XRP has skilled a major downturn in latest value motion, with its worth dropping almost 15% over the previous seven days as bears preserve management of the market. The coin’s technical indicators are displaying blended alerts, with the RSI rebounding from oversold territory whereas Ichimoku Cloud patterns proceed to color a predominantly bearish image.

Regardless of yesterday’s take a look at of the vital $2.06 help degree leading to a short lived bounce, the momentum stays damaging, with short-term EMAs positioned beneath long-term averages. The transfer from excessive oversold circumstances suggests XRP may be getting into a consolidation section earlier than its subsequent important value motion.

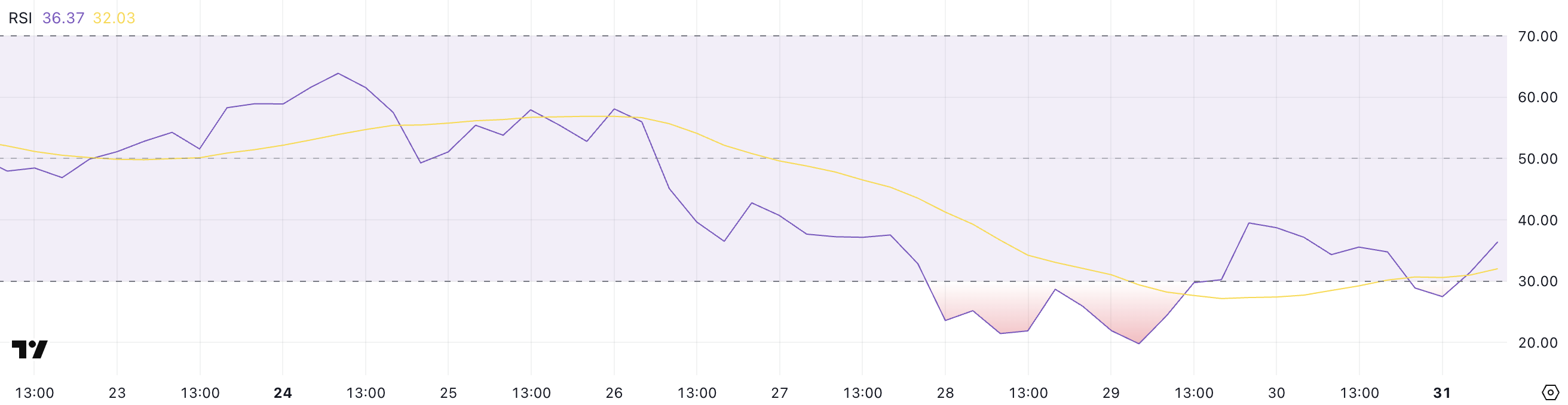

XRP RSI Is Up From Oversold Ranges

XRP’s Relative Energy Index (RSI) is at present at 36.37, displaying a notable rebound from a low of 27.49 just some hours in the past. This upward shift signifies a shift in momentum, as shopping for curiosity has began to choose up after a interval of heavy promoting strain.

Though nonetheless within the decrease vary, this restoration means that merchants could also be stepping again in. That would imply they’re doubtlessly viewing the latest dip as a chance.

RSI is a extensively used momentum indicator that measures the pace and alter of value actions on a scale from 0 to 100. Readings beneath 30 usually point out that an asset is oversold and could also be undervalued, whereas readings above 70 counsel it’s overbought and could possibly be due for a correction.

XRP’s bounce from 27.49 to 36.37 alerts that it might have simply exited oversold circumstances. This might imply that the latest promoting section is easing. If the shopping for momentum continues to construct, XRP may be getting into the early phases of a possible restoration.

