Bitcoin (BTC) enters April on shaky footing. It’s caught between fading bearish momentum and rising uncertainty forward of Wednesday’s extremely anticipated “Liberation Day” tariff announcement. Technical indicators just like the DMI, Ichimoku Cloud, and EMA traces present combined alerts, with early indicators of purchaser power rising.

The market stays range-bound, with each draw back checks and breakout rallies on the desk relying on macro developments. With the JOLTS report due in the present day and tariff readability nonetheless pending, Bitcoin’s subsequent main transfer might be simply across the nook.

BTC DMI Exhibits Patrons Took Management, However Will It Final?

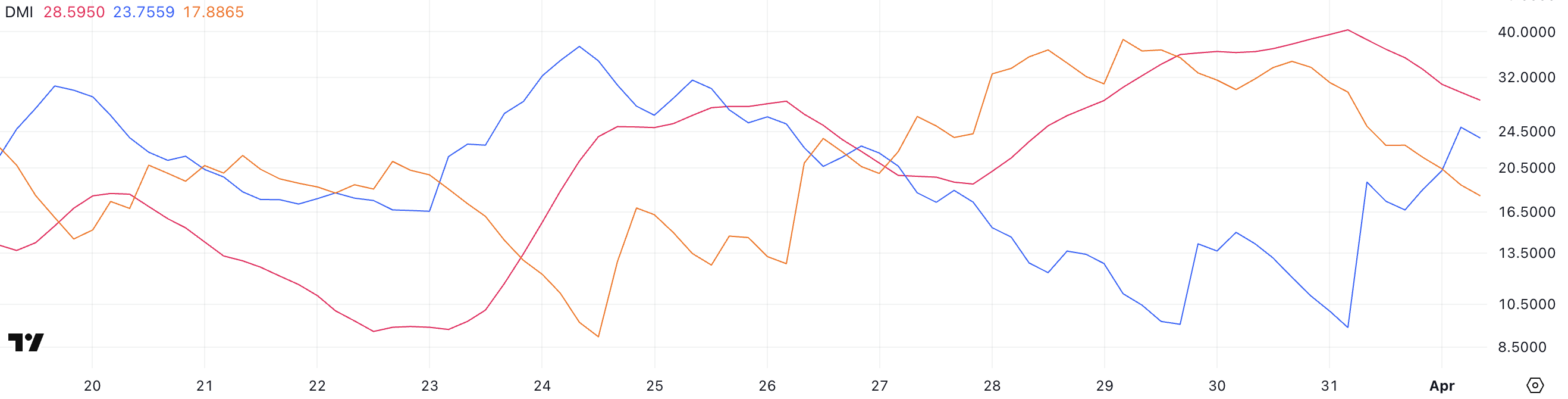

Bitcoin’s Directional Motion Index (DMI) is flashing potential indicators of a momentum shift. The Common Directional Index (ADX), which measures the power of a pattern no matter its course, has dropped to twenty-eight.59 from 40.38 yesterday. That signifies that the present downtrend could also be dropping steam.

Sometimes, an ADX studying above 25 alerts a robust pattern, whereas values under that recommend a weakening or sideways market. Though 28.59 nonetheless exhibits average pattern power, the drop alerts fading momentum.

In the meantime, the +DI (constructive directional indicator) has surged to 23.75 from 9.35, whereas the -DI (destructive directional indicator) has fallen to 17.88 from 34.58—suggesting bullish strain is starting to construct.

This crossover between the +DI and -DI may sign an early pattern reversal, particularly if confirmed by additional worth motion and quantity. Nonetheless, it’s essential to notice that Bitcoin stays in a broader downtrend for now.

Market individuals are additionally eyeing in the present day’s JOLTS report, a key indicator of U.S. job openings. A stronger-than-expected report may elevate the greenback and apply strain to crypto markets. However, weaker knowledge may enhance expectations of price cuts, doubtlessly boosting Bitcoin and different threat belongings.

With directional indicators shifting and macroeconomic knowledge in play, Bitcoin’s subsequent transfer might be closely influenced by exterior catalysts. Not too long ago, BlackRock CEO Larry Fink acknowledged that Bitcoin may take the greenback’s function because the world reserve foreign money.

