TNB blaming crypto mining for the 441 million ringgit ($100 million) loss it has suffered from electrical energy theft since 2020.

Chinese language programmer burns $6.8M in ETH, claims ‘brain-computer weapons’ management individuals

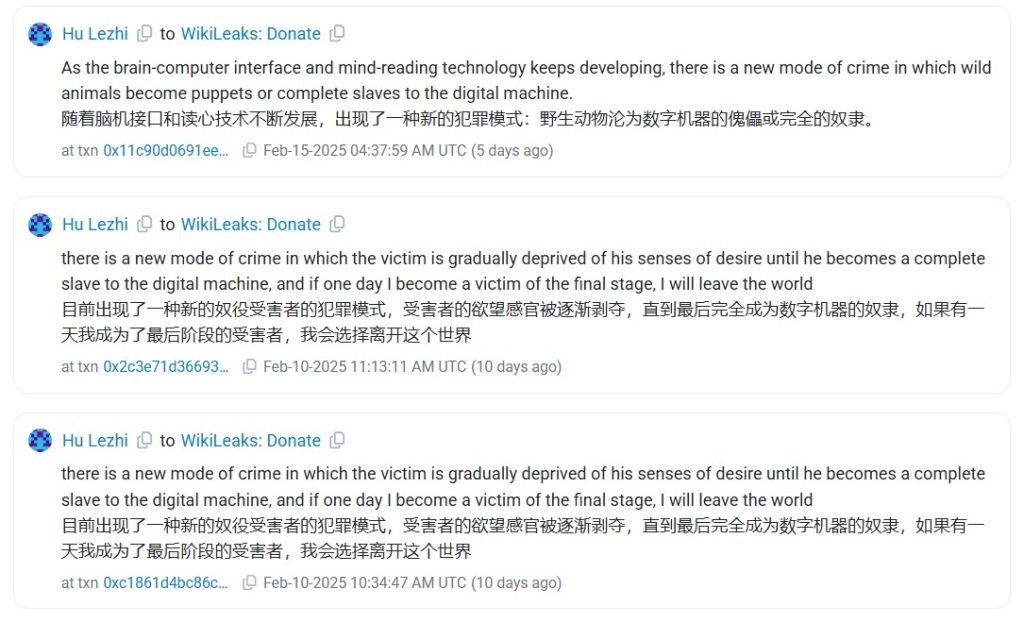

A Chinese language programmer self-identified as Hu Lezhi has burned and transferred tens of millions of {dollars} price of Ether to publicize his wild claims that Chinese language companies and navy forces are utilizing “brain-computer” tech to govern and management residents.

Between Feb. 10 and Feb. 17, Lezhi transferred greater than 2,553 ETH (price $6.8 million on the time) to numerous addresses, together with Ethereum’s burn tackle and WikiLeaks. His transactions contained onchain messages that state nano-computer chips and radio waves are getting used to show people into “puppets or full slaves to the digital machine.”

Hu’s largest transactions included 500 ETH ($1.35 million) despatched to a burn tackle, successfully eradicating the funds from circulation. He additionally donated 711.5 ETH ($2 million) to WikiLeaks throughout a number of transactions, claiming in a message that “brain-computer chips have been deployed militarily on a big scale.”

Amongst his allegations, Hu particularly referred to as out Feng Xin and Xu Yuzhi, hedge fund executives at Kuande Funding, accusing them of utilizing this know-how to regulate workers. He went so far as to say that the 2 executives themselves had been victims of the identical know-how.

Hu described himself as a pc programmer who had solely not too long ago realized he was being monitored and manipulated his complete life. Their final message claims that they’ve fully misplaced their dignity as a human being. Hu’s Ethereum pockets has since remained inactive.

Neither Kuande Funding nor any Chinese language authorities have publicly responded to Hu’s claims. Cointelegraph has reached out to Kuande Funding.

Learn additionally

Options

Championing Blockchain Schooling in Africa: Ladies Main the Bitcoin Trigger

Options

Creating ‘good’ AGI that received’t kill us all: Crypto’s Synthetic Superintelligence Alliance

Robinhood to enter the Singapore crypto market through Bitstamp

Buying and selling platform Robinhood is reportedly pushing into Singapore’s cryptocurrency market, aiming to roll out buying and selling companies by its Bitstamp subsidiary by late 2025.

The corporate’s $200 million acquisition of Bitstamp, introduced in 2024, continues to be awaiting remaining regulatory approval and is predicted to shut in 2025.

In the meantime, Kraken is getting ready to re-enter India, two years after being banned over Anti-Cash Laundering violations. The shift comes as a senior Indian official signaled that the federal government is reassessing its stance on crypto, probably clearing the best way for offshore exchanges.

Coinbase can also be eyeing a return, having beforehand exited when regulators lower off entry to India’s Unified Funds Interface — the nation’s dominant monetary rail, managed by the Reserve Financial institution of India.

India had lengthy restricted crypto companies from utilizing RBI-linked companies, arguing that digital belongings lacked authorized recognition. However with world laws evolving, the nation seems to be rethinking its method, probably reopening the market to main exchanges.

Learn additionally

Options

‘Sic AIs on one another’ to forestall AI apocalypse: David Brin, sci-fi writer

Options

Strains within the sand: US Congress is bringing partisan politics to crypto

Hong Kong activates regulatory spurt on the worldwide stage

Hong Kong is increasing its digital asset regulatory framework, unveiling a brand new five-part initiative aimed toward adjusting market insurance policies, growing liquidity and shaping the town’s position within the world digital asset sector.

The Securities and Futures Fee has launched the ASPIRe initiative, a method targeted on market entry, investor safeguards, monetary merchandise, regulatory infrastructure, and business engagement. The announcement coincided with Consensus Hong Kong, a significant crypto occasion the place the town granted its tenth digital asset buying and selling platform license to Bullish, the mother or father firm of CoinDesk, the occasion’s host.

The brand new framework explores the opportunity of introducing regulated staking, derivatives buying and selling, and margin lending for sure buyers whereas reinforcing Anti-Cash Laundering measures to align with world oversight requirements.

The enlargement comes as different monetary hubs, together with the US, Singapore and the Center East, proceed creating their very own digital asset methods. Within the US, President Donald Trump’s administration has taken a pro-crypto stance, shifting sentiment after years of regulatory uncertainty.

SFC Chief Govt Julia Leung argued that Hong Kong intends to supply extra constant regulation in comparison with the US’s fragmented method.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist protecting blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.