Stablecoin payments within the US are drawing consideration from institutional buyers and politicians. Not too long ago, US Consultant Bryan Steil advised journalist Eleanor Terrett that the 2 main stablecoin payments—the STABLE Act and the GENIUS Act—have solely minor variations.

This raises hope for a unified regulatory framework within the close to future. The STABLE Act was drafted by the Home, and the Senate proposed the GENIUS Act.

STABLE Act and GENIUS Act Differ by Solely 20%

On March 31, journalist Eleanor Terrett posted on X (previously Twitter) concerning the dialogue.

Consultant Bryan Steil acknowledged that after Wednesday’s evaluation, the STABLE Act is “properly positioned to reflect up” with the GENIUS Act after a number of extra drafting rounds within the Home and Senate. The Securities and Trade Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC) are offering technical assist.

Steil emphasised that about 20% of the variations between the 2 payments are primarily textual, not elementary. The most important variations contain necessities for worldwide stablecoin issuers, state-level oversight of issuers, and a few minor technical particulars.

He expressed optimism about working with Senate colleagues to go the invoice.

“On the finish of the day, I believe there’s recognition that we wish to work with our Senate colleagues to get this throughout the road,” he mentioned.

This settlement is a optimistic signal. Each payments get pleasure from bipartisan assist, which is essential within the often-divided US political panorama.

Based on NatLawReview, Senators Invoice Hagerty, Tim Scott, Cynthia Lummis, and Kirsten Gillibrand assist the GENIUS (Guiding and Establishing Nationwide Innovation for US Stablecoins) Act.

In the meantime, the STABLE (Stablecoin Transparency and Accountability for a Higher Ledger Economic system) Act was drafted by Home Monetary Providers Committee Chair French Hill and Consultant Bryan Steil.

Regardless of some variations, each payments purpose to determine a authorized framework for issuing stablecoins below federal or state supervision. For instance, the GENIUS Act requires the Treasury Division to review algorithmic stablecoins, whereas the STABLE Act imposes a two-year ban on issuing them.

If handed, these payments might reshape the way forward for stablecoins and speed up crypto adoption within the US. This might profit each buyers and on a regular basis customers.

Nonetheless, specialists in Europe and China have voiced considerations. They fear that US lawmakers’ assist for stablecoins might destabilize their monetary methods.

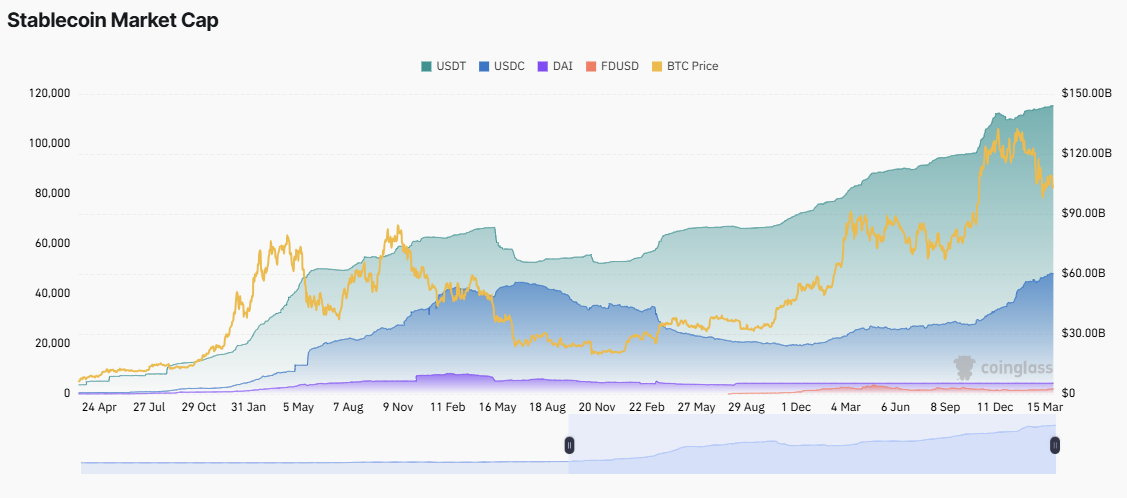

As of this writing, the stablecoin market capitalization has surpassed $230 billion. Tether’s USDT accounts for 61%, whereas Circle’s USDC holds 25%.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.