Since hitting a brand new all-time excessive in January, Bitcoin (BTC) has struggled to determine a bullish type leading to a downtrend that has lasted over the past two months. Based on distinguished market analyst Egrag Crypto, the premier cryptocurrency may probably stay in correction for the following few months earlier than launching a value rally.

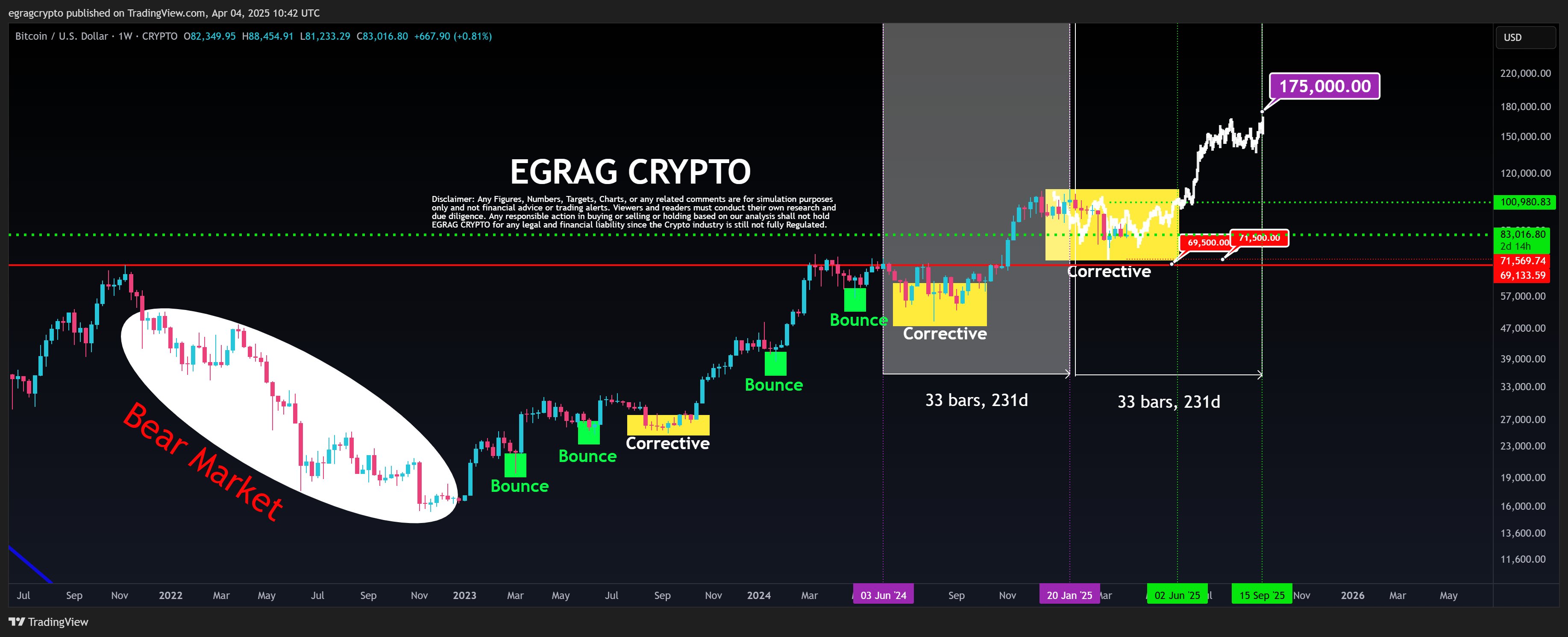

Bitcoin’s 231-Day Cycle Hints At $175,000 Goal By September

Following an preliminary value decline in February, Egrag Crypto had postulated Bitcoin may expertise a value correction because of a CME hole earlier than experiencing a value bounce. Nevertheless, the shortage of robust bullish convictions over the previous weeks has compelled a conclusion that the premier cryptocurrency is caught in a probably lengthy corrective section.

Based on Egrag in a latest publish, Bitcoin’s ongoing correction aligns with a fractal sample i.e. a repeating value construction that has appeared throughout a number of timeframes. This sample relies on a 33-bar (231-day) cycle throughout which BTC transits from a corrective section to an explosive value rally.

In evaluating earlier cycles to the present creating one, Egrag has predicted Bitcoin may probably escape of its recalibration by June. On this case, the analyst expects the crypto market chief to hit a market prime of $175,000 by September, hinting at a possible 107.83% acquire on present market costs.

Nevertheless, in igniting this value rally, market bulls should guarantee a breakout above the stiff value barrier at $100,000. Then again, any potential fall under the $69,500-$71,500 help value degree may invalidate this present bullish setup and presumably sign the top of the present bull run.

