Ethereum (ETH) enters the week with combined indicators as merchants brace for tomorrow’s “Liberation Day” tariff announcement, a possible macro catalyst that might influence threat property. Whereas the BBTrend indicator stays deeply unfavorable, it’s starting to ease, hinting at a doable slowdown in bearish momentum.

On-chain knowledge exhibits a slight uptick in whale accumulation, suggesting cautious optimism from giant holders. In the meantime, Ethereum’s EMA setup exhibits early indicators of a pattern reversal, however the value nonetheless wants to interrupt key resistance ranges to verify a shift in path.

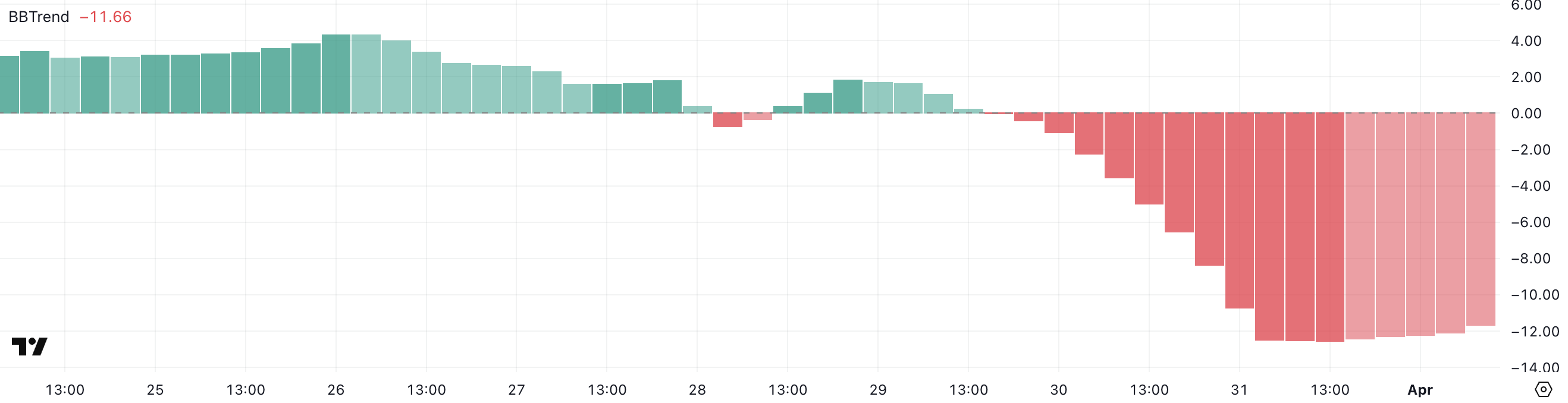

ETH BBTrend Is Easing, However Nonetheless Very Unfavourable

Ethereum’s BBTrend indicator is at the moment studying -11.66, barely improved from -12.54 the day earlier than, however nonetheless in unfavorable territory for the second consecutive day.

The Bollinger Band Pattern (BBTrend) measures the energy and path of a pattern based mostly on how value interacts with the higher and decrease Bollinger Bands.

A optimistic BBTrend suggests bullish momentum, with the value increasing towards the higher band, whereas a unfavorable BBTrend signifies bearish momentum, with the value leaning towards the decrease band. Usually, a worth past 10 is taken into account a powerful pattern sign, making the present -11.66 studying an indication of continued draw back strain.

The persistent unfavorable BBTrend means that Ethereum stays in a short-term bearish part, with sellers nonetheless dominating the value motion.

Whereas yesterday’s slight uptick hints at a possible slowing of downward momentum, the indicator stays properly under the impartial zone, which means any reversal remains to be unconfirmed, regardless of Ethereum flipping Solana in DEX buying and selling quantity for the primary time in 6 months.

Merchants might interpret this as a warning to remain cautious, particularly if ETH continues hugging the decrease Bollinger Band. For now, value motion stays fragile, and any bounce will must be supported by a decisive shift in quantity and sentiment to sign a significant reversal.