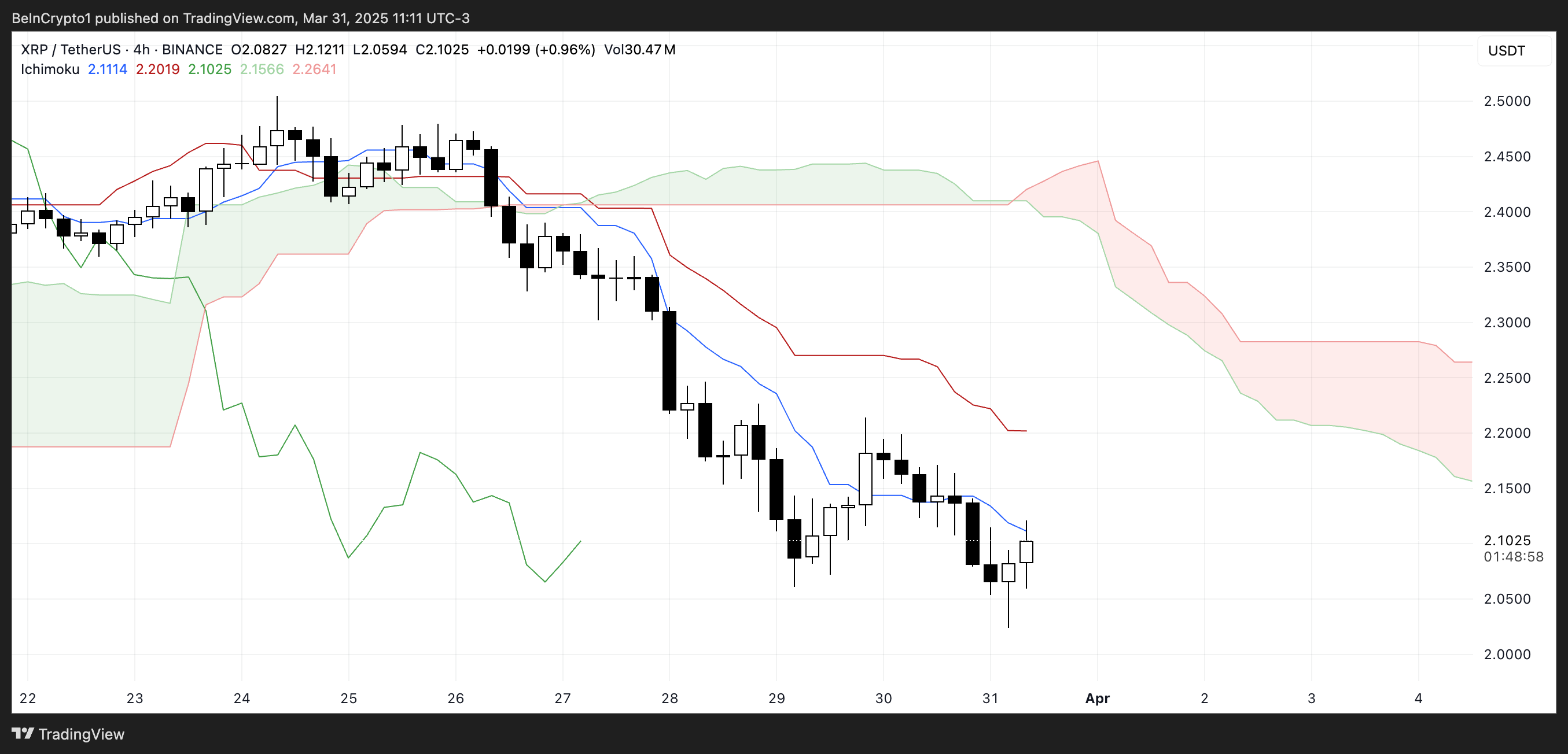

XRP Ichimoku Cloud Exhibits A Bearish State of affairs

XRP’s Ichimoku Cloud chart reveals that the value motion stays beneath each the purple baseline (Kijun-sen) and the blue conversion line (Tenkan-sen). That signifies the prevailing momentum continues to be bearish.

The candles are additionally forming properly beneath the cloud, which displays a broader downtrend.

When the value is underneath all main Ichimoku parts like this, it usually alerts continued downward strain except a robust reversal breaks these resistance ranges.

Moreover, the cloud forward is purple and spans horizontally with a downward slope, reinforcing the bearish outlook within the close to time period. The thickness of the cloud suggests reasonable resistance if the value makes an attempt to maneuver upward.

Nonetheless, some consolidation is obvious within the latest candles, displaying that sellers could also be shedding some management.

For any potential pattern reversal, XRP would want to interrupt above the Tenkan-sen and Kijun-sen, and ultimately problem the cloud itself — a transfer that might require a transparent uptick in momentum.