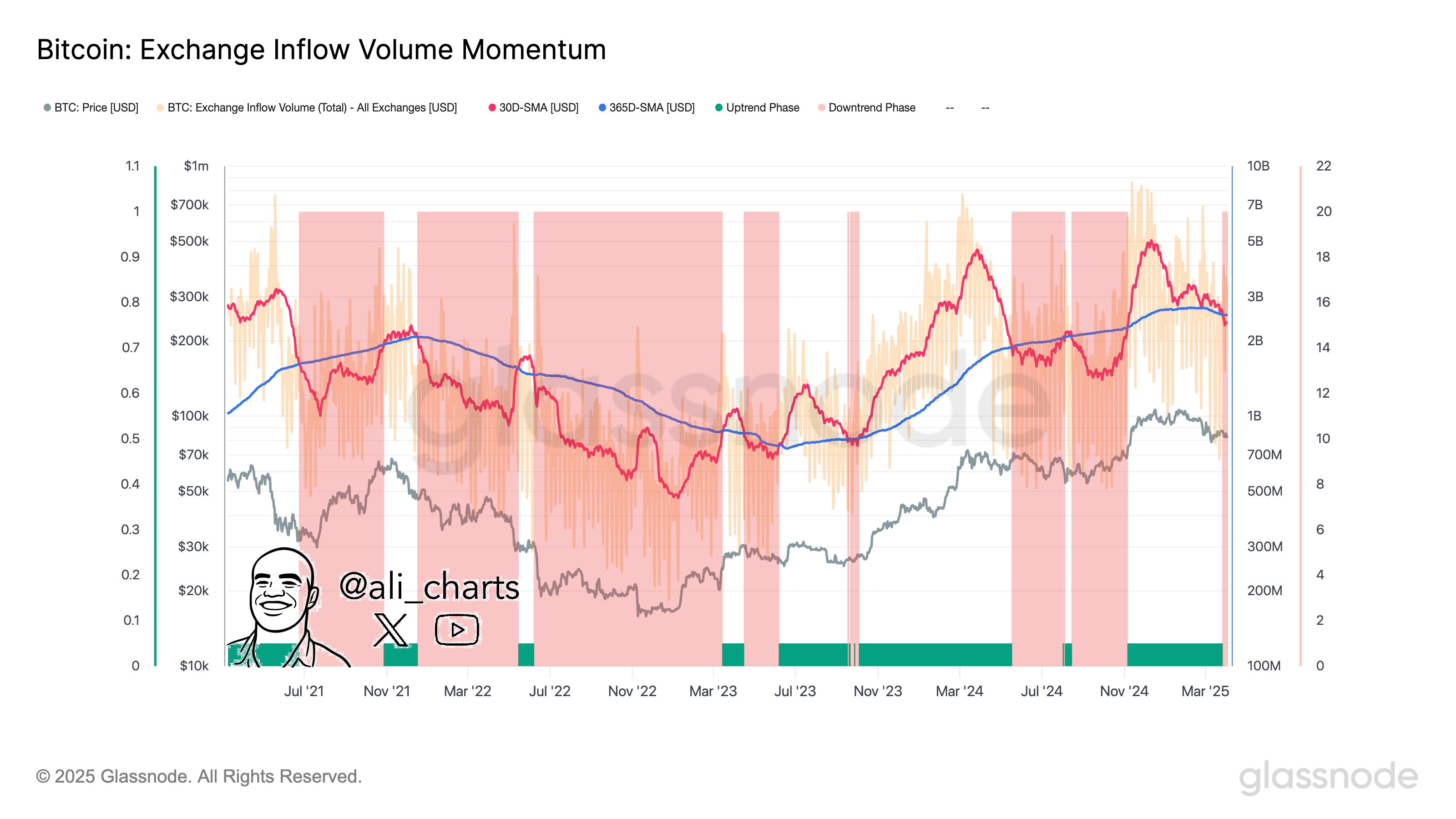

BTC Traders Wait As Alternate Exercise Slows Down

In different information, common crypto knowledgeable Ali Martinez has reported a decline in Bitcoin exchange-related exercise indicating diminished buyers’ curiosity and community utilization. Notably, this growth means that buyers are hesitating to deposit or withdraw Bitcoin on exchanges maybe because of market uncertainty on the asset’s instant future trajectory.

Based on Martinez, Bitcoin is now prone to endure a pattern shift as buyers anticipate the following market catalyst. Notably, Bitcoin has proven commendable resilience regardless of the brand new tariffs imposed by the US authorities on April 2. Based on knowledge from Santiment, BTC’s value dipped solely 4% within the hours following the announcement—a milder response in comparison with earlier tariff-related market strikes.

Since then, BTC has made some value beneficial properties and at the moment trades at $83,805 as buyers flock to the crypto market which has recorded a $5.16 billion influx over the previous day. In the meantime, BTC’s buying and selling quantity is up by 26.52% and is valued at $43.48 billion.

Featured picture from UF Information, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.