Cardano (ADA) is going through mounting strain as its value corrects by 10% over the previous seven days, persevering with a broader downtrend that has saved it buying and selling beneath the $1 mark for practically a month. With technical indicators flashing warning indicators and huge holders exiting their positions, considerations round ADA’s short-term stability are rising.

The latest rejection at greater resistance ranges and a powerful directional pattern sign recommend that bearish momentum is way from over. Because the $0.64 assist stage is examined as soon as once more, ADA’s subsequent transfer may decide whether or not a rebound is feasible—or if additional draw back is forward.

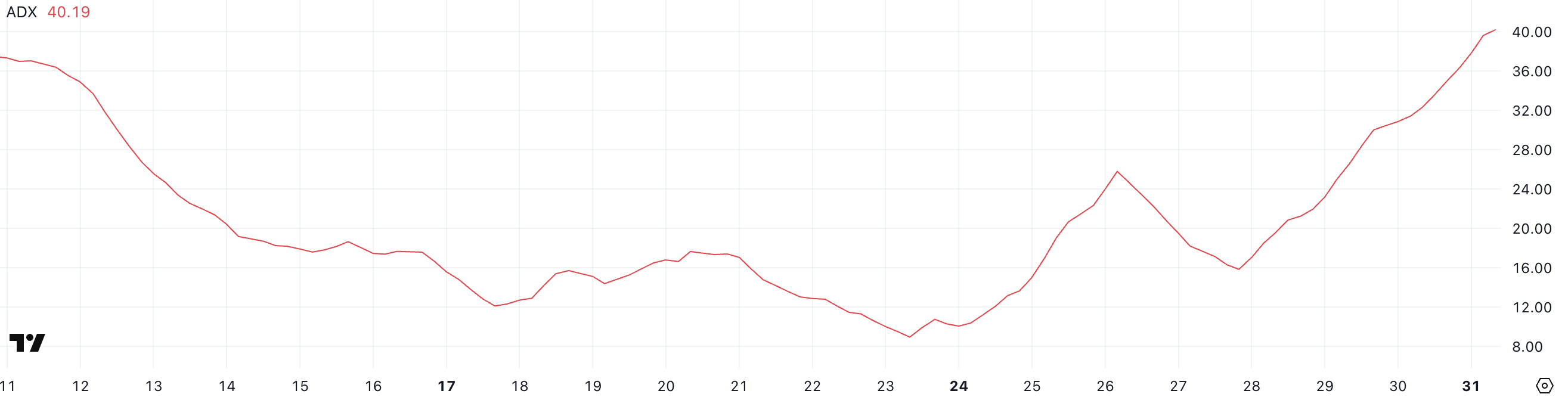

Cardano ADX Exhibits The Downtrend Is Very Robust

Cardano’s Common Directional Index (ADX) is presently at 40.19, rising sharply from 15.83 simply 4 days in the past. This steep enhance suggests a fast strengthening within the pattern’s momentum.

Provided that ADA is presently in a downtrend, the rising ADX signifies that bearish momentum is intensifying and the present downward transfer is gaining traction.

The ADX is a pattern energy indicator that measures how robust a pattern is, no matter its route. It ranges from 0 to 100, with readings beneath 20 usually indicating a weak or non-existent pattern, whereas values above 25 recommend a powerful pattern is in place.

Cardano’s ADX climbing above 40 confirms that the present downtrend is energetic and turning into stronger. If this pattern continues, it could level to additional draw back strain except a shift in momentum begins to construct from the bulls.

