Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

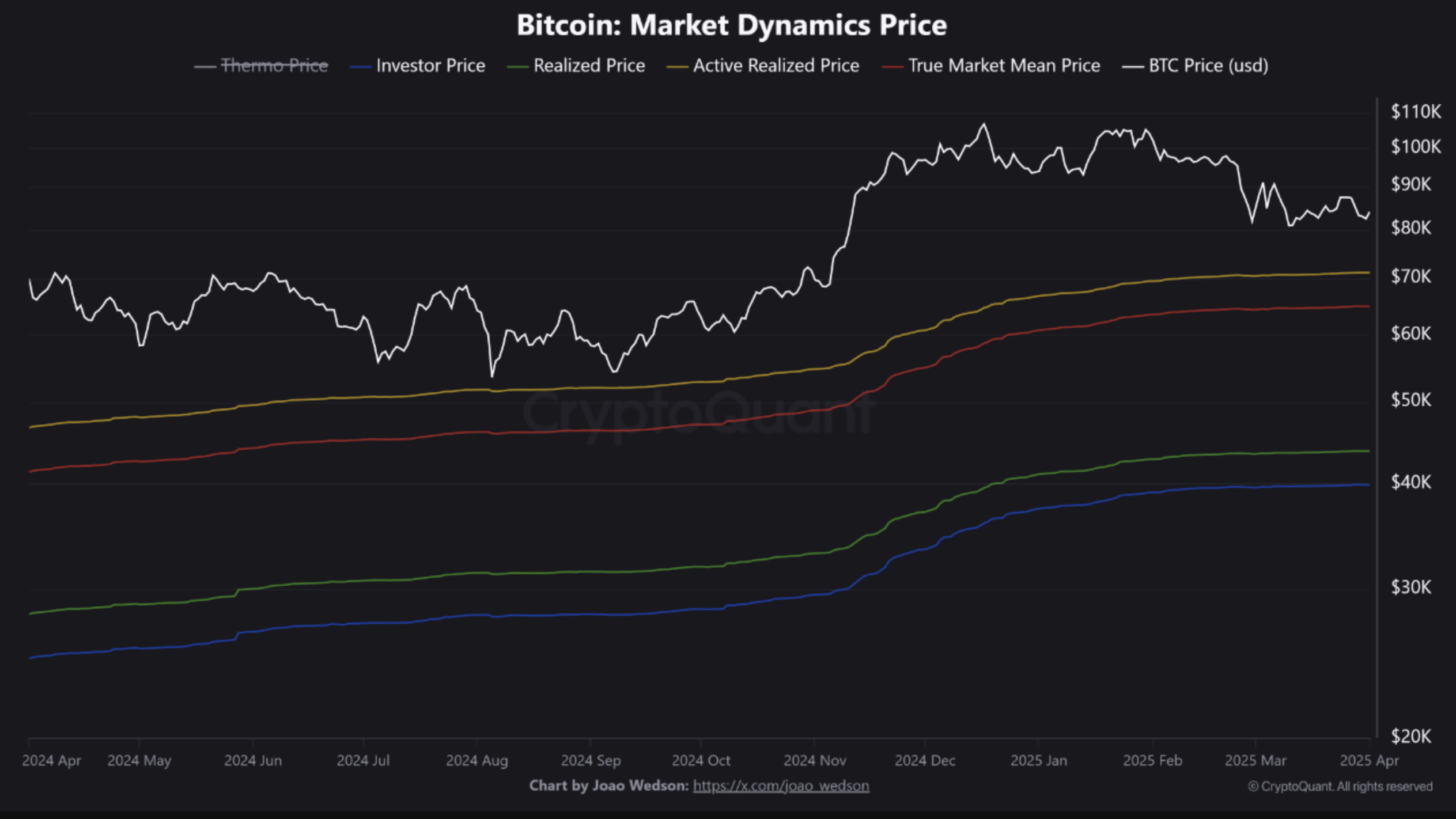

In a CryptoQuant Quicktake publish revealed at the moment, contributor BorisVest highlighted a key demand zone for Bitcoin (BTC) that would supply traders a possibility for ‘substantial positive aspects.’ The analyst used the Energetic Realized Worth (ARP) and the True Market Imply Worth (TMMP) to determine this essential zone.

