Welcome to the US Morning Crypto Briefing—your important rundown of an important developments in crypto for the day forward.

Seize a espresso to see how Bitcoin is holding its floor whereas Wall Road stumbles, why Trump’s tariffs could push the Fed into money-printing mode, and what that might imply for crypto’s subsequent chapter. From Ethereum’s check of resilience to rising odds of a US recession, right here’s all the things you might want to know to remain forward.

Bitcoin Enters Its Threat-Dynamic Period Amid Tariffs and Turmoil

Bitcoin’s response to latest macro shocks—notably Trump’s sweeping tariffs—has been noticeably calm in comparison with conventional markets, and that’s turning heads. Whereas Wall Road stumbles tougher than anticipated, crypto has held comparatively regular.

Nexo Dispatch Editor Stella Zlatarev instructed BeInCrypto that this isn’t simply resilience—it’s proof that Bitcoin could also be getting into a brand new section of market maturity.

“A 2–3% drop in crypto is a rounding error in comparison with previous cycles,” she mentioned, emphasizing that this stability amid chaos suggests Bitcoin is now not only a speculative punt. “Bitcoin’s skill to climate macro turbulence with out the wild swings of earlier years suggests institutional buyers are treating it much less as a speculative punt and extra as a strategic asset,” Zlatarev mentioned.

Analysts additionally burdened that Bitcoin’s conduct doesn’t align with conventional asset classes.

“It’s not gold, and it’s not the yen. As a substitute, Bitcoin is rising as a risk-dynamic asset – one which doesn’t crumble like high-growth shares but in addition doesn’t entice the identical flight-to-safety flows as conventional protected havens,” Zlatarev instructed BeInCrypto.

This idea of a “risk-dynamic” asset positions Bitcoin in a novel position: one thing that thrives in uncertainty however doesn’t collapse when the market turns.

Zlatarev from Nexo additionally famous that how Ethereum and different blue-chip altcoins reply subsequent shall be key.

“If ETH mirrors BTC’s efficiency, it strengthens the case that top-tier crypto property are evolving right into a extra predictable asset class. If ETH wobbles, it reinforces that, for now, Bitcoin is in a league of its personal.”

In the meantime, the macro backdrop is shifting quick. Trump’s new “Liberation Day” tariffs have spooked world commerce companions and have additionally despatched ripple results via prediction markets. Polymarket now offers virtually 50% odds of a US recession this 12 months—a serious shift following the announcement.

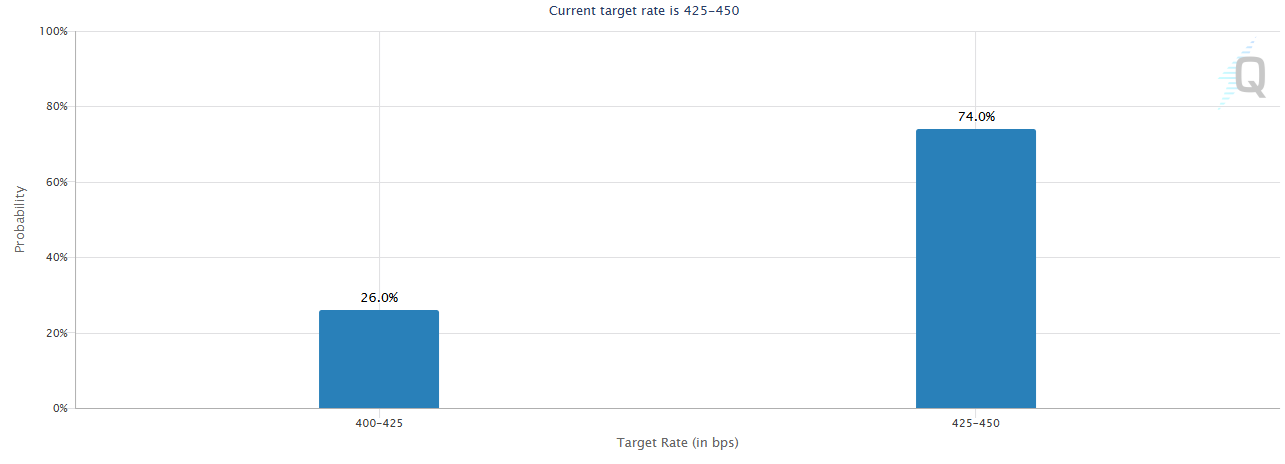

Additionally, CME FedWatch software exhibits rate of interest merchants have boosted the likelihood the US Federal Reserve will make 4 price cuts this 12 months. Finally, this might reduction the present macroeconomic stress on Bitcoin.