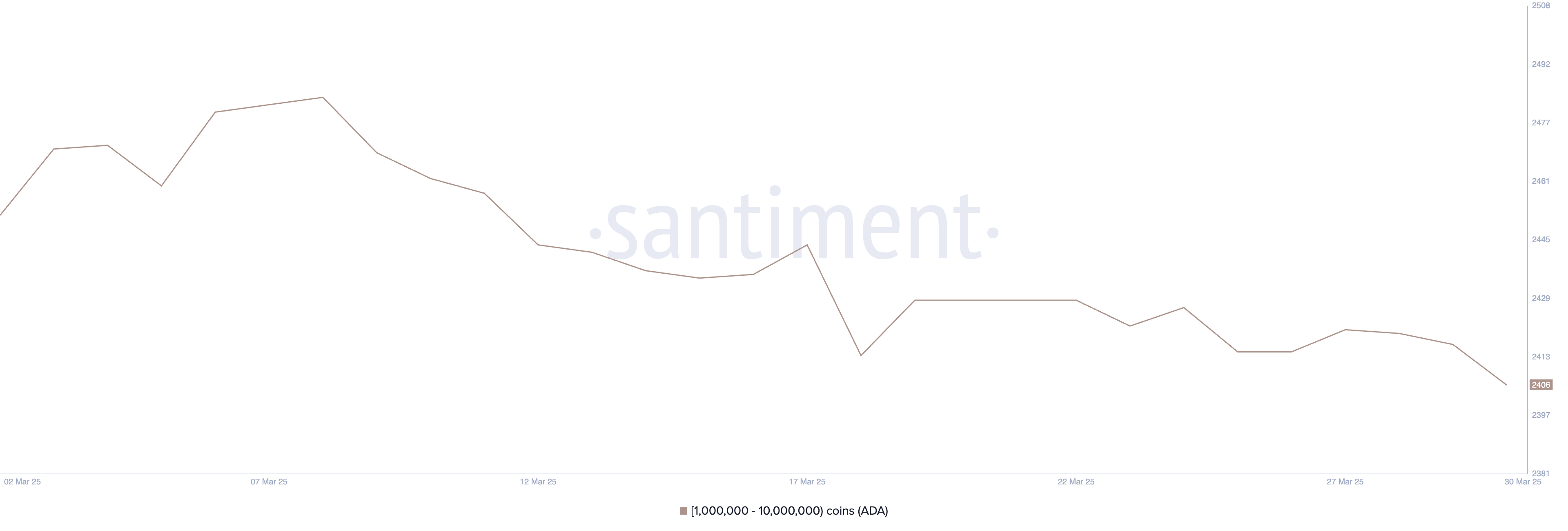

ADA Whales Dropped To Their Lowest Degree Since February 2023

The variety of Cardano whales—wallets holding between 1 million and 10 million ADA—has dropped to 2,406, down from 2,421 simply 4 days in the past.

This decline brings the whale rely to its lowest stage since February 2023, marking a doubtlessly significant shift in large-holder habits. These actions are value taking note of, as modifications in whale holdings usually precede broader market developments.

Monitoring whales is vital as a result of these giant holders can considerably affect value motion by means of their shopping for or promoting selections. A decline in whale numbers can sign lowered confidence or capital rotation into different belongings.

In Cardano’s case, the drop means that some main gamers could also be exiting or decreasing publicity, which may add downward strain to ADA’s value.

If this pattern continues, it may weaken investor sentiment and make it more durable for ADA to get well within the quick time period.

Can Cardano Maintain The $0.64 Help Once more?

Cardano value not too long ago examined the assist stage at $0.64 and managed to carry, displaying that patrons are nonetheless defending that zone. This assist has turn out to be a key line within the sand for ADA’s short-term outlook.

If the present downtrend is reversed and bullish momentum picks up, the subsequent upside goal can be the resistance at $0.69. A breakout above that stage may open the door for a push towards $0.77.

Ought to the rally proceed with energy, ADA may purpose for $1.02—marking a return above the $1 stage for the primary time since early March.

Nonetheless, the $0.64 assist stays a vital stage to look at. If Cardano exams it once more and fails to carry, it may point out weakening purchaser conviction.

A breakdown beneath $0.64 would doubtless ship ADA towards the subsequent assist at $0.58. This is able to verify a continuation of the downtrend and presumably set off additional promoting strain.

Disclaimer

Consistent with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.