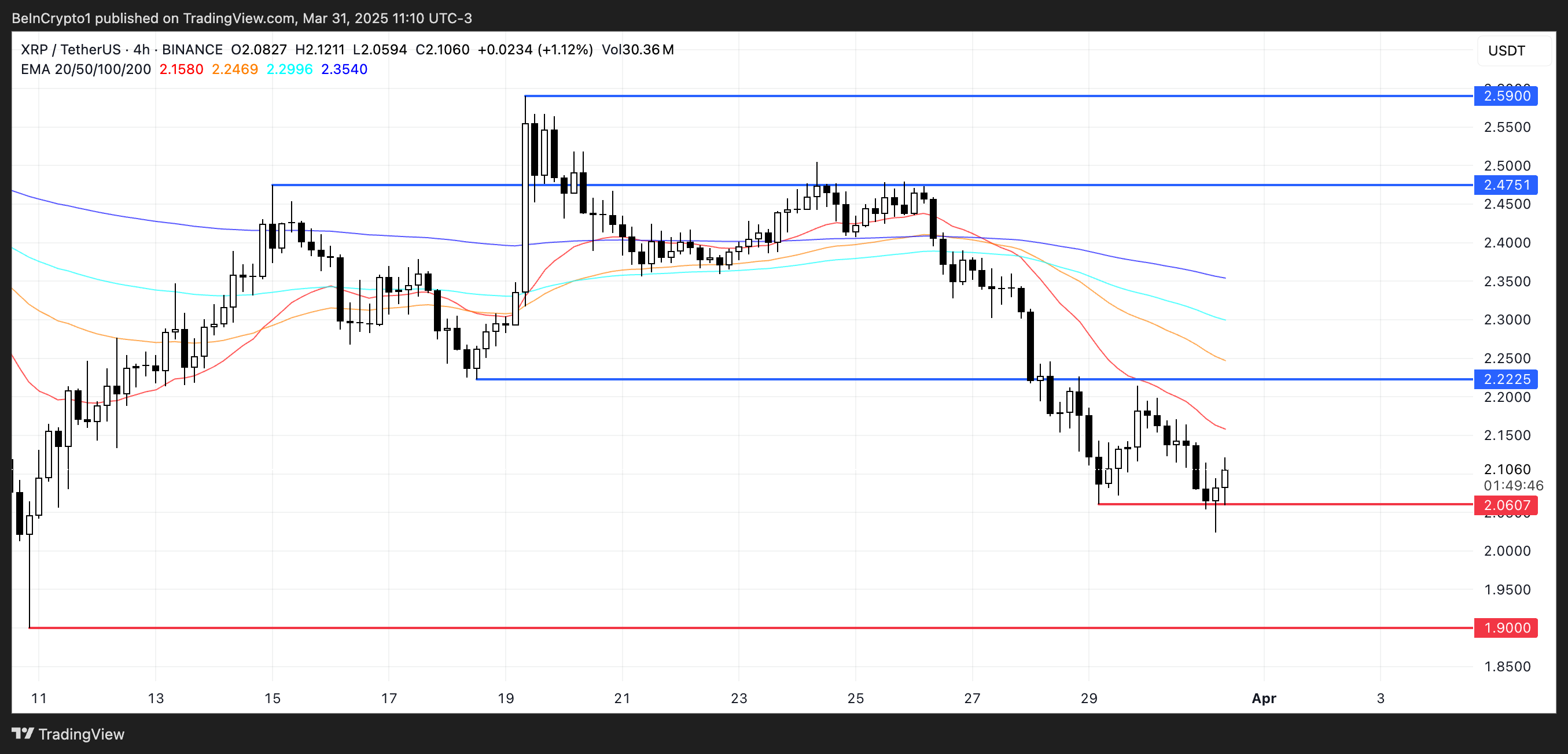

XRP May Rise After Testing An Necessary Assist Yesterday

XRP’s EMA traces are clearly aligned in a bearish formation, with the short-term averages sitting properly beneath the long-term ones and a noticeable hole between them—highlighting sturdy downward momentum.

Yesterday, XRP value examined the help degree at $2.06 and rebounded, displaying that patrons are nonetheless energetic at that zone. Nonetheless, this help stays vital. Whether it is examined once more and fails to carry, XRP might fall additional. Its subsequent main help sitting round $1.90.

If the pattern begins to shift and XRP breaks above the short-term EMAs, the primary key resistance to observe is at $2.22. A profitable transfer above this degree might set off a stronger restoration, doubtlessly pushing the value towards $2.47.

If bullish momentum continues, the following upside goal could be $2.59. For now, although, the EMA construction nonetheless leans bearish. XRP would want sustained shopping for strain to flip the pattern and goal for these increased resistance ranges.

Disclaimer

In keeping with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.