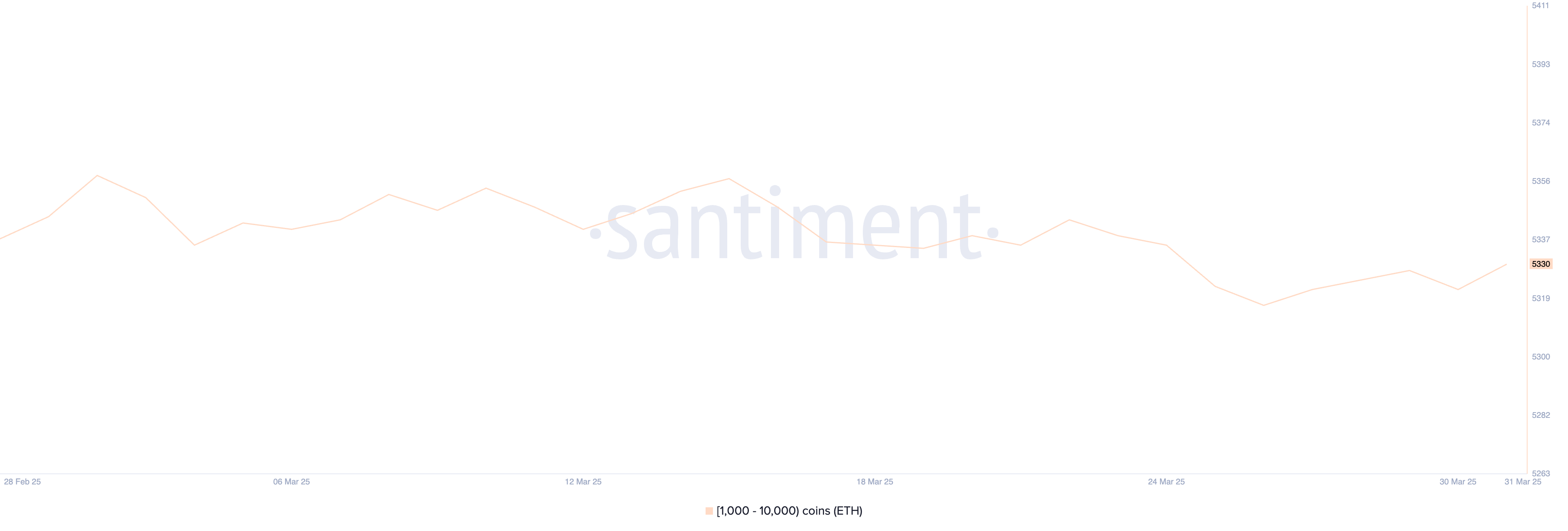

Ethereum Whales Are Accumulating Once more

The variety of Ethereum whales—wallets holding between 1,000 and 10,000 ETH—has ticked up barely, rising from 5,322 to five,330 prior to now 24 hours.

Whereas it is a modest improve, whale exercise stays one of the carefully watched on-chain metrics, as these giant holders usually affect market path. Whales’ accumulation can sign rising confidence in Ethereum’s medium—to long-term prospects, particularly in periods of value uncertainty or consolidation.

Conversely, a decline in whale addresses usually suggests weakening conviction or profit-taking.

Though the current uptick is a optimistic signal, it’s essential to notice that the present variety of Ethereum whales remains to be under the degrees noticed in prior weeks.

Which means that whereas some giant holders could also be re-entering the market, the broader whale cohort has but to completely decide to an accumulation part.

If the upward pattern in whale numbers continues, it may help a bullish shift in sentiment and value. Nevertheless, for now, the information factors to cautious optimism quite than a decisive reversal.

Will Ethereum Break Above $2,100 Quickly?

Ethereum’s EMA traces are displaying early indicators of a possible pattern reversal, with value motion making an attempt to interrupt above key short-term averages.

If Ethereum value can push via the resistance at $1,938, it might sign the beginning of a broader restoration, doubtlessly focusing on the following resistance ranges at $2,104, and if momentum builds—particularly with supportive macro catalysts—growing towards $2,320 and even $2,546.

On the flip aspect, if Ethereum fails to keep up its rise and bearish momentum resumes, the main target will shift again to draw back ranges.

The primary key help sits at $1,823; a break under that might expose Ethereum to additional losses towards $1,759.

Disclaimer

In step with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.