Hyperliquid (HYPE) is below strain, down 16% over the previous seven days as technical indicators more and more level towards bearish management. Momentum has weakened sharply, with the Relative Energy Index (RSI) dropping under 40 and exhibiting no indicators of robust shopping for curiosity since late March.

On the similar time, the Directional Motion Index (DMI) reveals sellers gaining dominance, with a rising ADX suggesting a possible strengthening of the downtrend. As HYPE approaches key assist ranges, the market now waits to see if bulls can mount a restoration—or if additional draw back is forward.

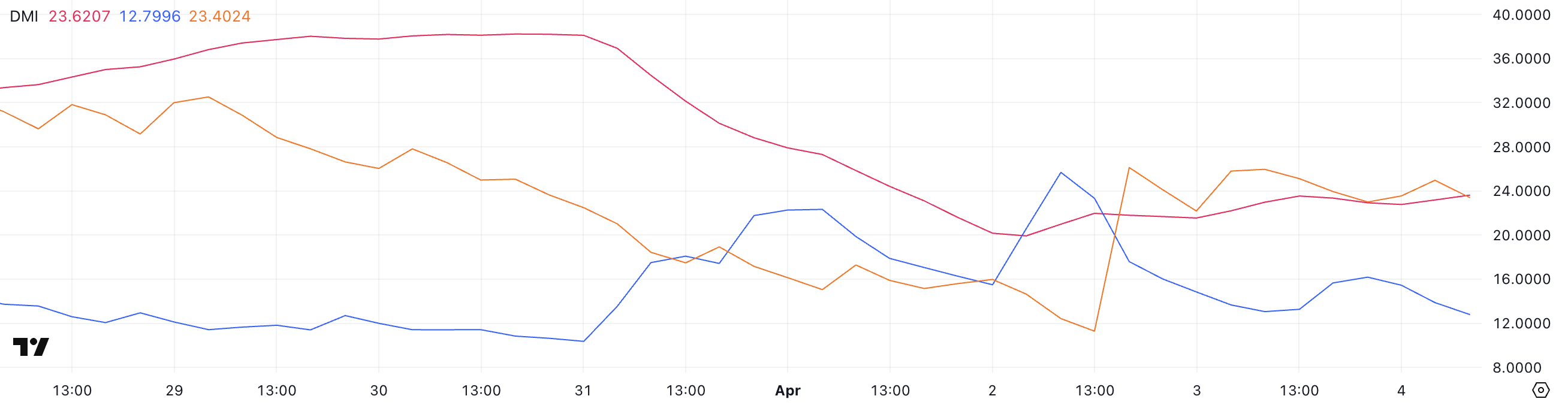

Hyperliquid DMI Reveals Sellers Are In Management

Based on its Directional Motion Index (DMI), Hyperliquid is exhibiting early indicators of a growing development, with the Common Directional Index (ADX) rising from 21.5 to 23.6.

The ADX measures the power of a development no matter its path. Readings under 20 usually point out a weak or range-bound market, whereas values above 25 counsel the presence of a powerful development.

With the present ADX shifting nearer to that 25 threshold, it means that development power is constructing—however hasn’t totally confirmed but—indicating that merchants needs to be on alert for potential continuation in worth motion.

In the meantime, the +DI and -DI strains, which symbolize bullish and bearish directional motion, respectively, have shifted considerably.

The +DI has dropped sharply from 25.68 to 12.79, whereas the -DI has surged from 11.29 to 23.4, indicating that bearish momentum has clearly overtaken bullish strain. This shift means that sellers are gaining management of the market, and until the +DI line can reverse and regain floor, HYPE might be prone to additional draw back.

If the present dynamics proceed, this, mixed with the rising ADX, may sign the beginning of a stronger bearish development.

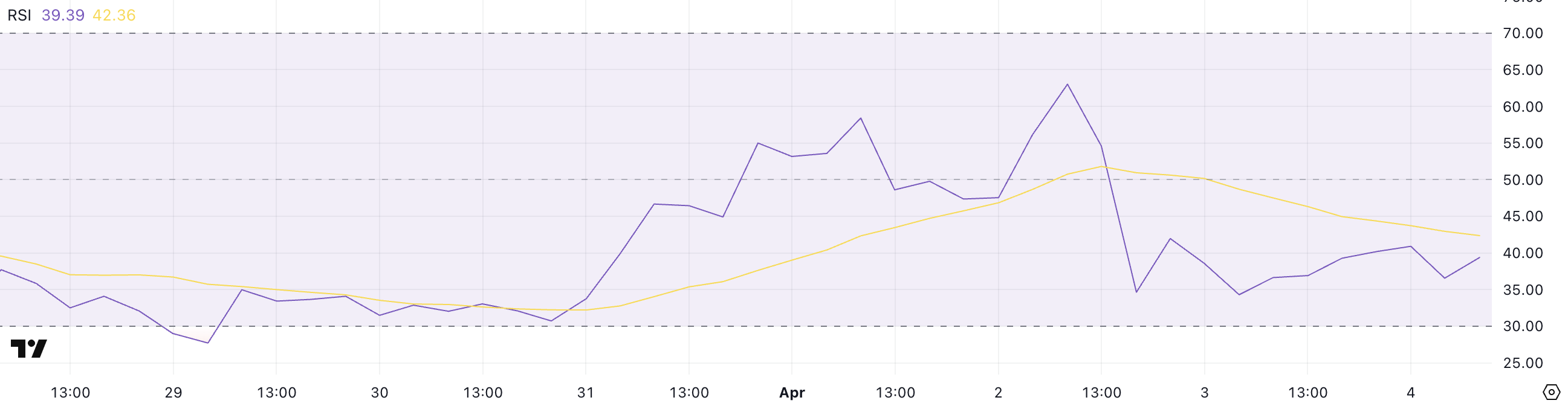

Hyperliquid RSI Reveals The Lack Of Shopping for Momentum

Hyperliquid has seen its Relative Energy Index (RSI) fall considerably over the previous two days, dropping from 63.03 to 39.39.

The RSI is a momentum oscillator that measures the velocity and magnitude of latest worth adjustments, starting from 0 to 100.

Readings above 70 usually point out that an asset is overbought and could also be due for a correction, whereas readings under 30 counsel it’s oversold and might be primed for a rebound. Ranges between 30 and 70 are thought of impartial, however directional shifts inside this vary usually replicate altering momentum.

With HYPE’s RSI now sitting at 39.39, the indicator suggests weakening bullish momentum and rising bearish strain. The truth that the RSI hasn’t touched or exceeded the 70 mark since March 24 alerts an absence of robust shopping for conviction in latest weeks.

This downward development in RSI might point out that the market is cooling off. Except patrons step in to reverse this trajectory, HYPE may proceed to face promoting strain.

If the RSI continues to float towards 30, it might increase the potential of additional draw back or consolidation within the brief time period.

Will Hyperliquid Fall Beneath $11 Quickly?

Hyperliquid worth is at present at an vital threshold, with motion leaning bearish however potential for a rebound nonetheless on the desk.

If the present downtrend continues, HYPE may quickly dip under the $11 mark.

This could align with the latest drop in momentum indicators just like the RSI and the rising bearish strain seen in directional motion knowledge.

Nevertheless, if patrons handle to step in and shift momentum, HYPE may try and reclaim larger ranges. A break above the speedy resistance at $12.19 can be the primary signal of restoration, doubtlessly opening the door for a transfer towards $14.77.

If bullish momentum accelerates, the rally may prolong so far as $17.33, which might mark a full reversal of the present bearish construction.

Disclaimer

Consistent with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.