- Circle has formally filed for an IPO with the SEC, aiming to go public on the NYSE.

- The corporate beforehand tried a SPAC deal in 2022 and was valued at $9 billion on the time.

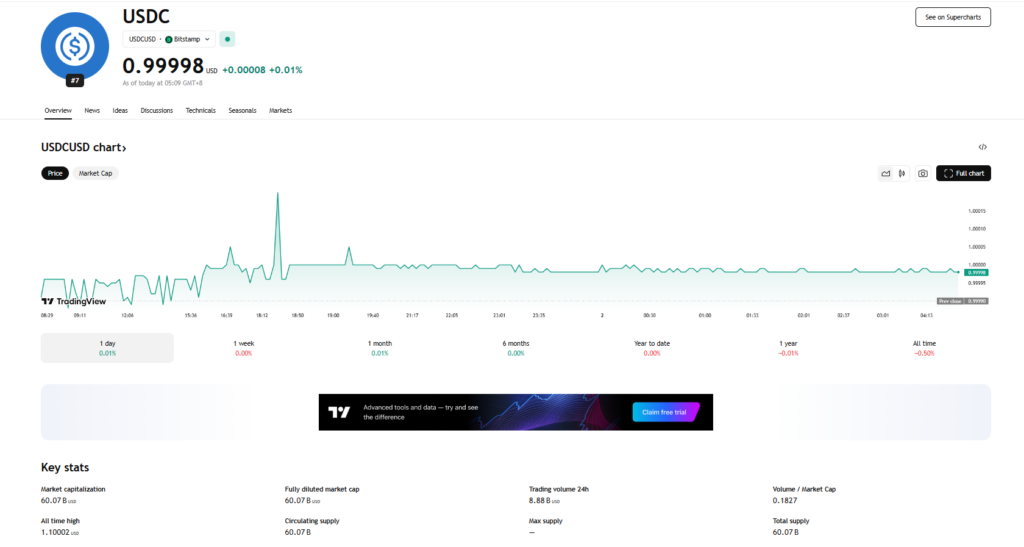

- Since 2018, USDC has powered over $25 trillion in transactions and serves thousands and thousands of customers globally.

Circle Web Monetary, the corporate behind USDC, simply filed a proper prospectus with the U.S. Securities and Alternate Fee (SEC), signaling its plans to go public.

The transfer comes sooner or later after the agency quietly submitted a confidential draft of its S-1 registration—a fairly commonplace play for corporations prepping for an IPO however nonetheless determining the finer particulars behind closed doorways.

No Numbers But, However the Wheels Are Turning

The precise prospectus didn’t embrace a few of the large questions—like what number of shares Circle plans to promote or what sort of IPO value goal it’s aiming for. So yeah, we’re nonetheless within the ready recreation there.

What we do know: the underwriters are heavyweights, together with JPMorgan and Citigroup. That’s not nothing.

“Going public on the NYSE is a continuation of our purpose to function with most transparency and accountability,” stated Jeremy Allaire, Circle’s CEO, within the submitting.

Backstory: Circle’s Been Eyeing This for a Whereas

Based on Bloomberg, Circle had already been chatting with advisors a few doable IPO way back to final yr. And if this all sounds acquainted—it’s in all probability as a result of Circle tried going public by way of a SPAC deal in 2022, which fell aside. On the time, they have been valued at round $9 billion.

Whether or not they’ll goal greater or decrease this time… unclear.

Timing Feels Kinda Strategic

Circle’s not the one main crypto agency poking on the IPO window. Rumors are swirling that Kraken, one other large title in crypto, would possibly increase $1 billion in debt as a runway to its personal public debut.

The distinction now? There’s a noticeable shift in tone from the U.S. authorities. With Washington displaying extra openness towards digital belongings currently, the door to regulated crypto finance appears—effectively, a bit extra open.

Circle’s Numbers Are No Joke

Since its launch in 2018, USDC has been utilized in over $25 trillion price of on-chain transactions, in accordance with Allaire’s assertion within the prospectus.

That’s… lots.

Tens of millions of customers are already utilizing the stablecoin for every little thing from on a regular basis funds to cross-border settlements and even simply storing worth in digital {dollars}.

Circle controls the second largest stablecoin on the planet by provide—second solely to Tether (USDT)—so if this IPO goes by way of, it might be a milestone second for the crypto trade’s crossover into conventional finance.