Shopping for Bitcoin Right here Might Be Worthwhile

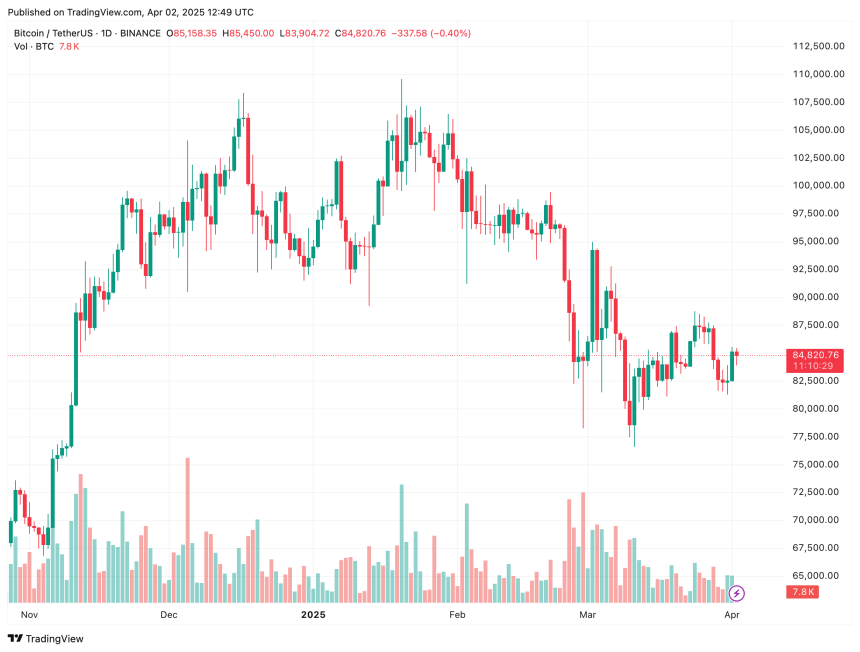

Bitcoin is presently buying and selling roughly 10% increased than its latest native backside of practically $77,000, recorded on March 10. Nonetheless, uncertainty out there has elevated attributable to US President Donald Trump’s looming commerce tariffs, with some analysts predicting that the highest cryptocurrency might expertise additional draw back earlier than a development reversal happens.

Associated Studying

Amid this backdrop, CryptoQuant contributor BorisVest famous that, based mostly on market dynamics, BTC’s ARP is presently hovering round $71,000 – representing virtually a 20% pullback from its present value within the mid-$80,000 vary.

For the uninitiated, Bitcoin’s ARP is a metric that calculates the typical acquisition value of all actively traded BTC, filtering out dormant cash. It helps determine market sentiment by exhibiting the associated fee foundation of energetic traders, offering insights into potential assist or resistance ranges.

Moreover, BorisVest identified that BTC’s TMMP presently has a key assist degree at $65,000. The analyst said:

If we outline the world between the Energetic Realized Worth and the True Market Imply Worth as a zone, we will count on that within the close to future, if the worth declines, it ought to meet vital demand on this vary.

In essence, BTC’s present main demand zone lies between $71,000 and $65,000. Buying BTC inside this vary might present traders with a positive risk-reward ratio, doubtlessly resulting in substantial positive aspects.

Analyst Factors Out Key Resistance Ranges

In distinction to BorisVest’s evaluation, outstanding crypto analyst Ali Martinez recognized two key resistance ranges for Bitcoin. Martinez said:

Bitcoin BTC faces the 200-day MA at $86,200 and the 50-day MA at $88,300 as key resistance forward! A break above these ranges might shift momentum again to the bulls.

Transferring-average (MA) based mostly resistance ranges typically perform as key psychological and technical value obstacles. Market merchants usually place their promote orders round these ranges, main to cost reversal or consolidation.

Associated Studying

Martinez’s evaluation aligns with that of fellow crypto analyst Rekt Capital, who famous that regardless of BTC breaking its every day Relative Energy Index (RSI) downtrend, it could nonetheless face vital resistance forward.

That mentioned, a bullish development reversal could also be on the horizon for BTC. Latest experiences recommend that Trump could soften his stance on reciprocal tariffs, doubtlessly enabling a aid rally for risk-on belongings like BTC. At press time, BTC is buying and selling at $84,820, up 1.5% previously 24 hours.

Featured picture from Unsplash, Charts from CryptoQuant, X, and TradingView.com