Bitcoin Ichimoku Cloud Exhibits The Bearish Pattern Is Nonetheless Right here

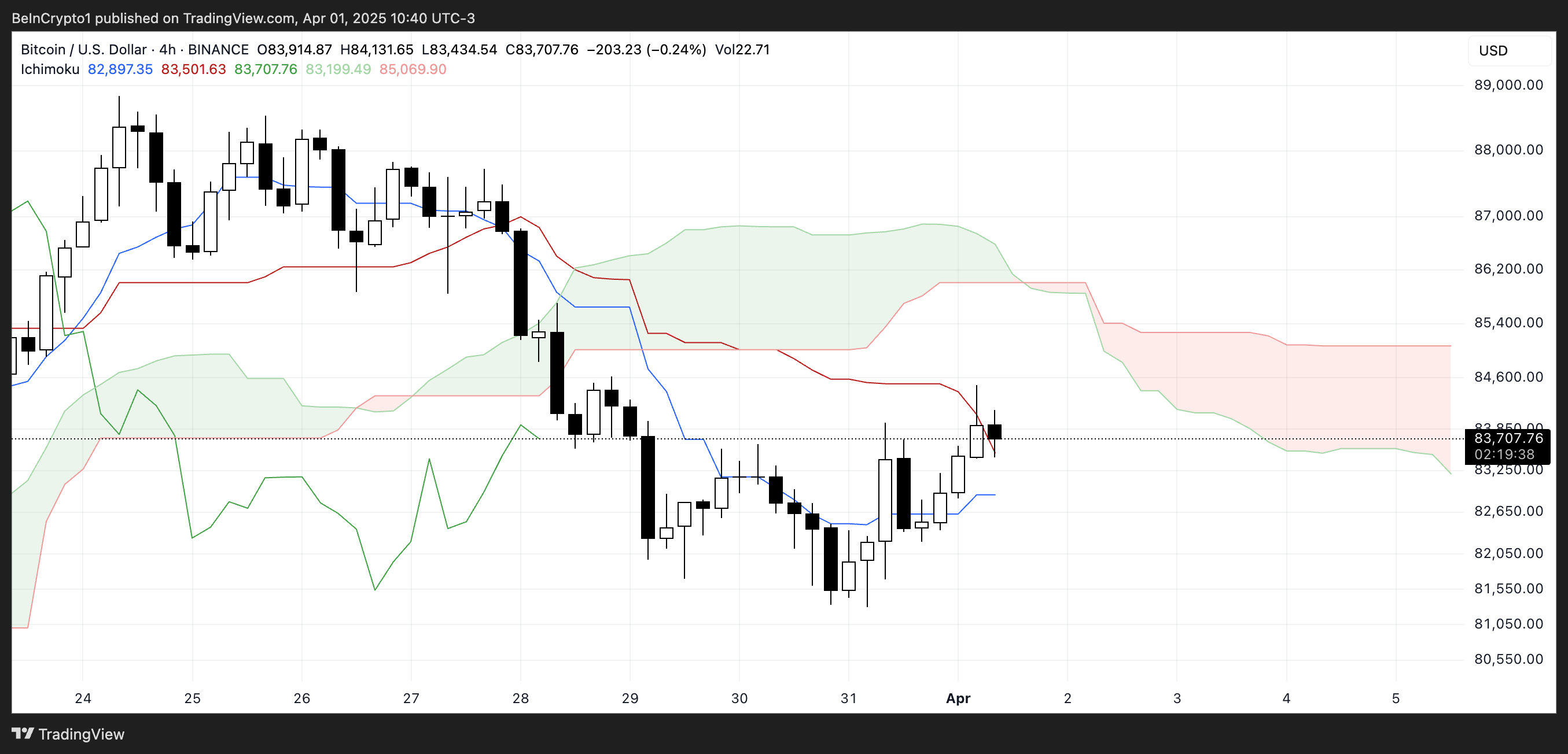

Bitcoin’s Ichimoku Cloud chart reveals a market nonetheless underneath bearish strain, regardless of latest indicators of short-term restoration. The worth is presently testing the Kijun-sen (crimson line), which acts as a key resistance degree.

Whereas the Tenkan-sen (blue line) is beginning to flatten and curl upward—typically an indication of momentum shift—the truth that the value stays under the Kumo (cloud) signifies that the broader pattern continues to be bearish.

The cloud forward is crimson and descending, suggesting continued downward strain within the close to time period.

Nonetheless, the value has briefly pushed into the cloud’s decrease boundary, indicating a possible problem to the bearish construction.

For a stronger pattern reversal sign, Bitcoin would wish to interrupt above the cloud and see a bullish Kumo twist type. Till then, the Ichimoku setup exhibits a cautious restoration at finest.

