Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

An analyst has identified how XRP and three different altcoins appear like they share an analogous technical evaluation (TA) destiny. Right here’s what might be in retailer for these belongings.

TA Patterns Are Pointing At Similar End result For 4 Altcoins

In a brand new publish on X, analyst Ali Martinez has identified a commonality that could be current amongst XRP (XRP), Ethereum Traditional (ETC), Bitcoin Money (BCH), and yearn.finance (YFI).

Associated Studying

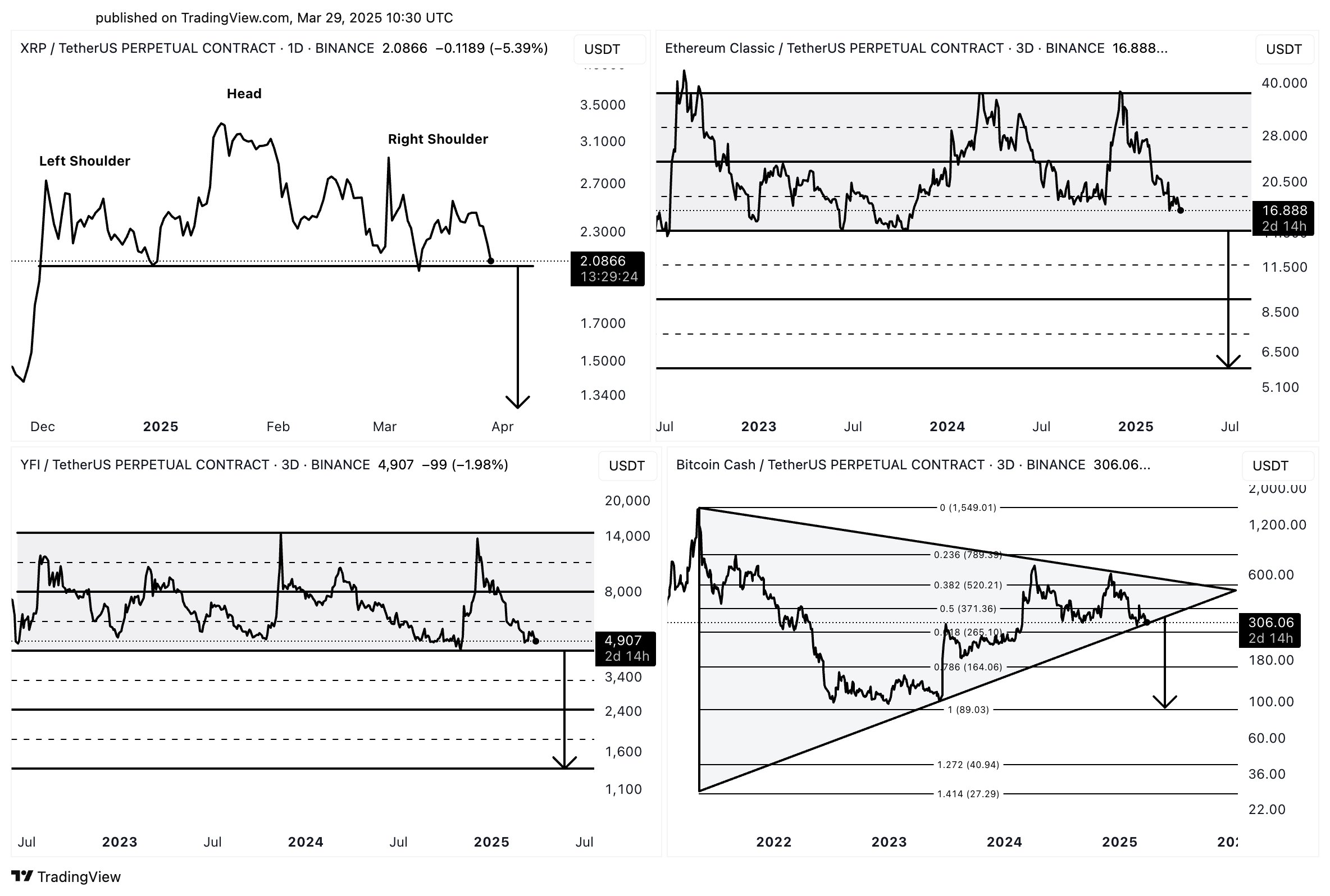

The similarity lies within the sign that TA is giving on the value charts of every of those altcoins. Listed here are the graphs the analyst shared, displaying the patterns:

The primary chart (high left) highlights the development within the 1-day worth of XRP, the fourth largest cryptocurrency by market cap. It might seem that the asset has probably been forming what’s referred to as a head-and-shoulders sample.

This sample varieties when an asset’s worth reveals three peaks following a pointy surge, with the internal and outer peaks being comparable in scale (the shoulders), and the center one the biggest (the top). The formation additionally entails one different characteristic: a assist trendline that facilitates the formation of the completely different peaks.

From the graph, it’s obvious that XRP is presently retesting this assist line, after forming its third peak (the proper shoulder). The pinnacle-and-shoulders typically sign a reversal of development, so it’s doable that the coin might find yourself failing this retest and a pointy plunge would comply with subsequent.

Bitcoin Money, the underside proper chart, can be making a retest of what might be an vital assist line. On this case, the trendline is the decrease one in every of a symmetrical triangle.

The symmetrical triangle happens when an asset finds itself consolidating between two trendlines that converge at a roughly equal and reverse slope. Because of this as the value travels contained in the channel, the gap between its tops and bottoms progressively turns into narrower.

The higher channel gives resistance and the decrease one gives assist, however because the consolidation will get very slim (that’s, the value approaches the apex of the triangle), a breakout can turn out to be seemingly.

Lately, Bitcoin Money has come fairly near the triangle’s finish, so it’s doable that an escape could also be taking place quickly. As BCH is retesting the decrease trendline proper now, it’s doable that this break might occur in direction of the draw back. Such a breakout, if one occurs, might be a bearish sign for the coin, similar to the one for XRP.

Associated Studying

The opposite two altcoins, Ethereum Traditional (high proper) and yearn.finance (backside left), are each close to the underside line of a parallel channel. On this sample, consolidation happens between two parallel trendlines.

It’s doable that assist would possibly find yourself holding for these cash, similar to it has up to now, however given the truth that they’ve been buying and selling contained in the channel for a few years now and {that a} shift towards a bearish temper has taken place within the sector, a breakout to the draw back could also be coming.

It now stays to be seen if XRP and the opposite altcoins will find yourself following within the trajectory that TA has been hinting at or not.

XRP Value

On the time of writing, XRP is buying and selling round $2.06, down over 16% within the final seven days.

Featured picture from Dall-E, charts from TradingView.com