Made in USA cash proceed to attempt a rebound, with Solana (SOL), RENDER, and Jupiter (JUP) standing out as key names to look at in April. Regardless of latest worth corrections, every of those tokens performs a significant function in high-growth areas like DeFi, AI, and blockchain infrastructure.

Solana has seen its worth dip, however ecosystem exercise stays sturdy; RENDER is driving the wave of AI demand regardless of market turbulence; and Jupiter is displaying strong utilization metrics at the same time as its token struggles. Right here’s a better have a look at the technical and basic setups for every of those standout U.S.-based tasks.

Solana (SOL)

Solana has confronted a notable worth correction over the previous week, with its worth dropping almost 13%. If this bearish momentum continues, the token may very well be on monitor to retest the essential assist stage at $120.

A breakdown under that would see SOL sliding additional towards the $112 mark.

Regardless of the latest downturn, Solana stays some of the related Made in USA cash and continues to point out spectacular utilization metrics. PumpFun, for instance, generated almost $9 million in income over the previous 24 hours, second solely to Tether.

After a brief interval when BNB led the DEX quantity race, Solana appears to be regaining traction—its decentralized alternate quantity has surged by 128% in simply seven days, reaching $18 billion and surpassing each Ethereum and BNB.

If this restoration in momentum persists, SOL might goal a transfer towards the $131 resistance stage. A profitable breakout there might open the door to additional beneficial properties towards $136 and probably $147.

RENDER

RENDER, some of the outstanding U.S.-based cryptocurrencies with a give attention to synthetic intelligence, has seen its worth decline almost 11% over the previous seven days.

This drop displays the broader correction that has impacted many AI-related tokens in latest months.

Nonetheless, new developments within the AI infrastructure house could present a catalyst for a possible rebound, particularly as the restrictions of centralized programs turn out to be clear.

Tory Inexperienced, CEO of main world GPU-power aggregator io.internet, advised BeInCrypto:

“The latest spike in demand for OpenAI’s service after the discharge of its new picture era capabilities has as soon as once more highlighted that these large centralized AI gamers are merely not ready to cope with spiralling demand. GPU melting isn’t a sustainable option to deal with site visitors, and it’s not possible for OpenAI and others to extend their processing amenities promptly.”

He defends that AI centralization is a large drawback, with decentralized options being an incredible different to energetic additional sources:

“The issue isn’t simply entry to chips, however the centralization of those large gamers. They’ll by no means have the ability to deliver hundreds of GPUs on-line because of the time it takes to construct a knowledge middle and since they lack entry to different compute sources that may be activated when wanted. (…) By connecting current information facilities to a world community, such decentralized choices can shortly cater to altering site visitors with out centralization chokepoints.”

If bullish momentum returns to the AI sector, RENDER might look to problem the resistance at $3.47, and a profitable breakout would possibly open the door for a rally towards $4.21.

Nonetheless, if the present correction deepens, the token might fall to check the $3.14 assist stage. A breakdown there could set off additional losses, probably dragging RENDER right down to $2.83 and even $2.52—its lowest stage in latest weeks.

Jupiter (JUP)

Regardless of Solana’s latest struggles, Jupiter—its main DEX aggregator—is demonstrating spectacular energy by way of exercise.

Within the final 24 hours, Jupiter ranked because the fourth-highest protocol in crypto by price era, gathering almost $2.5 million.

Solely Tether, PumpFun, and Circle managed to outperform it, highlighting the platform’s rising relevance throughout the Solana ecosystem even in periods of broader market weak spot.

