On-chain knowledge reveals the small Bitcoin holders have deepened their selloff not too long ago, whereas the most important of buyers have been ramping up their shopping for.

Bitcoin Accumulation Development Rating Reveals Divergence Forming Amongst Holders

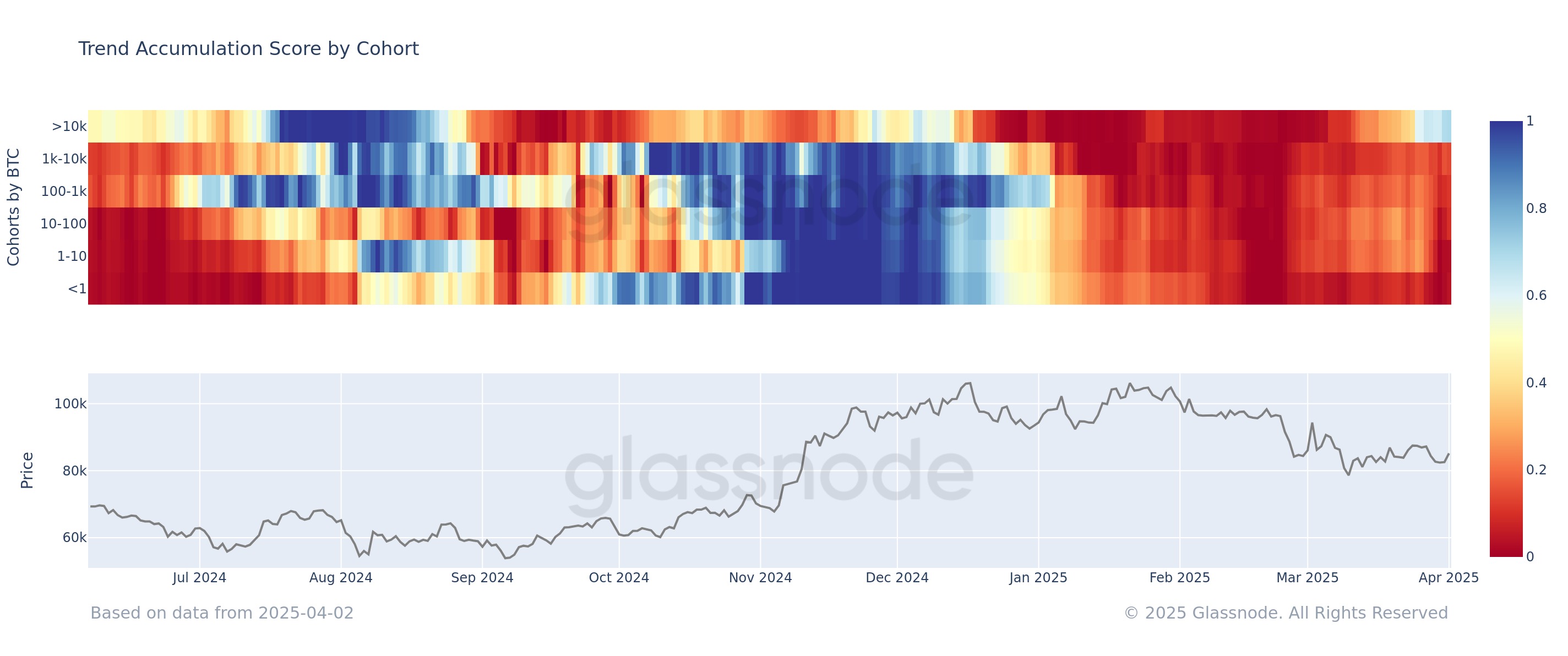

In a brand new put up on X, the on-chain analytics agency Glassnode has mentioned the newest development within the Accumulation Development Rating for the varied Bitcoin holder cohorts.

The Accumulation Development Rating is an indicator that mainly tells us about whether or not BTC buyers are accumulating or distributing. The indicator calculates its worth not simply by holding observe of the stability modifications happening within the wallets of the buyers, but in addition by accounting for the scale of the addresses.

When the metric’s worth is bigger than 0.5, it suggests that giant buyers (or alternatively, a lot of small buyers) are shopping for. The nearer the indicator is to the 1 mark, the stronger is that this conduct.

Then again, the rating being beneath 0.5 means the market goes by way of a possible section of distribution. On this case, the acute level lies at a worth of zero.

Within the context of the present subject, the model of the Accumulation Development Rating that’s of curiosity isn’t the one for the mixed community, however somewhat the one which tracks the conduct individually for the varied investor teams.

Addresses or holders have been divided into these cohorts on the premise of pockets dimension. Right here is how the Accumulation Development Rating has modified for every of the teams over the previous yr:

Seems to be like many of the market is presently in a section of distribution | Supply: Glassnode on X

As displayed within the above graph, the Bitcoin Accumulation Development Rating noticed a worth near the 1 degree for many of the investor teams between November and January, implying robust accumulation was occurring. Alongside this shopping for, BTC loved its bull run past the $100,000 degree.

With the beginning of this yr, although, a shift to promoting occurred, with the indicator attaining a worth near zero for all of the cohorts in February. Naturally, the cryptocurrency noticed a bearish reversal because of this distribution.

March noticed the buyers pull again a bit on their promoting, however the internet scenario within the sector remained firmly that of distribution. From the chart, it’s seen that the holder conduct has been practically uniform for many of the yr up to now, however not too long ago, a divergence has change into distinguished.

Holders with lower than 1 BTC, popularly generally known as retail buyers, have deepened their distribution once more, with the metric dropping underneath 0.2. Then again, buyers on the precise reverse finish of the spectrum, the most important of entities with greater than 10,000 BTC, have shifted focus to accumulation, with the rating nearing 0.6.

When bullish strain began letting off for Bitcoin earlier, these ‘mega whales‘ have been the primary to start out taking part in a robust selloff. With this smart-money cohort now as soon as once more doing one thing completely different from the remainder of the market, it’s attainable that one other development shift could also be forward for the asset.

BTC Value

Bitcoin has opened April with some restoration as its value has gone as much as the $84,900 degree.

The value of the coin has been caught in consolidation recently | Supply: BTCUSDT on TradingView.com

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.