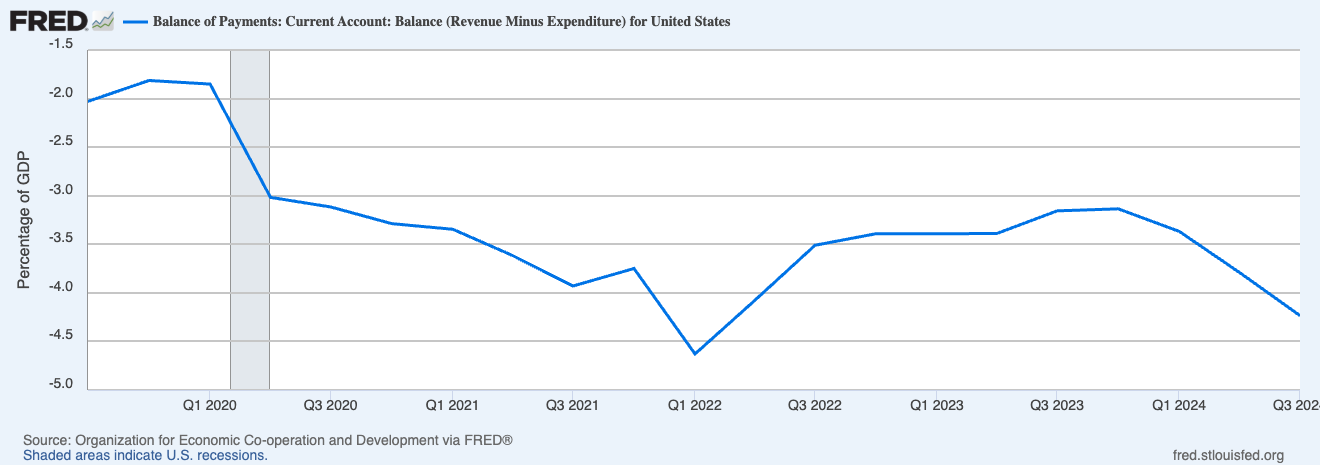

Former BitMex CEO Arthur Hayes talked about that Trump’s present tariff technique may complicate the US bond market. In different phrases, stress is constructing for the Fed to intervene—probably by turning on the liquidity spigot as soon as once more.

All of this places Bitcoin in a brand new highlight. Its steadiness is now not being dismissed as a coincidence. It could be the primary signal that crypto, or at the least its most mature gamers, is stepping out of the shadows of hypothesis and into the highlight of strategic finance.

Chart of the Day

By lowering international demand for US Treasuries, Trump’s tariffs could power the Fed to inject extra liquidity—probably weakening the greenback and boosting Bitcoin in its place retailer of worth.

Byte-Sized Alpha

– Trump’s “Liberation Day” enforces 10%+ tariffs on all imports, hitting China, the EU, and Israel, triggering market drops and recession fears.

– In line with Normal Chartered, Bitcoin could hit $500,000 by Trump’s time period finish, AVAX may 10x by 2029, and Ethereum’s 2025 goal drops to $4,000.

– The STABLE Act of 2025 advances with bipartisan assist, aiming to tighten stablecoin guidelines as competitors and regulatory stress intensify.

– Bitcoin ETFs see $221 million in April inflows led by ARKB, however BTC derivatives cool with falling futures curiosity and bearish choices sentiment.

– DXY hits a 2024 low after “Liberation Day” tariffs, fueling short-term Bitcoin surge hopes amid world tensions and coverage uncertainty.

– Bitcoin struggles under $85,000 amid weak sentiment, however long-term holders keep agency, protecting capitulation fears at bay.

– Polymarket sees virtually 50% likelihood of US recession as Trump’s tariffs spark market fears and commerce tensions.

Disclaimer

According to the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.