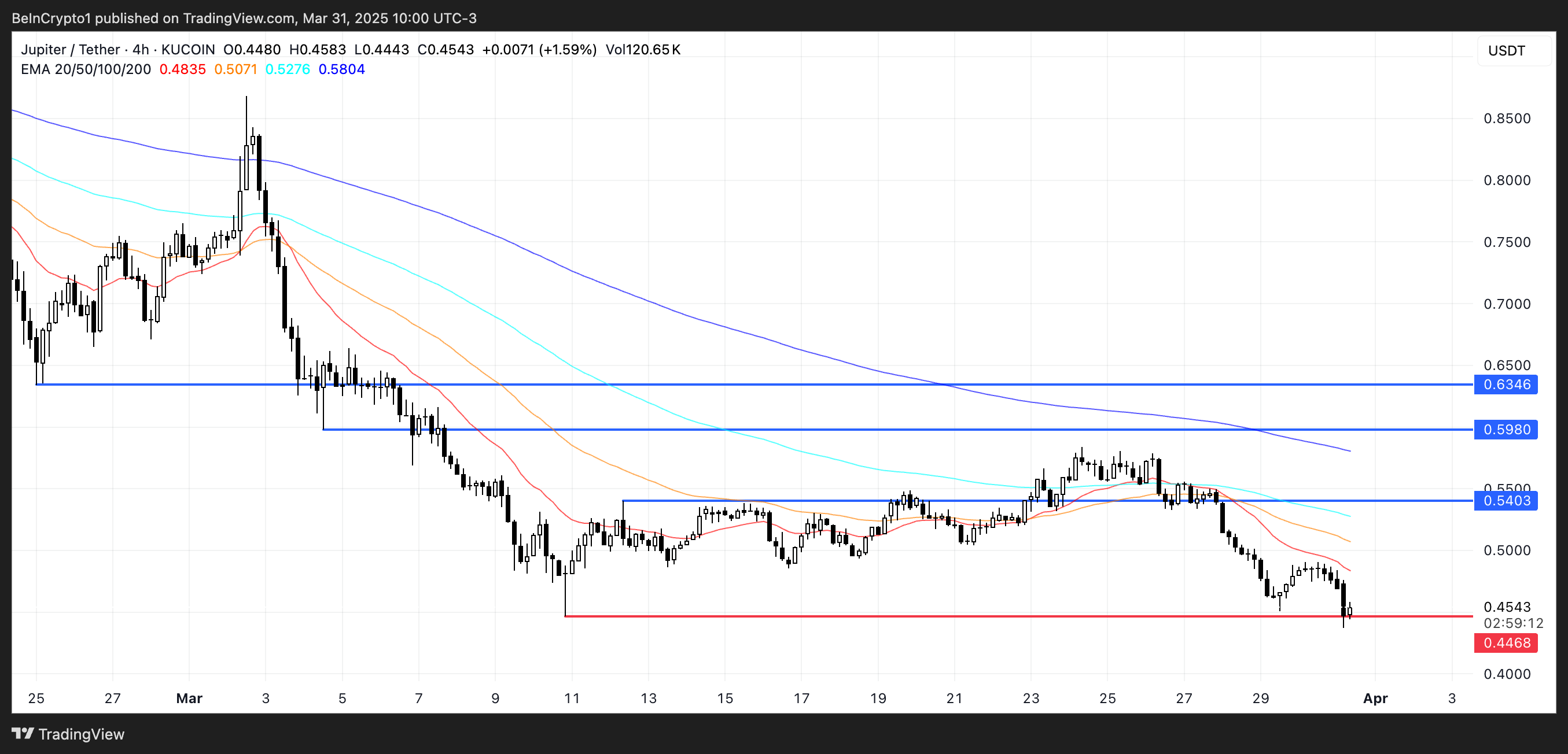

Nonetheless, JUP, Jupiter’s native token, hasn’t mirrored this optimistic momentum. Its worth has dropped over 21% prior to now week, being one of many worst performers among the many largest Made in USA cash. It has remained under the $0.65 mark for 3 consecutive weeks.

With JUP now hovering dangerously near a key assist at $0.44, a breakdown might see the token dip under $0.40 for the primary time ever.

Nonetheless, if market sentiment shifts and momentum returns, JUP might start climbing once more—first testing resistance at $0.54, then probably shifting towards $0.598 and even $0.63 if bullish stress intensifies.

Disclaimer

Consistent with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.