Liberation Day Might Strongly Affect Bitcoin Value

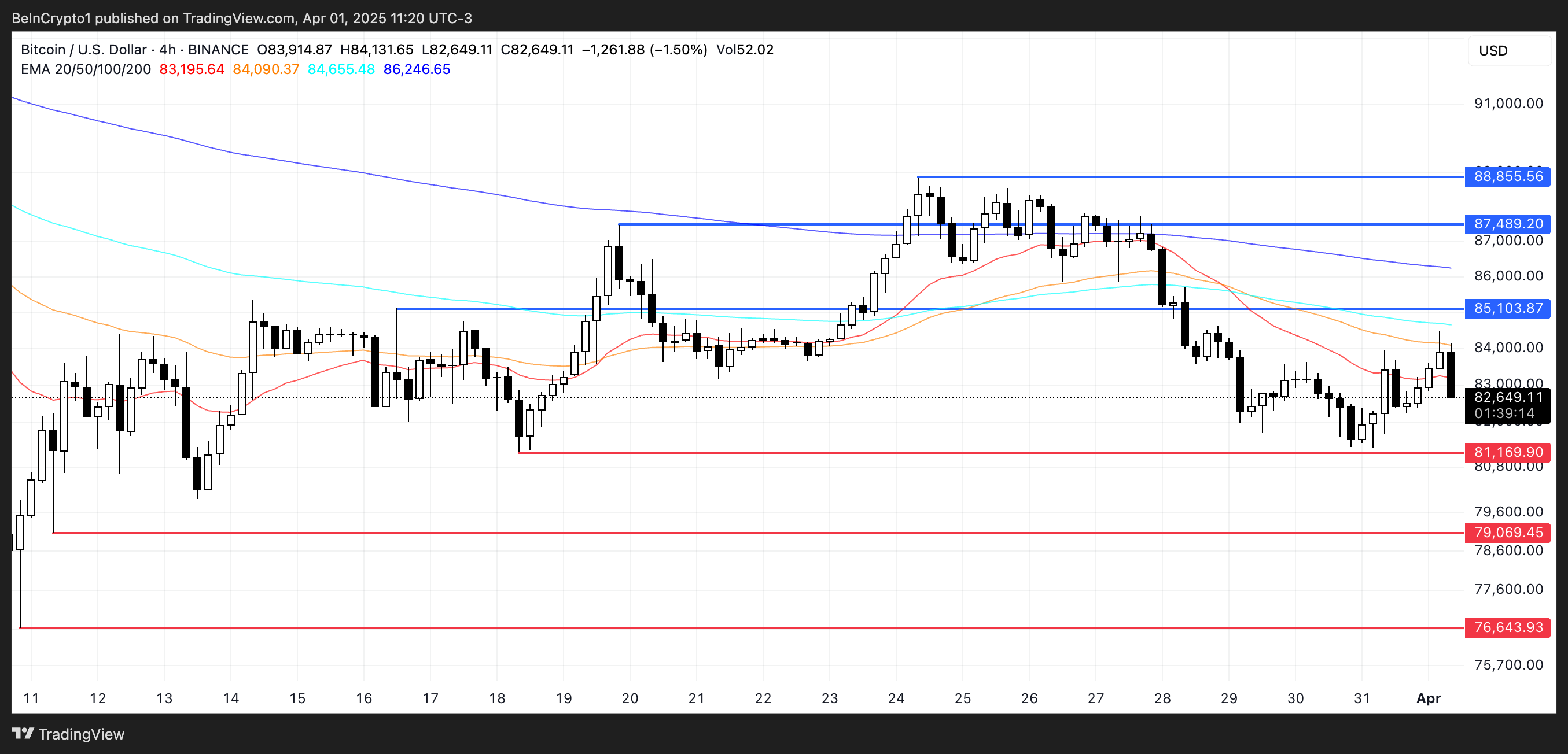

Bitcoin’s EMA traces stay bearish. Its shorter-term averages are nonetheless under the longer-term ones, a sign that downward momentum persists.

This setup suggests sellers proceed to manage the pattern, and until reversed, Bitcoin worth may revisit key help zones. If the present downtrend accelerates, it might first take a look at help round $81,169. If that degree fails to carry, deeper drops towards $79,069 and even $76,643 may comply with.

Nic Puckrin, crypto analyst and founding father of The Coin Bureau instructed BeInCrypto the market’s heightened uncertainty forward of the so-called “Liberation Day” tariffs. He notes that Bitcoin is equally positioned for a pointy transfer in both course. It may presumably dip to $73,000 or surging towards $88,000:

“As Liberation Day approaches, the uncertainty across the magnitude of the tariffs is retaining Bitcoin and different threat belongings in limbo. (…) Till there’s extra readability round tariffs, this range-bound sample will proceed, but when we get softer information than feared or some type of concessions, we may see a breakout from the present buying and selling sample. If we do, $88,000 is the extent to look at within the quick time period, however we would wish to see a marked enhance in quantity for this to point an prolonged rally.”

He defends {that a} tariff shock may make BTC take a look at ranges round $73,000:

“If there’s a tariffs shock, conversely, we may see BTC breaking down towards $79,000 within the quick time period, and even additional all the way down to the subsequent help degree at $73,000 if excessive worry grips markets.“ – Nic instructed BeInCrypto.

Nonetheless, if Bitcoin manages to flip the pattern and achieve upward momentum, a climb towards resistance at $85,103 can be the primary goal. Breaking above that would open the trail to increased ranges at $87,489 and $88,855.

Disclaimer

Consistent with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.